Got a question on this topic?

Quick Summary

Table of Contents

Authored by, Amay Mathur | Senior Editor

Amay Mathur is a business news reporter at Chegg.com. He previously worked for PCMag, Business Insider, The Messenger, and ZDNET as a reporter and copyeditor. His areas of coverage encompass tech, business, strategy, finance, and even space. He is a Columbia University graduate.

Are you curious about how to become Income Tax Officer and build a prestigious career in the government sector? This role demands dedication, knowledge, and a clear understanding of the recruitment process. To qualify, aspirants must clear the SSC Combined Graduate Level (CGL) exam, which tests reasoning, general awareness, quantitative aptitude, and English.

Understanding how to become Income Tax Officer also includes knowing the eligibility criteria, salary expectations, and job responsibilities. The position offers competitive pay, allowances, and job stability. Additionally, meeting physical fitness standards and clearing document verification are crucial steps.

If you’re serious about how to become Income Tax Officer, start preparing early. This guide will help you navigate the exam process, eligibility, and career prospects, setting you on the path to success.

An Income Tax Officer (ITO) holds a significant role within the Income Tax Department. These professionals are tasked with evaluating financial records, assets, and liabilities to accurately ascertain the income of both individuals and businesses, ensuring that they fulfill their tax obligations appropriately.

Pursuing a career as an Income Tax Officer is both prestigious and rewarding, offering growth opportunities and the chance to uphold the nation’s taxation system. Learning how to become Income Tax Officer involves understanding their vital role in ensuring tax law compliance, investigating tax evasion, and assisting taxpayers effectively.

If you’re curious about how to become Income Tax Officer, here’s a detailed guide that outlines the essential steps and key information to help you reach your goal.

Candidates wondering How to become income tax officer should keep themselves updated with the latest income tax recruitment notifications. It is essential to thoroughly review the tax officer eligibility criteria outlined in each recruitment process and ensure compliance with the specific guidelines.

The written examination is the first step in your journey to understanding how to become Income Tax Officer. This test evaluates your knowledge, aptitude, and analytical skills, covering areas such as general awareness, English, quantitative aptitude, and reasoning.

Preparation Tips:

The interview is a crucial stage in learning how to become Income Tax Officer. It evaluates your personality, communication skills, and overall suitability for the role.

Preparation Tips:

Read About: You Must Know These Interview Etiquette Tips

The medical examination is an essential step in how to become Income Tax Officer. It ensures candidates meet the required physical and medical standards for the role, including general health, fitness, and visual acuity.

Preparation Tips:

Success in how to become income tax officer lies in diligent preparation, dedication, and a solid understanding of the requirements. Focus on core subjects, practice consistently, and demonstrate your passion and suitability for the role to increase your chances of achieving this esteemed career.

Also Read: Govt Jobs after Graduation

The SSC CGL (Staff Selection Commission Combined Graduate Level) exam is another distinct exam conducted by the Staff Selection Commission (SSC). It is not specifically focused on the role of an income tax officer but rather encompasses a broader range of positions and roles within various government departments and organizations.

The SSC CGL Exam is essential in how to become Income Tax Officer. It includes Tier-I (preliminary), Tier-II (main), Tier-III (descriptive), and Tier-IV (skill test/document verification) to select candidates for Group B and C posts in government organizations.

| Exam | Description |

| Tier 1 |

|

| Tier 2 |

|

Tier 3 |

|

| Tier 4 |

|

The SSC CGL exam plays a crucial role for those wondering how to become income tax officer. Successfully clearing this exam can help you secure a position as an income tax inspector in the Income Tax Department. It assesses candidates’ aptitude, reasoning, and general awareness—key skills for efficient tax administration.

Note: It’s important to note that the syllabus provided is a general overview and may vary slightly each year. It is advisable to refer to the official SSC CGL notification and exam syllabus for the most accurate and up-to-date information regarding the subject-wise syllabus breakdown.

Understanding the eligibility criteria is a crucial first step in learning how to become an Income Tax Officer. Meeting these requirements ensures that candidates are qualified to apply for this prestigious role within the Income Tax Department. Below are the key eligibility requirements you need to fulfill:

Note: Please note that specific details and procedures may vary each year, so it’s important to refer to the official SSC CGL notification and website for the most accurate and up-to-date information on the application process.

| Nationality | Indian citizens or individuals meeting specific criteria for Nepal, Bhutan, Tibetan refugees, or certain Indian-origin migrants intending to settle in India. |

| Educational Qualification | Hold a bachelor’s degree from a recognized institution; specifics vary by post—refer to official notification. |

| Age Limit | Generally 18-32 years; relaxations for reserved categories per government norms. |

| Physical Fitness | Certain posts may require meeting specific fitness standards set by recruiting authorities. |

| Other Requirements | Additional criteria like language proficiency or specific skills outlined in official notifications. |

The following are the prime responsibilities of a Tax assessor:

An Income Tax Officer (ITO) enjoys a clearly defined career trajectory along with substantial opportunities for advancement within the Income Tax Department, a crucial component of India’s financial management framework. ITOs play a vital role in enforcing tax regulations, ensuring compliance with taxation laws, and contributing to the nation’s economic stability and growth. The typical career progression includes the following stages:

| Rank | Approximate Salary Range (in INR) |

| Income Tax Inspector | 9,300 – 34,800 (Grade Pay: 4,600) |

| Tax Assistant | 5,200 – 20,200 (Grade Pay: 2,400) |

| Senior Tax Assistant | 5,200 – 20,200 (Grade Pay: 2,800) |

| Income Tax Officer | 9,300 – 34,800 (Grade Pay: 4,800) |

| Assistant Commissioner of Income Tax | 15,600 – 39,100 (Grade Pay: 5,400) |

| Deputy Commissioner of Income Tax | 15,600 – 39,100 (Grade Pay: 7,600) |

| Commissioner of Income Tax | 37,400 – 67,000 (Grade Pay: 10,000) |

Note: Please note that these income tax officer salary ranges are approximate and can vary based on factors such as location, years of service, and other allowances. It’s important to refer to the official notifications and guidelines from the income tax department for the most accurate and up-to-date information on the salary structures.

The career progression in the Income Tax Department provides ample opportunities for advancement. As you progress in your career as an income tax officer, you can be promoted to higher positions like Assistant Commissioner of Income Tax, Deputy Commissioner, and Commissioner of Income Tax. These advancements are based on your performance, experience, and qualifications, offering increased responsibilities, authority, and higher salaries. Knowing how to become income tax officer also includes understanding the career growth potential within the department.

To secure promotions, officers often need to meet specific criteria, such as:

Continuous learning, professional development, and acquiring relevant skills can significantly enhance your chances of career progression on how to become income tax officer. It’s important to note that salary structures, allowances, and promotion policies for income tax officers may change based on government regulations and policies.

|

Book Title |

Author |

Publisher |

Income Tax Officer Exam Guide |

R. Gupta |

Arihant |

|

Income Tax Officer Exam: A Complete Guide |

Deepak Agarwal |

Disha Publications |

|

Income Tax Officer Exam: Previous Year Papers |

Upkar Publication |

Upkar Prakashan |

|

Income Tax Law and Practice |

Girish Ahuja, Ravi Gupta |

Wolters Kluwer |

|

Income Tax Officer Exam Guide |

Dr. Lal & Jain |

Unique Publishers |

|

Income Tax Law |

Vinod Singhania |

Taxmann |

|

Income Tax Officer Exam: Practice Workbook |

S.K. Devgan |

Arihant |

|

Income Tax Officer Exam: Model Test Papers |

RPH Editorial Board |

Ramesh Publishing House |

|

Income Tax Officer Exam: Objective Questions |

Sanjay Mundhra |

CCH Wolters Kluwer |

|

Income Tax Law & Practice |

N.S. Govindan |

Lexis Nexis |

In conclusion, the answer to the question “How to become income tax officer” requires meeting the eligibility criteria, clearing selection exams, and obtaining additional certifications. By understanding the role and responsibilities of income tax officers, aspiring individuals can prepare themselves for the journey ahead.Seeking to navigate the path toward becoming an income tax officer?

Dive into our comprehensive Career Advice section for valuable insights and resources to propel your career forward.

To understand how to become income tax officer, you need to have a bachelor’s degree in any discipline from a recognized university. In India, aspiring candidates must clear the Civil Services Examination conducted by UPSC. Additionally, passing exams like the SSC CGL is crucial for securing the role of an income tax officer.

The salary of an Income Tax Officer in India typically ranges from ₹44,000 to ₹1,00,000 per month, depending on experience, location, and grade level.

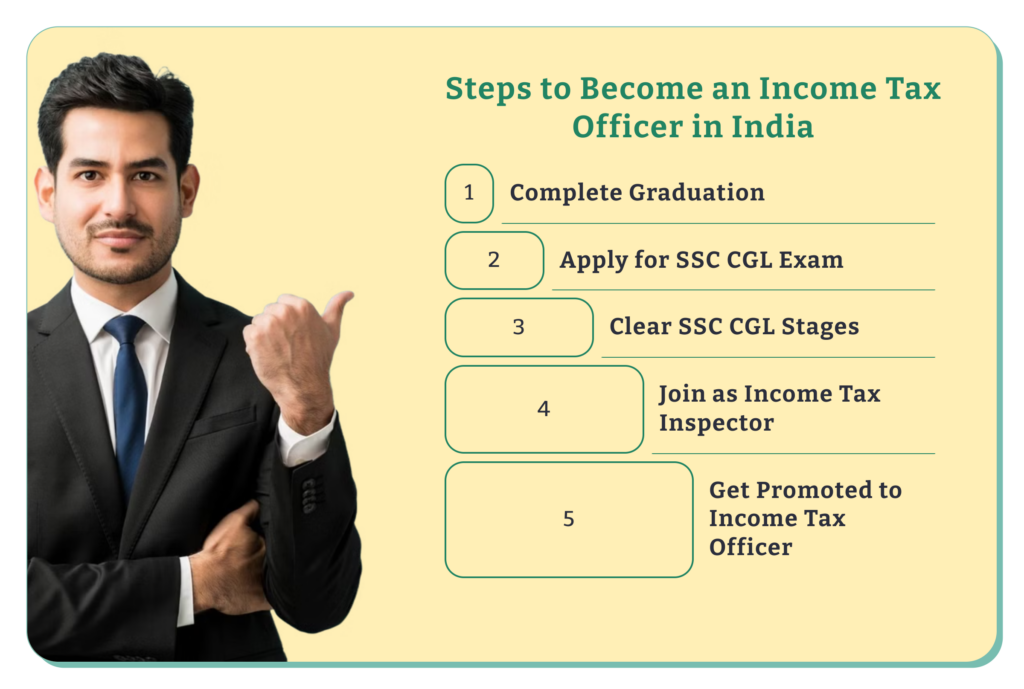

To become an Income Tax Officer in India:

1. Graduate from a recognized university.

2. Crack SSC CGL Exam (Tier 1, 2, 3 & 4).

3. Join as an Income Tax Inspector in CBDT.

4. Get promoted to Income Tax Officer through experience or exams.

To study for an Income Tax Officer role, focus on:

1. Eligibility & Exam: Prepare for SSC CGL or UPSC exams, depending on the recruitment process.

2. Syllabus: Cover subjects like General Awareness, Quantitative Aptitude, Reasoning, and English.

3. Taxation Knowledge: Study Indian taxation laws, current policies, and financial regulations.

4. Practice & Mock Tests: Solve previous years’ papers and take mock tests for better time management.

5. Stay Updated: Follow economic news, government schemes, and budget updates.

The highest post in the Income Tax Department is Principal Chief Commissioner of Income Tax (Pr. CCIT). It is the topmost rank in the Central Board of Direct Taxes (CBDT).

Editor's Recommendations

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.