Quick Summary

- BAF Course covers financial accounting, taxation, auditing, and financial management.

- Graduates can pursue careers with strong growth opportunities in financial analysis, auditing, banking, and corporate finance.

- Admission usually requires a Class 12 pass with a minimum percentage in commerce subjects.

- The program is offered by top universities like Delhi University, NMIMS, and Christ University.

- Strong placement support is provided, with opportunities in leading financial institutions and firms.

Table of Contents

Introduction

BAF Course is a 3-year full-time undergraduate course specializing in accountancy and finance. Students who want to know how to become an accountant can opt for this accountant study. This course teaches the technicality of finance and accounting standards through various accounting and finance subjects. The students pursuing this course must qualify for their 10+2 examinations with a minimum 50% score.

Numerous colleges and universities offer Bachelor of Accounting and Finance to candidates looking to qualify as accountants in India. A few colleges provide merit-based admissions, and some colleges conduct entrance examinations. Students who qualify for entrance examinations conducted by universities and colleges are provided admission and can study for an accountant’s career.

Those pursuing the BAF Course get ample opportunities in their career phases. Students graduating from this course are eligible to work in job sectors like Banks, excise departments, business analysis, stock exchange, etc., as this is a valid qualification for accountants in India.

What is a BAF Course?

The Bachelor of Accounting and Finance (BAF) degree is designed to provide in-depth knowledge in accounting and finance. It gives students the essential skills for a successful financial accounting, tax, and auditing career. The BAF program develops analytical skills in its graduates to dissect financial information and make strategic decisions that lead to financial success.

By getting a BAF degree, individuals unlock a wide range of career paths across finance and accounting sectors and specialization in auditing. The course structure is designed to address the complexities of the changing fiscal environment. This includes regular classroom instruction complemented by practicals, project work, and internship opportunities contributing to holistic education.

Graduates of the BAF program emerge with a robust skill set that can tackle the challenges faced by professionals in modern-day accounting sectors. This makes them prepared for various roles they can pursue post-graduation.

BAF Course Details

Numerous colleges and universities in India offer a Bachelor’s degree in accounting and finance. It is one of the best courses for candidates from a commerce background who want to pursue their careers in the same field. The main benefit of pursuing a B.Com in accounting and finance is the opportunity to learn technical skills regarding finance and accounts.

The highlights of the BAF Course details are given below:

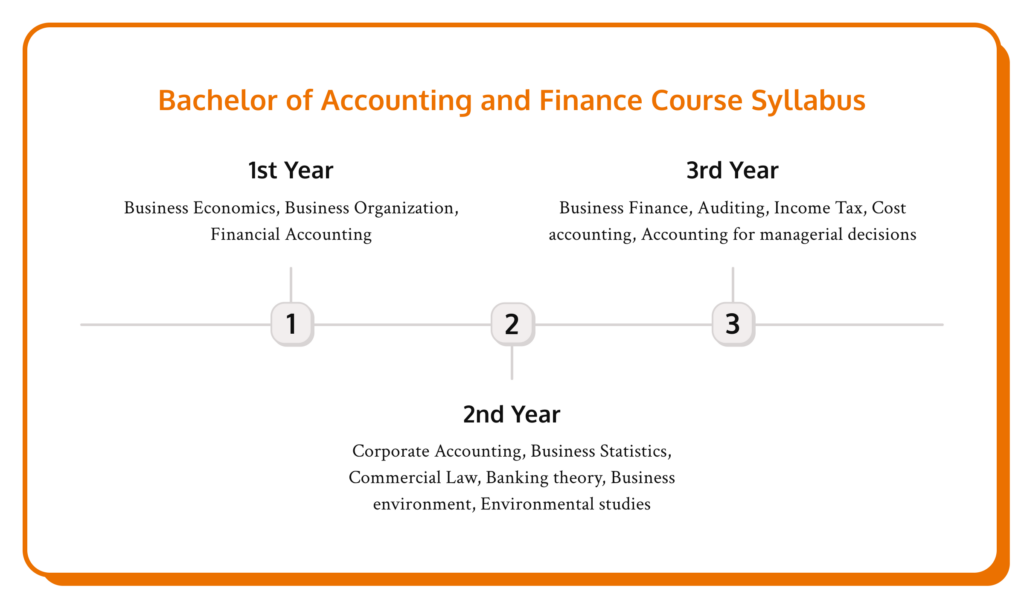

BAF Subjects and Syllabus

To pursue this course, candidates must know the subjects and syllabus included in this study for accountants. Students must apply to the top universities or colleges in India to pursue a bachelor’s in accounting and finance to get great placement opportunities after the course’s completion.

Many of these top colleges and universities conduct entrance exams to provide admissions to qualified candidates. The subjects and syllabus of all the years of the BAF Course are provided below:

Candidates pursuing a Bachelor’s in Accounting and Finance should understand that this qualification combines theoretical and practical knowledge. Mastering these areas is essential, as it allows students to apply their learning effectively when recruited by leading companies. Recruitment is often based on a candidate’s ability to use their knowledge to benefit the organization, making it crucial to grasp key concepts quickly.

The course covers subjects critical to business analysis and the banking sector. Students must have a strong command of numerical concepts, as financial roles require precision and attention to detail. Business-related knowledge and practices are at the core of the curriculum, emphasizing the importance of understanding how businesses operate financially.

Pursuing a Bachelor’s in Accounting and Finance is a great fit for students interested in numbers, statistical analysis, and finance. It provides the foundational skills and knowledge necessary for success in these fields.

Suggested Read: BBA vs BCom

Entrance Exams for BAF Course

Many prestigious colleges and universities across India offer a Bachelor’s degree in Accounting and Finance. While some institutions grant admission based on merit, others require students to clear an entrance exam. These entrance exams are a gateway to securing a spot in top universities. Below are some of the prominent entrance exams:

1. DU JAT – The Delhi University Joint Admission Test (DU JAT) is conducted for admission to various undergraduate courses at Delhi University. The exam is held online, and students who qualify are granted admission to their desired courses in participating colleges.

2. SET – Symbiosis International University organizes the Symbiosis Entrance Test (SET) to admit students to various undergraduate courses. Conducted on a national level, SET offers candidates an excellent opportunity to join one of India’s leading educational institutions.

3. IPU CET – Guru Gobind Singh Indraprastha University (IPU) conducts the Common Entrance Test (IPU CET) for admission to various undergraduate and postgraduate programs. This university-level exam is available online and is accepted by several affiliated colleges.

4. MHT CET – The Maharashtra Common Entrance Test (MHT CET) is a state-level examination for students seeking admission to undergraduate courses in Maharashtra. It is conducted online and is valid for all universities and colleges in the state.

Key Sections of Entrance Exams

Most of the entrance exams for Bachelor in Accounting and Finance share common sections, including:

- Quantitative Analysis

- Logical Reasoning

- English Proficiency

- General Awareness (with a focus on finance and banking)

Preparation Tips for Success

To perform well in these entrance exams, candidates should develop a clear strategy and focus on crucial subjects. It’s important to prioritize key topics, practice consistently, and manage time efficiently. Regular revision and solving practice papers can help improve speed and accuracy. Staying organized, keeping track of progress, and staying calm during preparation will increase the chances of success and ensure that candidates are fully prepared for the exams.

Here are some effective preparation tips –

1. Logical Reasoning

Practice makes perfect! Solve mock tests regularly and ensure you understand the basic concepts in logical reasoning. This will help you tackle the questions quickly and accurately during the exam.

2. Quantitative Aptitude

Mastering the fundamental concepts is crucial for success in the quantitative aptitude section. Understanding these concepts will allow you to solve questions faster, ensuring maximum accuracy.

3. General Awareness

Stay updated with current affairs, especially in the finance and banking sectors. Reading newspapers and following news on key global issues will help you easily answer questions related to general awareness. Don’t forget to review basic static GK questions regularly.

4. English Proficiency

To excel in the English section, focus on grammar and vocabulary. Reading journals and editorials daily will sharpen your language skills. Additionally, solving daily mock tests will improve your ability to manage this section effectively.

5. Speed and Accuracy

Speed and accuracy are critical for success in these exams. While answering questions, maintain a balance between quick responses and careful evaluation. Aim for maximum accuracy without rushing through the questions.

6. Be Mindful of Negative Marking

Most entrance exams penalize incorrect answers with negative markings. Therefore, only attempt a question if you’re confident in your answer. Avoid guessing to prevent unnecessary deductions from your score.

Related read: Career after Bcom

Top Colleges to Pursue a BAF Course

Most of the colleges and universities in India offer great courses for commerce background students. A bachelor in accounting and finance is one of them.

But there are a few colleges which are regarded better than the others. These colleges are listed below:

Scope: Jobs after Bachelors of Accounting and Finance

The market demands more BAF graduates, so this course plays a huge role across various sectors.

Opportunities for BAF graduates in:

- Banking

- Insurance industries

- Consultancy agencies

- Financial analysis

Students of this course are equipped with extensive skills in financial, accounting, and business analytical roles. So they have various career options with finance and accounting and finance degrees.

As finance and accounting expand, there are many upward opportunities for those who hold a BAF degree. With the growing need for business analysts and financial experts, BAF holders are in a great position to capitalize on these evolving trends and build their careers.

Highly valued in government institutions and private sectors, a BAF degree gives job security and opportunities for upward mobility in one’s profession. A Bachelor’s in Accounting and Finance offers graduates various career opportunities. Those who excel in their studies and graduate with strong academic records often find themselves with placement opportunities in top-tier companies.

Many of the leading colleges in India not only offer quality education but also provide valuable internships and placement programs that help bridge the gap between academic learning and real-world application. Graduates with a Bachelor’s in Accounting and Finance can pursue various roles, such as accountants, financial analysts, investment bankers, tax consultants, auditors, risk managers, corporate finance executives, and banking sector professionals. Each role provides a unique opportunity to engage with different aspects of finance and accounting, offering stability and growth.

Moreover, graduates who wish to further specialize in their field can opt for advanced studies such as Chartered Accountancy (CA), Company Secretary (CS), Cost Management Accounting (CMA), or an MBA. These higher qualifications can enhance career prospects, open doors to senior roles, and offer better learning potential. With the right combination of knowledge, skills, and determination, a Bachelor’s in Accounting and Finance lays a strong foundation for a prosperous and rewarding career.

Conclusion

In summary, the BAF degree gives students a solid foundation in accounting and finance and opens up many career paths. The BA degree has a chosen curriculum and is offered in different modes, so it’s perfect for those who want a successful career in these fields.

The BAF degree teaches students the basics of accounting and finance and prepares them for excellence in these industries. The program’s flexibility and electives cater to many career goals and plenty of career opportunities upon graduation. Furthering your studies or getting specialized certifications can increase job prospects for BAF degree holders. This course can start a successful career in accounting and finance BAF fields.

Moreover, pursuing this degree offers the potential for higher education and professional certifications, such as Chartered Accountancy (CA), Cost Accountancy (CMA), and Certified Financial Analyst (CFA). These certifications further enhance career prospects and salary potential. Overall, a Bachelor’s in Accounting and Finance is a strong foundation for those interested in a career in finance, offering both stability and growth in a dynamic field.

Frequently Asked Questions (FAQs)

Q1. What is a BAF Course?

The Bachelor of Accounting and Finance is a three-year undergraduate course for students interested in finance careers. It covers financial management, accounting principles, investment analysis, and taxation. This program prepares graduates for banking, auditing, financial planning, and corporate finance roles. It is ideal for those looking to build a strong foundation in financial management.

Q2. What are the specializations available in the BAF Course?

Graduates of this course gain expertise in finance and accounting principles. They develop technical skills in financial analysis, taxation, auditing, and investment management. This specialization prepares them for banking, corporate finance, and financial consulting careers. With a strong foundation in finance and accounting, they can effectively manage financial records and make strategic business decisions.

Q3. Which qualification for an accountant in India has the highest salary?

CFA is among the highest-paying careers for Bachelor of Accounting and Finance students. It is ideal for those aiming to become professional accountants and financial analysts. With expertise in investment management, economic analysis, and risk assessment, CFAs earn high salaries and have excellent career opportunities in banking, corporate finance, and investment firms.

Q4. Is a BAF degree a good qualification for accountants in India?

A Bachelor’s in Accounting and Finance is an excellent choice for students interested in finance and accounting careers. It provides essential knowledge of financial management, taxation, auditing, and investment analysis. This degree opens up various job opportunities in banking, corporate finance, and economic consulting, making it a valuable option for aspiring finance professionals.

Q5. What are the subjects in a BAF Course?

In a BAF Course, students study subjects such as Financial Accounting, Corporate Accounting, and Cost Accounting, which form the core of accounting knowledge. They also learn about Business Law, Taxation, and Auditing, along with Management Accounting and Financial Management, to understand business operations. Additionally, subjects like Economics and Investment Management help students develop a broader understanding of finance and economics. These subjects provide a strong accounting, finance, and business principles foundation.

To read more related articles, click here.

Got a question on this topic?