Quick Summary

- CFA stands for Chartered Financial Analyst and MBA stands for Master of Business Administration.

- Individuals who are interested in investment analysis and portfolio management can opt for a CFA program.

- One looking for managerial and leadership positions in the business field should consider taking up an MBA program.

Table of Contents

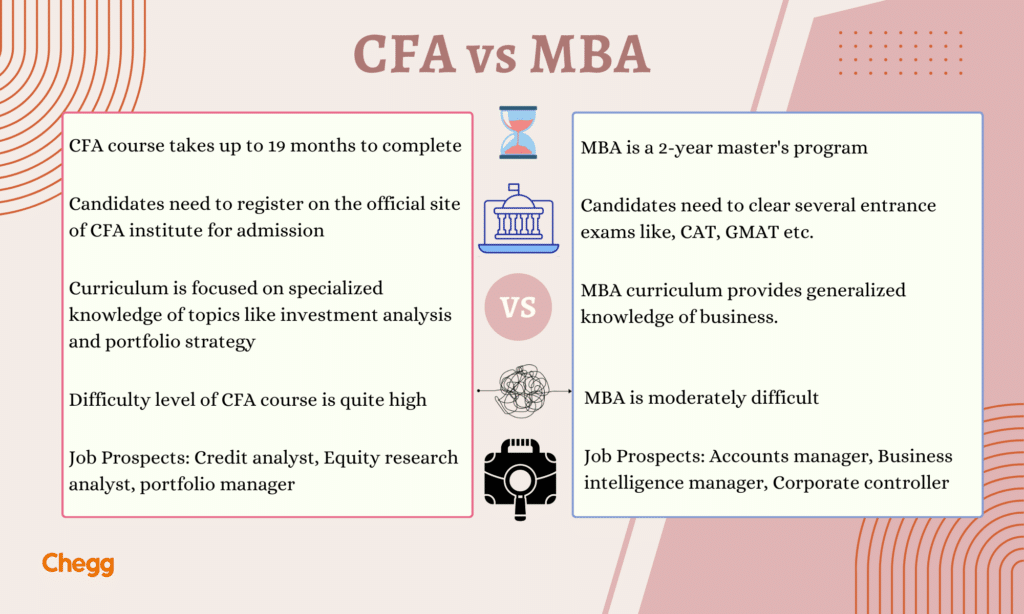

Deciding between the CFA vs MBA is a common dilemma faced by finance students and professionals. Both paths provide valuable opportunities for career advancement in fields like finance, investment, and business management. However, choosing the right option can be challenging, as each has its unique benefits. The CFA program focuses deeply on investment analysis and portfolio management, making it ideal for those pursuing careers in investment banking or asset management. On the other hand, an MBA offers a broader business education, covering various aspects of management, finance, and marketing. When weighing the CFA vs MBA, individuals should consider their career goals and interests to make an informed decision that aligns with their aspirations.

Each program offers unique advantages, making it essential to align your decision with your personal goals and interests, as well as the demands of your industry. When considering CFA vs MBA, think about whether you want to deepen your expertise in finance or broaden your business knowledge. The CFA program is ideal for those aiming for specialized roles in investment analysis and portfolio management, while an MBA provides a wider perspective on various business disciplines, including management and marketing. Understanding the differences between CFA vs MBA is key to making an informed choice that suits your career aspirations. Take the time to evaluate which program aligns best with your future goals and professional growth.

In this article, we will explore the pros and cons of both CFA vs MBA programs to help you make an informed decision about your career path. Each option has its unique strengths and weaknesses, which can significantly impact your professional journey. The CFA program is highly regarded for its focus on investment analysis and financial expertise, making it suitable for those looking to excel in finance-related roles. Conversely, an MBA offers a broader education in business management, preparing graduates for leadership positions across various industries. By examining the key differences and advantages of CFA vs MBA, you will gain valuable insights that can guide your choice and support your long-term career goals. Let’s dive in!

CFA vs MBA: A Quick Overview

To compare CFA vs MBA, two of the most prestigious courses in India, it’s essential to start with a basic understanding of what each program offers. The CFA, or Chartered Financial Analyst, is a specialized course focused on investment management and financial analysis. It is designed for those seeking careers in finance and investment. On the other hand, an MBA, or Master of Business Administration, provides a broader business education that covers various areas such as marketing, operations, and management. By understanding the core differences between CFA vs MBA, you can better assess which path aligns with your career goals and interests. This foundational knowledge will help you make a more informed choice as you explore your options.

Chartered Financial Analyst (CFA)

CFA known as the Chartered Financial Analyst program is a globally recognized professional qualification for investment professionals. It is a self-study program that focuses on investment knowledge, ethical and professional standards, and practical skills. The program consists of three levels, each of which requires passing a six-hour exam. The curriculum covers topics such as economics, financial reporting, equity investments, fixed income, derivatives, alternative investments, and portfolio management.

The CFA designation is highly respected in the investment industry and is often a requirement or preference for employers. To earn the CFA charter, candidates must first complete three levels of exams that cover topics like investment analysis and portfolio management. Additionally, candidates need at least four years of relevant work experience in a finance-related role. This practical experience is crucial for understanding real-world applications of the concepts learned. Moreover, CFA charter holders must commit to a strict code of ethics, ensuring they maintain professionalism and integrity in their work. This combination of education, experience, and ethical standards makes the CFA designation a valuable asset for anyone looking to advance in the investment field.

Master of Business Administration (MBA)

Master of Business Administration (MBA), is a graduate-level degree program that covers various aspects of business, including management, marketing, accounting, and finance. This course is designed to equip you with the knowledge and skills required to excel in leadership positions in various industries.

MBA courses usually last two years and include a mix of coursework, case studies, and real-world projects. Throughout the program, students have the chance to network with industry professionals and gain practical experience through internships and other opportunities. This hands-on learning is essential for applying theoretical knowledge in real-life situations. After completing an MBA, graduates can explore various career paths, making the degree especially valuable for those looking to advance in the business world. The skills and connections gained during the program can significantly enhance career prospects and open doors to leadership roles in diverse industries.

CFA vs MBA- Admission Process

|

CFA |

MBA |

|

The CFA course admission process is very simple. Eligible candidates have to register on the official website of ICFAI or CFA Institute. After you need to register for the Level I exam before September, and the exam is conducted in December. |

To gain admission in MBA finance, students need to clear entrance exams of respective colleges. Some exams are CAT, XAT, SNAP, MAT, CMAT, NMAT, etc. After securing a minimum percentile, candidates are called for Group Discussions and Personal Interview rounds. Some colleges also conduct tests like WAT, Team activity, and case study discussions. Candidates get admission to colleges after the successful completion of all the rounds. |

CFA vs MBA- Entrance Exam Format

|

CFA |

MBA |

|

For CFA, students need to clear three levels. All these exams are conducted in two sessions, morning, and afternoon.

|

The Common Admission Test (CAT) is the main entrance exam conducted for admission to top MBA colleges in India. It is a 3-hour online exam comprising multiple-choice questions. CAT consists of three sections:

Candidates need to clear the sectional and an overall cut-off for admission to MBA colleges. |

CFA vs MBA- Job Prospects

|

CFA |

MBA |

||

|

Job |

Average Salary (in INR) |

Job |

Average Salary (in INR) |

|

Equity Research Analyst |

10 LPA |

Accounts Manager |

8.6 LPA |

|

Financial Analyst |

5.8 LPA |

Cash Manager |

2.4 LPA |

|

Credit Analyst |

7.9 LPA |

Consulting Manager |

29.8 LPA |

|

Senior Financial Analyst |

8.3 LPA |

Credit Manager |

7.4 LPA |

|

Equity Research Associate |

12.5 LPA |

Corporate Controllers |

24 LPA |

|

Corporate Financial Analyst |

7.0 LPA |

Finance Officers & Treasurers |

5.5 LPA |

|

Auditor |

4.4 LPA |

Risk Manager |

11.5 LPA |

|

Consultant |

13.4 LPA |

Investment Manager |

6.1 LPA |

|

Portfolio Manager |

11.7 LPA |

Business Intelligence Analyst |

8.5 LPA |

Salary Source: Ambition Box

CFA vs MBA: Key Differences at a Glance

|

Point of Difference |

CFA |

MBA |

|

Course Overview |

The Chartered Financial Analyst course focuses on several aspects of investment management and financial analysis. |

Master of Business Administration aims to provide students with in-depth knowledge of management studies. |

|

Eligibility |

Bachelor’s Degree in any discipline from a recognized institute. |

Bachelor’s Degree in any discipline from a recognized university. |

|

Institute |

AIMR – CFA Institute |

Almost all colleges such as IIMs, FMS New Delhi, etc |

|

Admission Procedure |

Registering on the official website. |

Entrance Exams – CAT |

|

Core Subjects |

|

|

|

Exam Format |

The course comprises three levels of Examination |

The Common Admission Test comprises three sections |

|

Course Fee |

INR 40,000 – 2.2 Lakh |

20,000 – 40 Lakh |

|

Duration |

1.5 – 4 Years |

2 Years |

|

Difficulty Level |

High |

Moderate |

|

Scope |

|

|

|

Average Salary (Annual) |

6.87 Lakh |

8.48 Lakh |

Who Should Consider the CFA Program?

CFA (Chartered Financial Analyst) is a professional designation that is highly valued in the investment industry. The CFA course is designed for individuals who want to develop a deep understanding of investment analysis and portfolio management.

If you are interested in pursuing a career in finance, particularly in investment analysis, portfolio management, or investment banking, then the CFA program can be a great fit for you. It is also suitable for professionals who want to enhance their skills and knowledge in the field of finance, such as accountants, financial advisors, and economists.

In short, if you have a keen interest in finance and want to develop a deep understanding of investment analysis and portfolio management, then the CFA course is an excellent choice for you.

Who Should Consider the MBA Program?

An MBA (Master of Business Administration) is a dynamic graduate program designed to prepare individuals for leadership and management roles in the business world. If you want to advance your career and gain valuable skills in areas like finance, marketing, management, and operations, pursuing an MBA might be the perfect choice for you. This degree offers practical knowledge and networking opportunities that can significantly enhance your professional growth and open new career doors.

This degree is especially valuable for aspiring entrepreneurs and those aiming to enter competitive fields like consulting or investment banking. An MBA equips students with essential skills and knowledge needed to succeed in these areas. Ultimately, pursuing an MBA is a strong choice for anyone looking to enhance their business acumen, expand their professional network, and unlock new opportunities for growth and advancement in their careers. It can lead to significant personal and professional development.

CFA vs MBA- Which is Better?

After comparing the CFA vs MBA, it’s clear that both paths offer distinct advantages, but the right choice depends on your personal interests and career goals. An MBA provides a broad skill set for managing various aspects of business, such as finance, marketing, and operations. This comprehensive education prepares you for leadership roles by covering a wide range of disciplines. If you’re looking for versatility and the ability to work in different sectors, an MBA may be the better option. When weighing CFA vs MBA, consider how each program aligns with your ambitions and the specific skills you want to develop for your future career.

In contrast, the CFA program focuses deeply on finance and investment, specializing in how to manage and grow money. This specialized knowledge is ideal for individuals committed to a career in finance, although it may limit career options to finance-specific roles. If you’re passionate about finance and investments, the CFA vs MBA comparison will highlight the advantages of pursuing a CFA. While it provides in-depth financial expertise, it’s essential to think about whether you prefer a specialized role or a broader career path that an MBA might offer in the business world.

MBAs generally offer greater versatility and often lead to higher starting salaries because graduates can work across various sectors and roles. This broader applicability can result in more immediate financial rewards and diverse career paths. In the CFA vs MBA debate, it’s important to recognize that MBAs can open doors to different industries, giving you the flexibility to explore various career options. If immediate financial gain and varied opportunities are your priorities, an MBA may be the more suitable choice for your career aspirations.

Conversely, CFAs may start with lower salaries but can achieve significant financial success as they progress in their specialized field. Their expertise in finance and investments can lead to high-level positions and substantial earnings over time. While the initial salary might be lower in the CFA vs MBA comparison, the long-term financial potential in finance roles is promising. If you are dedicated to a finance career and willing to invest time in specialization, the CFA could be the path that leads to significant rewards and career advancement in the finance industry.

Ultimately, the decision between a CFA and an MBA should align with your career goals and personal strengths. While trends and statistics can offer insights, your choice should reflect your long-term vision and aspirations. In the CFA vs MBA discussion, consider what motivates you and where you see yourself in the future. Whether you choose the specialized knowledge of the CFA or the broad skill set of the MBA, make sure your decision supports your personal and professional growth in the years to come.

CFA vs MBA- Make your Choice Today!

Making career decisions can be challenging, but having a clear vision for your future can simplify the process. After reviewing this comparison of CFA vs MBA programs, you should have a better understanding of which path aligns with your goals and aspirations. The CFA program offers specialized knowledge in finance and investment, ideal for those dedicated to a finance career. In contrast, an MBA provides a broader skill set applicable across various business disciplines, preparing you for leadership roles. By considering the key differences in the CFA vs MBA discussion, you can make an informed choice that suits your personal interests and professional objectives, ultimately guiding you toward a fulfilling career in your chosen field.

With your questions about CFA vs MBA addressed you are now equipped with the knowledge necessary to make an informed decision. Understanding the differences between these two paths allows you to evaluate which aligns better with your career aspirations. The CFA program offers a focused approach to finance and investment, while an MBA provides a broader business education that covers various disciplines. As you reflect on your interests and goals, consider how each option can shape your future. Whether you choose the specialized expertise of the CFA or the versatile skill set of an MBA, you can move forward confidently, knowing you’ve made a choice that supports your professional ambitions and long-term success in your field.

Evaluate numerous career choices to choose the right career path for yourself. Dive into our guide on Career Advice.

Frequently Asked Questions

Who earns more in CFA vs MBA?

CFA vs MBA, who earns more? In general both the courses are great. However, if we see the career opportunities and earning potential, an MBA pass out will make more money than the CFA holder. The starting average annual income of an MBA is around ₹8LPA which can increase with experience, on the other hand, the starting package of CFA designation starts from ₹6LPA.

Is a CFA harder than an MBA?

Both the CFA and MBA courses present challenges, but the CFA is often seen as more difficult. This is mainly due to the specialized subjects and the in-depth study required for each topic in the CFA program. Candidates must thoroughly understand complex financial concepts and demonstrate their knowledge through rigorous exams. In contrast, the MBA covers a broader range of business topics, making it less specialized but still demanding in its own right.

Is CFA worth more than a master’s?

The master’s course is ideal for those seeking general knowledge across various subjects rather than in-depth specialization. In contrast, the CFA course is designed specifically for individuals interested in asset management, portfolio strategy, and investment analysis.

To read more related articles, click here.

Got a question on this topic?