Quick Summary

Understanding how to calculate HRA in salary is essential for every salaried employee in India. House Rent Allowance (HRA) is a major part of your salary structure. It offers significant tax benefits if you live in a rented house. However, the calculation can be confusing because the rules change based on your salary, rent, and city where you live. As tax laws and salary structures change in 2025, knowing the latest HRA calculation methods will help you maximize your tax savings and avoid costly mistakes.

Whether you’re new to the job or have years of experience, understanding the HRA formula and eligibility criteria will help you manage your finances better. In this guide, you’ll learn step-by-step how to calculate HRA in salary and get the most from your compensation package.

HRA is an allowance that is paid to an employee for the expenses incurred on rented accommodation. HRA is a deduction under taxes in section 10(13A).

HRA has city-level variations and, therefore, varies according to the cost of living in that particular city. The calculation and deduction of HRA from taxable income vary based on the city and a few parameters, among them being the city of residence.

To claim a House Rent Allowance (HRA) exemption, employees need to submit certain documents as proof of rental payments, including rent receipts and lease agreements. The HRA exemption significantly reduces the tax burden on employees, making it a valuable benefit.

Let’s explore how to calculate HRA in salary with the following example:

Curious about how to calculate HRA in salary? To calculate it, you need to know the following :

Now, let’s understand how to calculate HRA in salary for tax exemption on HRA:

The HRA calculation for tax exemption is based on three factors:

The tax exemption on HRA is determined by the minimum of these three calculations. Here’s an HRA exemption calculation example:

Example for Metro Areas

Let’s consider an employee named Sadiq, working in a metropolis with a basic salary of Rs. 100,000 per month. The HRA provided by the employer is Rs. 50,000 per month, and Sadiq pays Rs. 40,000 per month as rent.

Calculation: Actual HRA received = Rs. 50,000 per month

Rent Paid – (10% of Basic Salary Received) = Rs. 40,000 – (10% of Rs. 100,000) = Rs. 30,000

50% of Basic Salary = 50% of Rs. 100,000 = Rs. 50,000

The minimum amount among these calculations is Rs. 30,000. Therefore, after the HRA exemption calculation, the taxable amount would be Rs. 20,000 (Rs. 50,000 – Rs. 30,000).

Example for Non-Metro Areas:

To understand the concept of HRA in a non-metro city, let’s consider an employee named Dinesh, who works in a non-metro city with a basic salary of Rs. 50,000 per month. The HRA provided by the company or employer is Rs. 20,000 per month, and Dinesh pays Rs. 10,000 per month as rent.

Now, let’s determine Dinesh’s HRA exemption based on this information:

Calculation: Actual HRA received = Rs. 20,000 per month

Rent Paid – (10% of Basic Salary Received) = Rs. 10,000 – (10% of Rs. 50,000) = Rs. 5,000

40% of Basic Salary = 40% of Rs. 50,000 = Rs. 20,000

The minimum amount among these calculations is Rs. 5,000. Therefore, after the HRA exemption calculation, the taxable amount would be Rs. 15,000 (Rs. 20,000 – Rs. 5,000).

In this scenario, Dinesh would be eligible for an HRA exemption of Rs. 15,000, and the remaining Rs. 5,000 would be taxable.

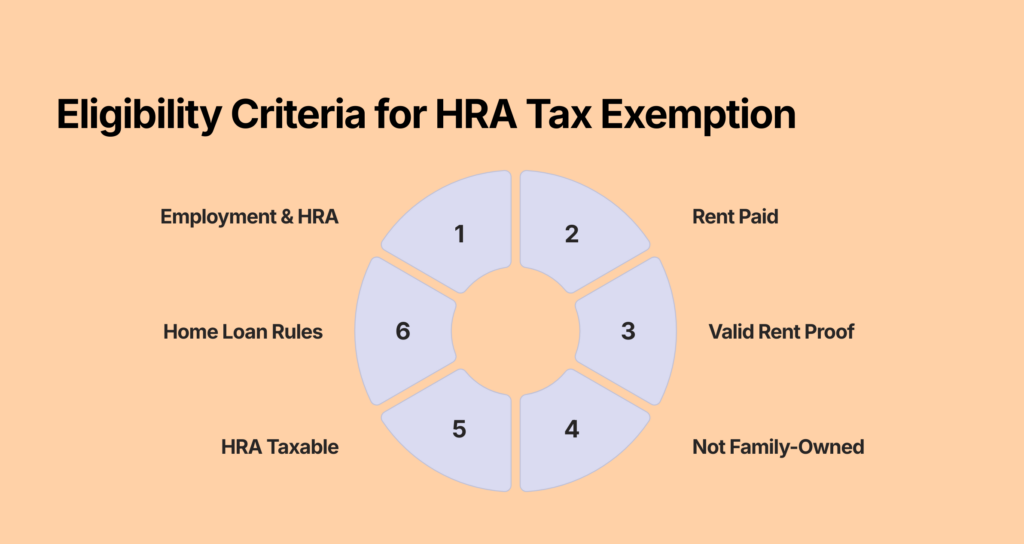

To be eligible for an HRA tax exemption in India, certain conditions must be met:

To qualify for HRA exemption under Section 10(13A), you must satisfy certain conditions:

To claim an HRA exemption, employees need to provide certain documents as proof. These may include:

HRA calculation made easy! Excel comes in handy as an automated means of calculating the HRA amount per your basic salary. A simple formula can be created by multiplying your basic salary by the percentage applicable, in metro or otherwise, so that as your salary or city of residence changes, the calculation of HRA will be performed automatically.

This process not only streamlines the process but also benefits one’s financial planning. You can play around with such a tool to try different scenarios for HRA calculation and use it to make informed decisions on housing concerned with your benefit and financial security overall.

HRA exemption is vital for employees who don’t have any accommodation facilities on their own. This is a blessing to the employees who live in both metro and non-metro cities as tenants. To know how to reduce your tax, you have to know about the HRA exemption, and for that, you should know how to calculate HRA in salary.

Finally, learning how to calculate HRA in salary is an important part of managing your money efficiently. By following the methods indicated above, you will be able to correctly calculate your HRA and make educated decisions regarding your housing and pay package. Remember, calculating HRA in pay is a simple method that may help you maximize your benefits while minimizing your taxes. Take charge of your money today and discover how to calculate HRA in your salary.

Calculating HRA in your salary can be simple. By knowing the basic formula and keeping your rent receipts, you can find your HRA exemption and improve your tax benefits. Remember that factors like where you live, your basic salary, and the actual rent you pay all affect the final calculation.

As financial rules change in 2025, staying updated on HRA regulations for better tax planning is essential. Don’t let your hard-earned money go to waste; use these tips to make better salary choices and increase your take-home pay. Start calculating your HRA today and confidently take charge of your financial future.

Evaluate numerous career choices to choose the right career path for yourself. Dive into our guide on Career Advice.

HRA is calculated as the lowest of the following three amounts according to Income Tax rules in India:

Actual HRA received from employer

50% of basic salary (for metro cities) or 40% for non-metro cities

Actual rent paid minus 10% of basic salary

Example: If your basic salary is ₹40,000, your HRA received is ₹20,000, and your rent paid is ₹15,000 in a metro city:

Actual HRA = ₹20,000

50% of basic = ₹20,000

Rent minus 10% of basic = ₹15,000 minus ₹4,000, which equals ₹11,000

HRA exemption = ₹11,000 (the lowest of the three amounts)

Tip: Keep your rent receipts as proof. You need valid documents to qualify for tax exemption.

You can calculate HRA by entering your basic salary, actual HRA received, rent paid, and city type (metro or non-metro) into a salary calculator. It uses the HRA formula and shows the exempt amount.

For example, if your basic salary is ₹30,000, HRA received is ₹12,000, and rent paid is ₹10,000 in a non-metro city:

40% of basic = ₹12,000

Rent minus 10% of basic = ₹10,000 minus ₹3,000 equals ₹7,000

Actual HRA equals ₹12,000. The exempt HRA equals ₹7,000, the lowest of the three amounts.

Tip: Always select “metro” or “non-metro” correctly in the calculator, as it changes the 50% or 40% rule.

No. HRA is not set at 12%. It changes depending on the employer’s policy and is calculated according to tax rules.

For example, if the basic salary is ₹25,000 and the HRA is ₹7,000, that’s 28%, not 12%.

Tip: Always check your payslip to see your actual HRA.

HRA is typically 40% of the basic salary in non-metro cities and 50% in metro cities. However, the actual percentage varies based on the employer’s policy.

For example, if your basic salary is ₹30,000, HRA could be ₹12,000 (40%) in a non-metro city or ₹15,000 (50%) in a metro city.

Tip: Review your salary structure. Companies can set HRAs of 10% to 50% of the basic salary.

Employees who do not pay rent, live in their own house, or do not receive HRA from their employer cannot get an HRA exemption.

Example: A person living in a house they own and not paying rent cannot claim HRA.

Tip: Keep rent receipts on hand if you claim HRA to avoid tax problems.

The HRA Calculation formula in Excel is = MIN(HRA Received, (Basic Salary * Percentage), (Rent Paid - (Basic Salary * 10%))).

HRA allowance is typically 18% for tier-2 cities and 9% for tier-3 cities

Yes, you can claim both HRA under section 10(13A) and the interest on the home loan under section 24(b) as income tax deductions simultaneously. For example, you have taken a home loan for a property that is under-construction, and you currently live in a rented house. In this instance, you can claim both home loan interest and HRA as deductions to reduce your total taxable income.

Yes, you can still claim HRA as a tax deduction if you live in your parent’s house, provided that you have a rental agreement with your parents and you pay them rent every month. If you show rental receipts with your name on them, you can save on your tax outgo. Just ensure that you meet the eligibility criteria listed above and get HRA paid to you as part of your salary.

The taxable portion of the HRA component needs to included under ‘Salary, as per section 17(1).’

An exempt portion of the HRA component is to be included under the heading ‘allowances to the extent exempt u/s 10’ (make sure it is included in salary income u/s 17(1), 17(2), 17(3)).

Just a note if you are filing your ITR online through Cleartax. It auto-populates the Form 16, then you will have to check the amount that has been auto-populated only.

You have to maintain the receipts of rent paid during the year. They have to be provided at the time of filing Income Tax Returns. If there is no receipt then you will have to file your lease agreement along with bank statements showing rent paid.

Read more:

Authored by, Mansi Rawat

Career Guidance Expert

Mansi crafts content that makes learning engaging and accessible. For her, writing is more than just a profession—it’s a way to transform complex ideas into meaningful, relatable stories. She has written extensively on topics such as education, online teaching tools, and productivity. Whether she’s reading, observing, or striking up a conversation while waiting in line, she’s constantly discovering new narratives hidden in everyday moments.

Editor's Recommendations

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.