Quick Summary

- CA or Chartered Accountancy is an acclaimed profession which requires detailed understanding of finance, taxation, accounting and auditing.

- The CA course curriculum covers a wide range of subjects like taxation, corporate and allied laws, financial reporting and a lot more.

- A CA aspirant has distinctive blend of abilities like sharp analytical thinking, attention to detail, effective communication and dedicated to work. Though the course is demanding but offers significant rewards and a promising future.

Table of Contents

Chartered Accountancy is one of the most prestigious professions in the commerce industry. With over 7 lakh students currently pursuing the CA course, we can say that it is one of the most flourishing career prospects for students.

Chartered Accountancy, or CA, is a highly respected and prestigious profession that requires individuals to possess a deep understanding of finance, taxation, accounting, and auditing. Chartered Accountants are regarded as experts in their field and play a vital role in the financial health of organizations, businesses, and governments around the world.

To become a Chartered Accountant, one must complete a rigorous and comprehensive course of study, consisting of multiple levels of exams and practical experience in the form of articleship. The CA course curriculum covers a wide range of subjects, including financial reporting, corporate and allied laws, strategic management, taxation, and information systems.

Along with theoretical knowledge, CA aspirants are also required to possess a range of important skills such as analytical thinking, problem-solving, communication, and teamwork. A career in Chartered Accountancy offers a range of opportunities in various fields such as accounting and auditing firms, financial institutions, consultancy firms, and independent practice.

CA Course Details

| Degree | Undergraduate |

| Full-Form | Chartered Accountant |

| Duration | 5 Years |

| Age | 17 to 25 Years |

| Minimum Percentage required in 12th | 50% |

| Course Fees | INR 1,06,100/- (on average) |

| Average Salary Offered | INR 8,04,427/- LPA |

| Employment Roles | Chartered Accountant, Taxation Expert, Financial Advisor, Finance Manager, Accounting Firm Manager, Cost Accountant |

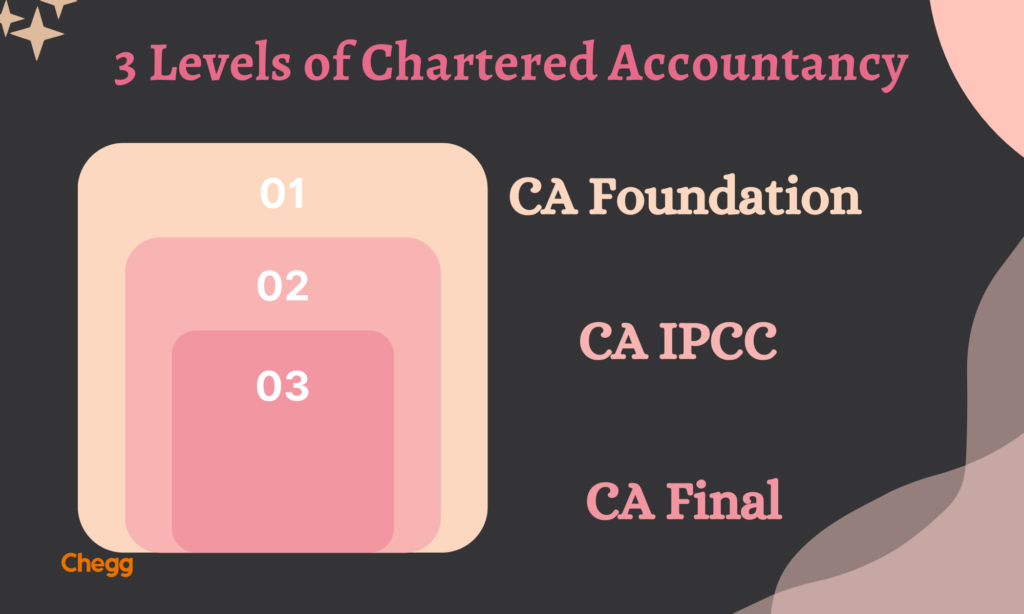

What are the 3 Levels of a CA Course?

To become a Chartered Accountant, students need to complete three levels. Each stage of the Chartered Accountant course has multiple subjects and an examination at the end. The examinations for the second and final stages take place twice a year. Besides theoretical CA study, there is a mandatory three-year long internship or training period known as ‘Articleship’.

CA Foundation

The first level of the Chartered Accountancy course is the CA Foundation. The Chartered Accountant course details for this level cover the basics of Accounting, Business Law and business economics. Students also have to learn Business Mathematics and Statistics. Another major part of this level’s syllabus involves learning about communication. The syllabus also has subject topics like writing articles, reports and letters.

CA IPCC

The CA Intermediate is the second stage after completing the first level. This level is not only vast but also takes some time to complete. The syllabus for this level has, in particular, a total of eight papers. The subjects are Accounting, Corporate Law, Cost and Management, and Taxation. Advanced Accounting, Auditing, Enterprise Information systems and Financial Management exist.

CA Final

The final stage of the CA course also has eight different papers. One of the papers out of eight is an elective chosen during registration. Besides the subjects taught earlier, this level has Financial Reporting and Cost Management. There are also Direct and Indirect Tax Laws, including Advanced Auditing.

Read In Hindi – सीए बनने के लिए क्या पढ़ें: सीए का क्या काम होता है?

How to Become a Chartered Accountant

Please refer to the stepwise guide to know how can you become a CA in India:

CA Foundation Course

The first step in becoming a Chartered Accountant is to complete the CA Foundation Course. Here’s what you need to know:

Duration: 4 months

Fee: Rs. 9,000 – 13,000 (approx.)

Subjects: Principles and Practices of Accounting, Business Laws and Business Correspondence and Reporting, Business Mathematics and Logical Reasoning & Statistics, and Business Economics and Business and Commercial Knowledge.

Eligibility Criteria: Passed 10+2 with a minimum of 50% marks

Where to Register: ICAI website

Best Books: M.P. Vijay Kumar, Girish Ahuja, and Parveen Sharma

Passing Criteria: Minimum 40% marks in each subject and an aggregate of 50% marks in all subjects combined

CA Intermediate Course

After completing the CA Foundation Course, you need to move on to the CA Intermediate Course. Here are the details:

Duration: 8 months

Fee: Rs. 18,000 – 22,000 (approx.)

Subjects: Accounting, Corporate and Other Laws, Cost and Management Accounting, Taxation, Advanced Accounting, Auditing and Assurance, Enterprise Information Systems and Strategic Management, and Financial Management and Economics for Finance.

Eligibility Criteria: Completed CA Foundation Course or graduate/postgraduate degree in commerce with a minimum of 55% marks.

Where to Register: ICAI website

Best Books: M.P. Vijay Kumar, Pankaj Garg, and Padhuka

Passing Criteria: Minimum 40% marks in each subject and an aggregate of 50% marks in all subjects combined.

Articleship

After completing the CA Intermediate Course, you need to complete a period of practical training called Articleship. Here are the details:

Duration: 3 years

Subjects: Practical training under a practicing Chartered Accountant

Eligibility Criteria: After passing either or both groups of the CA Intermediate Course

Where to Register: ICAI website or practicing Chartered Accountant

Passing Criteria: Complete 3 years of practical training under a practicing Chartered Accountant.

CA Final Course

Finally, you need to complete the CA Final Course to become a Chartered Accountant. Here are the details:

Duration: 6 months

Fee: Rs. 22,000 – 25,000 (approx.)

Subjects: Financial Reporting, Strategic Financial Management, Advanced Auditing and Professional Ethics, Corporate and Economic Laws, Strategic Cost Management and Performance Evaluation, Elective Paper (choose one from six options), and International Taxation and Transfer Pricing (if chosen as an elective).

Eligibility Criteria: Completed 2.5 years of Articleship or served as an Audit Assistant in a CA firm for a year and a half.

Where to Register: ICAI website

Best Books: M.P. Vijay Kumar, Padhuka, and Surbhi Bansal

Passing Criteria: Minimum 40% marks in each subject and an aggregate of 50% marks in all subjects combined.

How to Get Articleship Opportunities in Top CA Firms

Securing articleship opportunities in top CA firms is a crucial step for Chartered Accountancy students as it offers valuable practical training and exposure to a variety of industries. Here are some tips on how to get articleship opportunities in top CA firms:

- Start early: Begin networking with Chartered Accountants and attending career fairs to get an idea of the firms you are interested in and the requirements they have.

- Focus on academics: A good academic record and consistent performance in the CA exams can make you stand out among the competition.

- Prepare a strong resume: Highlight your academic achievements, internships, and extra-curricular activities in your resume and tailor it to the specific firm you are applying to.

- Reach out to recruiters: Send personalized emails to recruiters expressing your interest in their firm and asking about articleship opportunities.

- Consider referrals: Networking with Chartered Accountants who work in top CA firms and requesting referrals can increase your chances of securing an articleship.

- Be proactive: Attend events hosted by top CA firms and take advantage of opportunities to meet recruiters and ask questions.

Top 10 CA Firms

- Deloitte

- PwC (PricewaterhouseCoopers)

- EY (Ernst & Young)

- KPMG

- BDO International

- Grant Thornton International

- RSM International

- Crowe Global

- Nexia International

- Moore Global

Remember, securing articleship opportunities in top CA firms is competitive, so be prepared to put in the effort to stand out among the competition.

Who Should Opt for Chartered Accountancy

If you are considering a career in finance, Chartered Accountancy could be an excellent option for you. However, it is essential to understand the skills required to excel in this field. Here are some skills and qualities that make for a successful Chartered Accountant:

Strong Analytical Skills

As a Chartered Accountant, you will need to analyze complex financial data and provide insights to your clients. Strong analytical skills are essential to perform this task effectively.

Attention to Detail

The ability to pay close attention to detail is crucial in Chartered Accountancy. This skill ensures that you don’t miss any important financial information that could lead to incorrect financial statements or audit reports.

Strong Communication Skills

As a Chartered Accountant, you will often have to communicate complex financial information to non-financial stakeholders. Strong communication skills, both verbal and written, are essential to convey information effectively.

Problem-Solving Skills

Chartered Accountants often encounter complex financial issues that require creative problem-solving skills to resolve.

Ethical Standards

Chartered Accountants must have high ethical standards and adhere to a strict code of conduct to maintain the integrity of the profession. If you possess these skills and qualities, Chartered Accountancy could be an excellent career choice for you. It offers a range of career opportunities, from public accounting to private industry, and can be a fulfilling and financially rewarding career path.

Courses After CA Course for Career Advancement

After completing your Chartered Accountancy (CA) certification, there are several courses you can pursue to advance your career and increase your earning potential. Here are some courses you may consider:

Diploma in Information System Audit (DISA)

This course focuses on providing knowledge and skills related to information systems audit and control. It is an excellent option for CA professionals interested in specializing in IT audits.

Chartered Financial Analyst (CFA)

The CFA program is a globally recognized certification for investment professionals. It covers a broad range of topics related to financial analysis, including equity valuation, portfolio management, and ethics.

Certified Information Systems Auditor (CISA)

This certification is designed for professionals who specialize in auditing, monitoring, and assessing information technology and business systems. It is a popular choice for CA professionals who want to focus on IT risk management.

Investment Banking

Investment banking is a lucrative career path for CA professionals. Specializing in investment banking can lead to opportunities in mergers and acquisitions, corporate finance, and equity and debt capital markets.

Financial Risk Management

This certification covers topics related to risk management in the financial industry, including credit risk, market risk, and operational risk. It is an excellent option for CA professionals interested in specializing in risk management.

Bachelor of Law (LLB)

Pursuing an LLB degree can complement your CA certification and open up opportunities in tax law, corporate law, and other areas of legal practice.

Career Prospects for Chartered Accountants

As a Chartered Accountant (CA), you will have a diverse range of career opportunities available to you. Here are some of the career prospects for CAs:

CA Firm

You can work with CA firms such as Deloitte, PwC, EY, and KPMG, among others. As a CA, you can work in various departments, including audit, tax, and advisory. The average annual salary for a CA working in a top CA firm can range from INR 8-25 lakhs, depending on experience and designation.

Financial Institutions

You can work with financial institutions such as banks, insurance companies, and investment firms. Some of the top financial institutions in India include HDFC Bank, ICICI Bank, Axis Bank, SBI, LIC, and Bajaj Allianz, among others. The average annual salary for a CA working in a financial institution can range from INR 8-18 lakhs, depending on experience and designation.

Businesses

You can work with businesses across various industries, including manufacturing, retail, and IT. Some of the top businesses in India that hire CAs include TATA Group, Reliance Industries, Aditya Birla Group, and Infosys, among others. The average annual salary for a CA working in a business can range from INR 7-20 lakhs, depending on experience and designation.

Consultancy Firms

You can work with consultancy firms such as McKinsey, Boston Consulting Group, and Accenture, among others. As a CA, you can work in various departments, including strategy consulting and financial advisory. The average annual salary for a CA working in a top consultancy firm can range from INR 12-35 lakhs, depending on experience and designation.

Independent Practice

You can start your own practice as a CA and offer services such as audit, taxation, and advisory to clients. As an independent practitioner, your earnings will depend on the number and size of clients you have. The average annual salary for a CA in independent practice can range from INR 6-25 lakhs, depending on the size and complexity of the practice.

Salary Source – Payscale, Ambitionbox

Way forward

You now have a good understanding of what the course entails, the various levels of the course, eligibility criteria, and career prospects for Chartered Accountants.

As a CA aspirant, you possess a unique combination of skills and qualities, including analytical thinking, attention to detail, excellent communication skills, and a strong work ethic. The CA course is a challenging but rewarding path that can lead to lucrative career opportunities in various industries.

By successfully completing the CA course, you will have gained valuable knowledge and skills that can be applied in a range of professional settings. Whether you choose to work with a top CA firm, financial institution, business, or start your own practice, your CA qualification can open doors to exciting and fulfilling career opportunities.

Frequently Asked Questions (FAQs)

Q. What is the CA course subject?

A. The entire Chartered Accountant course covers several subjects from basic to advanced levels. Each level has different subjects. Some subjects the course covers are Accounting, Business Mathematics, Business Economics, and Communication are part of the foundation level. The intermediate level has Cost Accounting, Taxation, Financial Management, and Corporate Law. Finally, the CA course finals have subjects like Financial Reporting, Electives, Direct and Indirect Taxes, etc.

Q. What is the qualification needed to become a CA?

A. To become a CA, both high schools pass-out and graduates are eligible. For the former, however, one must have a CPT score. Individuals with an undergraduate degree should have at least 55% of commerce students. On the other hand, students from other fields must have a 60% minimum score. For specific eligibility criteria, one must visit the ICAI website.

Q. Which course is best for CA?

A. There is no specific requirement to enroll in the Chartered Accountant course. ICAI accepts high school students who have taken their school leaving examination. However, they must have a Common Proficiency Test score. Primarily, finance and commerce students opt to do CA. Although, students in Science, Arts, and other fields can apply. There are also no limitations on the undergraduate or graduate degree the applicant must have.

Q. What is the duration of a CA course?

A. The Chartered Accountant course is considered long. Individuals are left wondering “how many years to complete CA”. The total duration for the entire course is around five years. For each level, the duration refers to the study period for students to complete the subjects. The foundation’s duration is four months, eight months for the intermediate, and three years for the final stage.

Related Reads

To read more related articles, click here.

Got a question on this topic?