Quick Summary

If you are a working professional, you must encounter the question, “What Is Your Current CTC?” If you’re a fresher looking for a job, you should know what CTC is all about for better salary negotiation. However, CTC sparks confusion among job seekers and employees. Therefore, understanding the current CTC meaning, its components, and its relevance is crucial for every working professional.

The “Cost to Company” is the full CTC form, representing the company’s total expenditure on its annual employee salary package. It encompasses several components that should be clear between employees and employers during the hiring process. This will help them understand what perks and expenses come with their employment. Without much delay, allow us to clear all your doubts through this blog on “What Is Your Current CTC?” to get better insights.

CTC (Cost to Company) is the total annual amount an employer spends on an employee, including salary, HRA, bonuses, PF, insurance, gratuity, and other perks. When asked about your current CTC, they mean your complete pay package—not just your monthly take-home. Remember, CTC differs from net salary, as deductions like tax and PF reduce what you actually receive. So, when negotiating offers, always clarify each CTC component to ensure it matches your expectations. Understanding your CTC helps you handle salary discussions confidently.

CTC (Cost to Company) is the total amount a company spends on an employee annually, including salary, benefits, bonuses, and statutory contributions like Provident Fund (PF) and gratuity. Gross salary is an employee’s earnings before tax and deductions, excluding employer contributions like PF and insurance. It includes basic pay, HRA, and other allowances. In-hand or net salary is the amount credited to the employee’s bank account each month after deductions like income tax, PF, and professional tax. In short, CTC > Gross Salary > In-Hand Salary in terms of value.

| Feature | CTC (Cost to Company) | In-Hand Salary | Gross Salary |

| Definition | Total annual cost incurred by the employer | Actual monthly income received by employee | Total monthly salary before deductions |

| Components | Basic pay, allowance, bonuses, taxes | Basic pay, allowances, after deductions | Basic salary, allowances, bonuses |

| Frequency | Annual | Monthly | Monthly |

| Importance | For company budgeting and analysis | For daily expenses and EMI planning | For loan eligibility and salary negotiation |

Companies use Cost to Company (CTC) as a standardized way to represent an employee’s total compensation package. When an employer asks, “What is current CTC?”, they want to evaluate your total earnings, including direct salary, perks, and benefits. Understanding CTC helps organizations maintain financial transparency and budget efficiently. Here’s why companies rely on CTC:

CTC includes direct and indirect benefits, giving a complete picture of an employee’s total remuneration.

Companies use CTC to design competitive salary packages while balancing costs. Breaking down salary components allows them to optimize employee tax benefits and align compensation with company policies.

By using CTC, employers ensure transparency in salary negotiations, helping candidates understand their full compensation. This clarity helps employees make informed career decisions while giving companies a structured way to present salary details.

Since CTC outlines the total cost incurred per employee, it aids in accurate budgeting and forecasting. Organizations can plan better for hiring, salary revisions, and overall workforce management.

Interviewers often ask, “what is your current CTC,” to evaluate if your salary expectations align with their budget and compensation structure. From a recruiter’s perspective, it helps determine how much of a hike they can offer and ensures transparency in the hiring process. Your answer can impact your offer—quoting too low might lead to an underwhelming package, while quoting too high without justification could eliminate you from consideration. A well-informed, honest response to what is your current CTC supports better negotiation and builds credibility with recruiters.

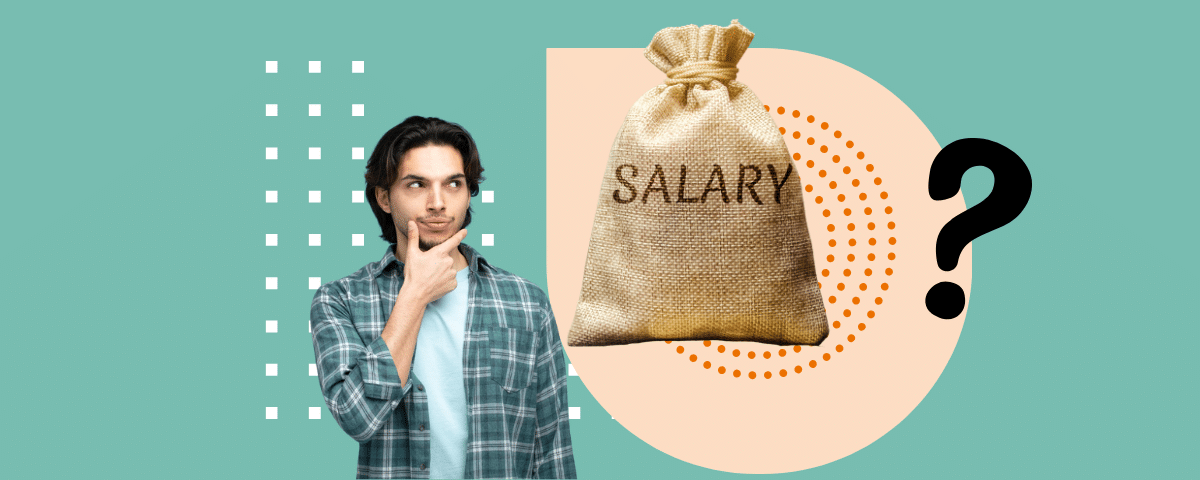

Knowing the current CTC meaning and its components is essential to evaluate your total compensation package effectively. CTC includes fixed components, variable pay, benefits, and tax deductions. Here’s a breakdown of these components:

Fixed components are stable and consistent parts of your CTC. These components are crucial for long-term planning, including:

Variable components depend on performance or company policies, offering flexibility and motivation. Key components include:

These components can significantly boost your income and align personal success with company growth.

Benefits and perks add non-monetary value to the CTC package, focusing on employee well-being. Common benefits include:

These perks contribute to job satisfaction and improve work-life balance while indirectly increasing the value of your CTC.

Tax deductions reduce your in-hand salary but ensure compliance with financial regulations. It includes:

Understanding these deductions helps optimize tax savings and manage take-home pay effectively.

Companies follow a few simple steps and a basic formula to determine the cost to the Company (CTC) for an employee. Here’s a step-by-step guide to calculate it:

CTC = Basic Salary + Allowances + Prerequisites + Employer Contributions + Bonuses – Deductions

For instance, if an employee’s components are:

| Components | Amount |

| Basic Salary | ₹6,50,000 |

| HRA | ₹2,20,000 |

| Provident Fund (Employer) | ₹55,000 |

| Medical Allowance | ₹25,000 |

| Annual Bonus | ₹1,25,000 |

| Total CTC | ₹1,075,000 (sum of all components) |

Note: Deductions (like taxes) are not part of your net income but are accounted for in CTC.

Read More: Salary Calculator

Although the calculation of CTC is straightforward, some employees might be confused between CTC, in-hand salary, and deductions. Below are some of those:

CTC helps employees get a clear picture of their compensation package. It’s crucial for various reasons:

Understanding “what is your current CTC” helps compare job offers effectively and negotiate better terms. Here are the following reasons:

CTC transparency enables better budgeting and investment decisions by highlighting net income. It clarifies which components contribute to your take-home salary versus long-term benefits.

When evaluating multiple offers, examine the complete CTC structure rather than the final figure. Consider factors like fixed versus variable components, immediate cash benefits versus long-term perks, and tax implications of different allowances.

“My current CTC is ₹12.5 lakhs per annum. This includes ₹10.2 lakhs fixed and the rest in performance bonuses and benefits like PF, gratuity, and health insurance. I’m open to opportunities that offer both professional growth and a fair compensation aligned with industry standards.”

“As a fresher, I don’t have a current CTC, but I have completed internships where I received a stipend of ₹15,000/month. I’m looking for a role that offers learning opportunities and a competitive entry-level salary.”

“As a freelancer, my earnings vary depending on projects. On average, I earn around ₹8–9 lakhs annually. I’m now seeking a full-time role where I can bring my skills to a stable team environment and grow professionally.”

4. Candidates With Recent Hikes

“My current CTC is ₹14 lakhs per annum, including a recent performance-based hike two months ago. This includes ₹11 lakhs fixed and ₹3 lakhs variable. I’m now exploring roles that align with my expanded responsibilities and expertise.”

“I’d prefer to focus on the value I can bring to this role and align compensation with industry benchmarks and the scope of the position. I’m confident we can find a number that works well for both sides.”

Tips for Managing Expectations:

- Do Your Research:

Know the market rate for your role, experience, and industry before stating your expected CTC.- Be Realistic and Fair:

A 30–50% hike is common, but this varies based on your current salary, skills, and job location.- Justify Your Expectation:

Back up your expected CTC with examples—new skills acquired, certifications, increased responsibilities, or industry standards.- Be Flexible, Not Vague:

Say you’re open to discussion if the role aligns with your growth goals.

“My current CTC is ₹9.5 LPA. Given my experience, upskilling in [skill], and current market standards, I’m expecting around ₹13–14 LPA. However, I’m open to discussion if the role offers strong learning opportunities and growth.”

Here’s how to approach CTC negotiations with clarity and confidence, along with sample scripts.

“Thank you for the offer. I’m excited about the role and the team. Based on my experience and the responsibilities, I was expecting something closer to ₹15 LPA. Is there flexibility to revise the compensation?”

“I truly appreciate the offer. I do have a competing offer of ₹14.5 LPA. However, I’m genuinely interested in your company and would love to move forward if we can come closer in terms of compensation.”

“Based on my research and current CTC of ₹10 LPA, I’m looking at an expected CTC of around ₹13–14 LPA. I’m open to discussing this further once we’re aligned on mutual fit.”

“I understand if the budget is fixed. In that case, I’d love to know more about performance reviews, bonus structure, or non-monetary perks that support growth and learning.”

Understanding the current CTC meaning is the key to your financial planning. CTC offers an in-depth overview of the total compensation package, helping in budget management. Not only do employees know about the key components and calculations of CTC, but they also offer an accurate picture of how much it costs to employ a person. This will help you estimate the complete compensation package, not only the net salary. It also ensures transparency, compensation, and effective financial planning.

Moreover, it highlights what bonuses, benefits, and perks companies offer to their employees in addition to the basic salaries. This means a fresher can negotiate their salary during hiring or the interview process if they are unhappy with the standard salary structure. This step will strengthen the relationship between employees and employers. With the proper knowledge and strategy, you can make informed decisions and create a better salary structure.

CTC, or Cost to Company, represents an employer’s annual expenditure on an employee. This includes salary, benefits, bonuses, insurance, and other allowances.

CTC package includes several components such as:

-Basic salary

-Allowances (like HRA and conveyance)

-Benefits (like health insurance and provident fund)

-Bonuses

-Perforamce incentives

-Deductions (like income tax and professional tax)

Yes, CTC includes both direct and indirect benefits. Health insurance, bonuses, and other perks like meal vouchers, paid leave, or travel allowances are part of the total CTC.

Figuring out your CTC helps you see the whole package, including salary and perks. It also lets you make informed decisions about salary negotiations and financial planning.

Calculate your CTC by calculating your basic salary, allowances, employer contributions, and other benefits. Then, subtract applicable deductions such as income tax and professional tax. The formula is:

CTC = Basic Salary + Allowances + Employer Contributions + Bonuses – Deductions

“My current CTC is ₹8,00,000 annually, which includes a fixed salary, performance bonuses, and employer contributions to benefits like PF and insurance. I am open to discussing salary expectations based on the role and responsibilities.”

For a ₹25,000 monthly take-home salary, the CTC would typically be higher, as it includes various components like basic pay, HRA, bonuses, employer contributions to PF, and other benefits. A rough estimate could range between ₹30,000 to ₹35,000 monthly, depending on the company’s structure.

Authored by, Mansi Rawat

Career Guidance Expert

Mansi crafts content that makes learning engaging and accessible. For her, writing is more than just a profession—it’s a way to transform complex ideas into meaningful, relatable stories. She has written extensively on topics such as education, online teaching tools, and productivity. Whether she’s reading, observing, or striking up a conversation while waiting in line, she’s constantly discovering new narratives hidden in everyday moments.

Editor's Recommendations

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.