Quick Summary

Imagine standing at a crossroads right after your 12th grade—one path leads toward the dynamic world of business management, and the other dives deep into the financial backbone of companies. Should you choose BBA vs BCom? This isn’t just about picking a course; it’s about shaping your future career, lifestyle, and opportunities. In this guide, we’ll explain how each degree can open doors to unique industries, job roles, and long-term growth, so you can make an informed, confident decision about your next step.

The Bachelor of Business Administration (BBA) is a three-year undergraduate degree that focuses on the practical side of running a business. It’s designed to give you the essential skills and knowledge. The degree covers various subjects, such as business mathematics, financial accounting, human resources, and business law. The curriculum is comprehensive, so you are ready to face the business world.

BBA is popular among business management, entrepreneurship, and corporate leadership students. It gives you a solid foundation in business administration and is a great starting point if you want to further your education with a postgraduate degree like an MBA. With its practical skills and real-world applications, the BBA degree is a valuable asset if you want to succeed in the competitive business world.

BCom is a 3-year undergraduate program that explores commerce, finance, and economics more deeply. This degree gives students a strong theoretical foundation in accounting, taxation, and financial analysis. BCom graduates are suitable for finance, auditing, and taxation careers, where a deep understanding of financial concepts is required. The BCom program is for students inclined towards analytical and quantitative aspects of business.

Students often opt for BCom to build their expertise in Finance, accounting, taxation, and economics. This allows them to build a strong foundation for professional courses like Chartered Accountants, Company Secretary, CFA, and MCom. It allows them to build a strong niche for detail and analytical thinking, and many individuals start preparing for government or banking jobs post-BCom.

Before choosing between BBA and BCom, it’s important to understand the eligibility criteria and admission processes for each degree.

BBA Eligibility:

BCom Eligibility:

BBA is a complete professional degree that teaches business, management, and more. After receiving a BBA degree, a master’s degree is no longer essential. One can learn everything one needs to know on the job.

The ultimate goal is to achieve a good salary and work-life balance. With a BBA, one can pursue managerial and administrative careers that offer high pay and quick promotions. If you’re confused about the difference between BBA and BCom salary prospects, it’s important to note that BBA degrees generally lead to attractive pay packages.

BBA students have a great cross-country network due to their seniors. This is because many BBA graduates start working in the corporate field after their degrees. Hence, they can help their peers and classmates with career advancement opportunities.

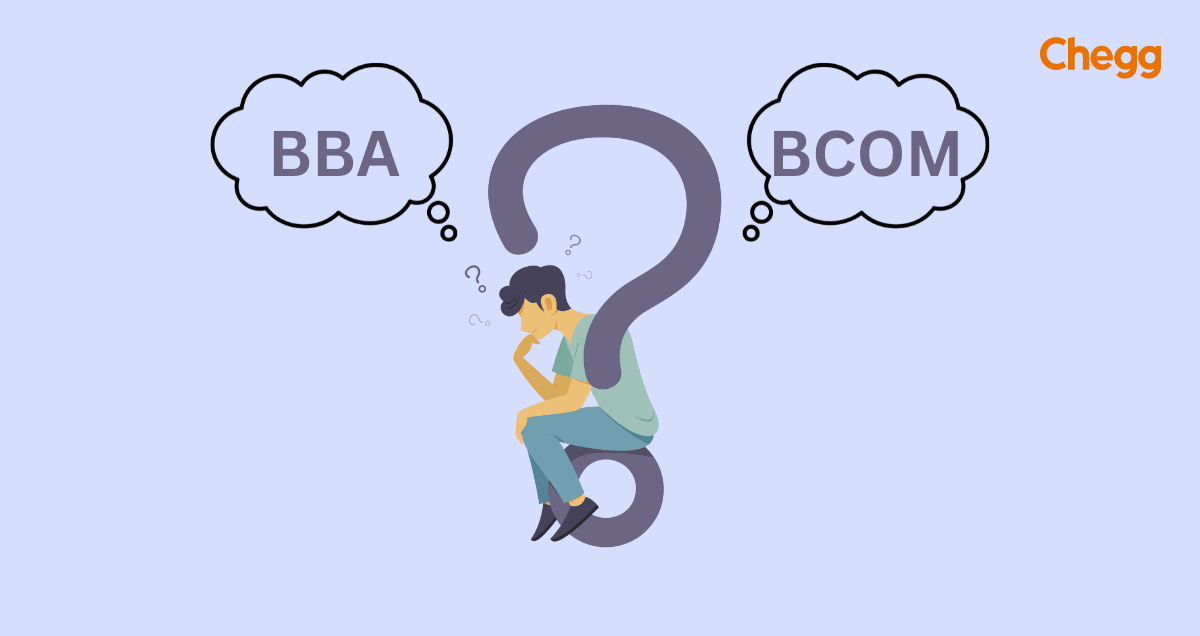

BBAs are comparatively less expensive than MBAs and similar programs in most Indian colleges. So, they promise a great return on investment.

After BCom, students have a wide range of job options to consider. It allows students to explore many fields without limiting the scope of growth.

Every firm needs a capable accountant or commerce specialist for a thriving business. BCom graduates are essential for managing finances and handling accounts in firms.

Commerce graduates can earn substantial salaries, and candidates with a few years of experience can potentially make excellent incomes. The monthly pay for new hires may vary from Rs. 10,000 to Rs. 25,000, depending on the organization. Understanding the difference between BBA and BCom can help graduates gauge their earning potential in different fields.

BCom graduates are often selected for promotion within their company. This also depends on their dedication, endurance, self-control, leadership, and teamwork.

| Semester / Year | BBA Subjects | BCom Subjects |

|---|---|---|

| 1st Year | Principles of Management, Business Communication, Financial Accounting, Business Law, Business Organisation | Financial Accounting, Business Economics, Economics, Business Mathematics |

| 2nd Year | Marketing Management, Human Resource Management, Corporate Accounting, Cost Accounting, Business Law, Operations Management | Business Statistics, Income Tax Law |

| 3rd Year | Financial Management, Entrepreneurship, Auditing, Financial Management, International Business, Electives/Specializations | Management Accounting, Electives |

BBA graduates typically develop:

BCom graduates typically develop:

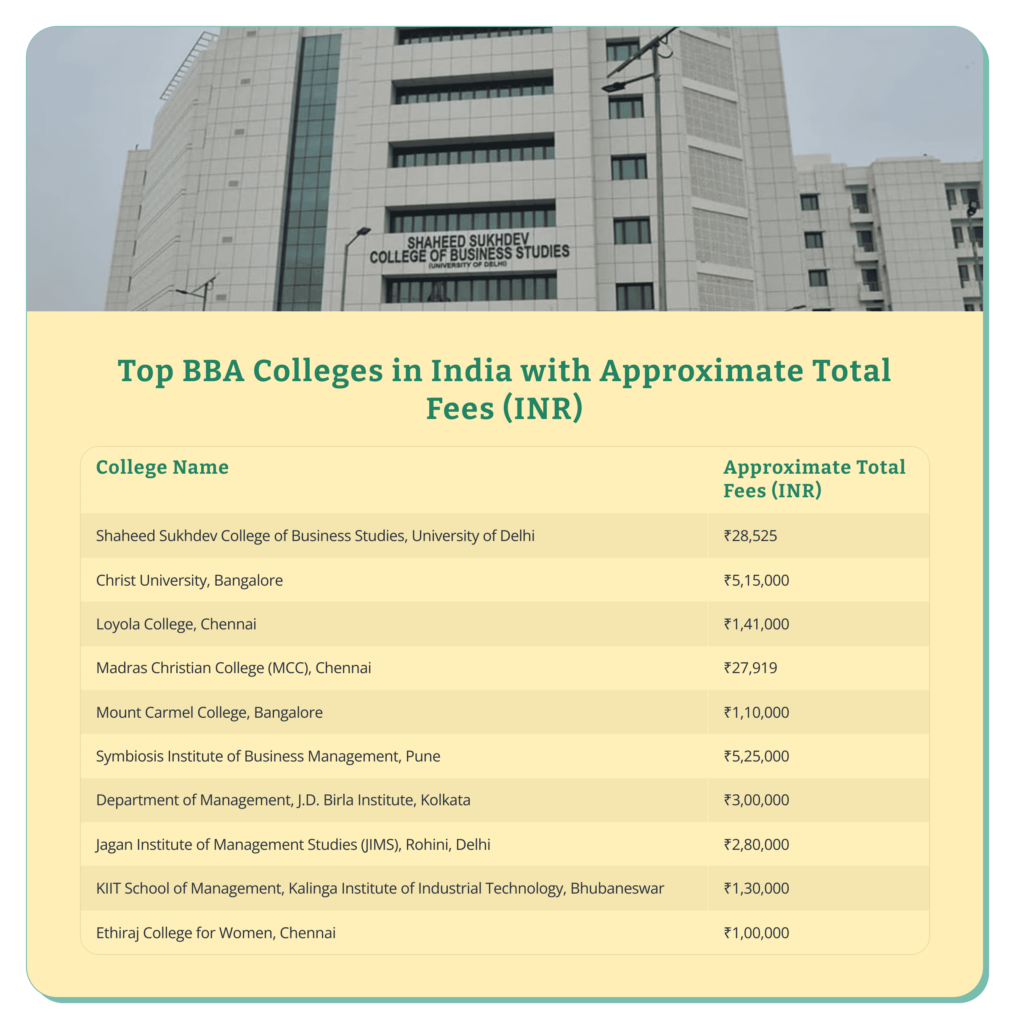

Note: The fees mentioned are approximate and may vary based on the specific program, duration, and other factors. It’s advisable to check the official college websites or contact the institutions directly for the most accurate and updated fee structures.

Sources:

MBA (Master of Business Administration) is among the world’s most well-known professional degrees. It continues to be the favorite amongst BBA graduates. This intensive program focuses on management and business skills development.

Students can study full- or part-time while selecting from various MBA options. These include executive MBA programs, global MBAs, distance learning MBAs, and more.

These prepare students for leadership roles in finance, marketing, HR, etc., based on the specialization. It also helps them guide big and small businesses toward success.

The Post Graduate Diploma in Management (PGDM) is an intensive two-year diploma program. It gives students the chief abilities needed in managerial positions across various industries. It is one of the most pursued courses by BBA graduates.

PGDM imparts management and leadership abilities and equips students with other crucial job skills. It mainly focuses on business, teamwork, and leadership.

BBA graduates can choose from several online and full-time PGDM courses.

Today, every business is looking to invest in digital marketing. So, it is another great post-BBA option. The course curriculum includes copywriting, graphic designing, Google Ads, and social media marketing. It is one of the upcoming courses that has recently gained much popularity.

Job roles include digital marketer, copywriter, website developer, social media marketer, etc.

Related Topic: Best Career Options for BBA Graduates

Master in Commerce (M.Com) is one of the most popular courses after BCom. The course comprehensively covers topics like:

Students can also specialize in business-related courses like finance, accounting, and economics. Other specializations include taxation, business studies, marketing, management, and statistics.

Chartered accounting is one of the most in-demand careers for commerce program graduates. It involves accounting, auditing, taxation, and financial assessment for a person or company.

A chartered accountant (CA) manages a firm’s finances. This includes filing tax returns and auditing financial statements and business procedures. It also involves tracking investments and generating and analyzing financial reports and records. Customer services and consulting are some of the other primary job roles.

Read more: Salary of a Chartered Accountant in India

After BCom, being a company secretary (CS) is a well-liked job path that requires an accredited degree. A company secretary handles tax returns, legal compliances, and statutory requirements.

A CS also manages records, counsels the directors’ board, and ensures that the company conforms.

Financial risk managers can get certified by the Global Association of Risk Professionals (GARP). This is an internationally recognized designation in the financial markets.

The course offers accounting firms, insurance businesses, asset management, and risk assessment training.

CIB is a well-known global certificate taken by many bankers. It covers B&F sub-sections such as financial statement analysis, CDF, IPO, listing, and fundraising.

Other roles include leverage buyouts, transaction analysis of company valuation, mergers and acquisitions, etc.

Related topic: Career after BCom: Jobs, Courses, Scope and Salary

BCom or BBA graduates can find entry-level banking, insurance, and finance jobs. Additionally, fields like hotel management, event planning, and human resource management also welcome BBA graduates. Understanding the difference between BBA and BCom can help students choose the right path for their career goals.

However, one must acknowledge the difference between BBA and BCom.

BBA provides professional career alternatives specific to certain industries, while BCom offers work options not strictly defined by the degree. Understanding the difference between BBA and BCom can be very helpful to explore this further. Check out the best career options after BBA here for a more detailed account.

Graduates have several employment opportunities after a BBA in Entrepreneurship. These include Assistant Manager, Business Consultant, Business Reporter, System Manager, Finance Controller, etc.

The BBA in Entrepreneurship has a vast course of content. The typical salary scale is between 5 and 10 LPA.

A marketing manager works with product managers to execute new or changed programs. The aim here is to build better business growth and development strategies.

A marketing manager handles many essential roles. This includes:

The salary range begins at around 7-9 LPA on average.

Businesses often face challenges in:

This requires the expertise of a consultant. Their average salary scale is 10-12 LPA.

Event management involves using management techniques to organize, prepare, and promote events. BBA graduates can work as event managers for:

The pay range is between 3-8 LPA.

Real estate and urban infrastructure are rising industries. Due to rapid expansion and urbanization, these fields offer fast-tracked career growth avenues. The pay range is 4-6 LPA on average.

Account executives manage daily operations and ensure client satisfaction. They connect the advertising agency or financial services provider and the client. Their average salary scale is around 2-3 LPA.

This is a remarkable career for BCom graduates to pursue. Analysts study external factors, like changes in economic legislation or policy. This helps them predict and explain how an event would affect company stock. The salary scale ranges from 3 to 4 LPA.

A tax consultant or advisor assists people and firms in filing their taxes. They know tax law, tax observance, and tax strategy and help to optimize long- and short-term taxes for individuals and businesses.

The salary scale ranges between 4-5 LPA.

A financial risk manager spots and studies dangers to a company’s resources, earnings potential, or success. They work in sales, loan origin, trading, marketing, financial services, private banking, etc. The salary scale is 5-6 LPA.

Auditors set up and review a business’s financial records. After an auditing course, candidates can find attractive and well-paying jobs in the private or public sectors. These include roles like budget analysts, financial analysts, financial managers, etc. The average yearly pay for auditors in India is up to 5 LPA. Understanding the difference between BBA and BCom can help candidates decide which degree aligns better with their career aspirations in auditing and finance.

Both BBA and BCom graduates are eligible for various government jobs. However, BCom aligns more closely with competitive exams like SSC-CGL, banking exams (IBPS, SBI PO), and accounts officer roles, as these often include commerce-related subjects in their syllabus. BBA graduates can also apply for generalist government positions, but BCom offers a slight advantage for finance and accounts profiles in the public sector.

| Job Role | BCom Salary (in INR) | BBA Salary (in INR) |

|---|---|---|

| Account Executive | 2.5 LPA | — |

| Business Executive | — | 3 LPA |

| Financial Analyst | 3.7 LPA | — |

| Tax Consultant | 4.5 LPA | — |

| Financial Consultant | 5 LPA | — |

| Accounts Manager | 5.8 LPA | — |

| Business Consultant | — | 9 LPA |

| HR Executive | — | 3.75 LPA |

| Marketing Executive | — | 2.91 LPA |

| Marketing Manager | — | 6.84 LPA |

| Sales Executive | — | 2.44 LPA |

| Entrepreneur | — | 7.44 LPA |

| Financial Advisor | — | 3.83 LPA |

| Public Relations Manager | — | 5.21 LPA |

Source: Salaries for BBA and BCom have been taken from Glassdoor

The decision between BBA and BCom can be quite challenging. Understanding the difference between BBA and BCom can help one make an informed choice.

1. Self-Assessment Checklist

Encourage readers to reflect on their interests, strengths, and long-term goals. Provide a short list of questions, such as:

2. Career Goals Alignment

Briefly outline which career paths align with each degree. For example, BBA is great for those aiming for management or entrepreneurship, while BCom is ideal for finance, accounting, or government roles.

3. Skill Development

Highlight the different skill sets each course builds. For example, BBA focuses on leadership and communication, while BCom emphasizes analytical and quantitative skills.

4. Industry Demand and Trends

Mention current trends, such as the growing demand for digital marketing (BBA) or the steady need for accountants and financial analysts (BCom).

5. Advice from Professionals or Alumni

Suggest speaking with current students, graduates, or professionals in both fields to get real-world insights.

6. Flexibility for Further Studies

Note how each degree can serve as a foundation for further studies, such as MBA, CA, or specialized master’s programs.

By including these points, you’ll help readers make a thoughtful, informed decision based on their unique aspirations and strengths. Would you like a sample draft for this section?

Choosing between BBA and BCom is a big step, but it doesn’t have to be overwhelming. Think about what excites you—whether it’s leading teams, understanding how businesses work, or diving into numbers and finance. Your interests and strengths should guide your decision, not just what others say.

Both degrees offer strong career opportunities and the chance to grow in the business world. Trust yourself, do your research, and pick the path that feels right for you. Whichever you choose, you’ll be setting yourself up for a bright and rewarding future.

The answer depends on your career plan. For instance, BCom is an excellent way into the accounts and finance sector. It opens opportunities such as CA, CMA, ACS, and more. On the other hand, BBA is the better option if you want to pursue an MBA.

BBA is a more lucrative choice for those pursuing an MBA, especially if you are taking courses in HR or marketing. However, if you are looking for an MBA in finance, BCom has a more well-rounded syllabus supporting finance. Hence, understanding the difference between BBA and BCom is essential for determining the right choice for an MBA.

Generally, BBA provides a more well-rounded skill set that makes it ideal for managing your business. For instance, planning, project management, and office management are all covered in BBA. But BCom is a better option if your business has a finance-based inclination. It covers finance and commerce-related subjects in greater detail.

BBA grads usually kick off their careers with higher pay, landing managerial positions that offer starting salaries between ₹3–7 LPA. Conversely, BCom grads certified as CA or CFA can eventually out-earn BBA folks, particularly in finance, accounting, and taxation.

BCom opens up great opportunities, especially with professional certifications like CA, CFA, or CMA, which can lead to lucrative jobs in finance and taxation. On the other hand, BBA focuses on developing managerial skills, particularly when paired with an MBA. Both degrees have their perks and can be rewarding, depending on what career path you want to take.

Authored by, Gagandeep Khokhar

Career Guidance Expert

Gagandeep is a content writer and strategist focused on creating high-performing, SEO-driven content that bridges the gap between learners and institutions. He crafts compelling narratives across blogs, landing pages, and email campaigns to drive engagement and build trust.

Editor's Recommendations

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.