Quick Summary

Starting and growing a business involves deciding where to invest money. Capital budgeting is one of the most crucial financial planning tools. It helps companies to determine which projects or investments are worth pursuing to ensure long-term profitability and growth. This comprehensive guide will explain everything you need to know about capital budgeting in a simple and easy-to-understand manner.

The importance of Capital Budgeting plays a crucial role in business decision-making. Here are some key reasons why it’s important:

Businesses can grow, innovate, and maintain their competitive edge by making well-planned capital budgeting decisions.

Capital Budgeting is a process that helps businesses decide where to invest their money for long-term growth. These investments include buying new equipment, building factories, or launching big projects. The primary purpose is to make smart financial decisions that benefit the company in the future. Here are some detailed objectives:

One of the key goals of Capital Budgeting is to figure out whether an investment will be profitable. Companies carefully analyze the expected costs and benefits to see if the project will earn more money than it costs. This helps ensure that only good projects are approved.

Businesses often have multiple investment choices but limited money. Capital Budgeting helps compare different projects to determine the best fit. Companies can prioritize the most profitable and least risky projects by evaluating their potential returns.

Not all investments are suitable for a company’s long-term plans. Through Capital Budgeting, businesses select projects that align with their financial goals, such as increasing market share or improving production efficiency. This ensures that resources are directed toward projects that support the company’s mission.

Money and resources are always limited. Capital Budgeting ensures that every penny is spent wisely by investing in projects that offer the best returns. This helps avoid waste and ensures that investments contribute positively to the company’s growth.

By following these objectives, companies can make smart decisions that lead to steady financial growth and long-term success.

Capital budgeting is an essential aspect to consider for companies while doing business.

Every company must consider these factors in capital budgeting. This depends on the size of the investment and its risk. Many strategies are involved in capital budgeting. They will help one to understand how companies and investors make investment decisions. Therefore, you must know what you mean by capital budgeting and what methods and risks it involves.

The projects that are assessed through the capital budgeting process are as follows:

All these projects need a perfect financial choice. The business’s success and shareholder values depend on it, so making this choice involves thoroughly examining all relevant factors. These elements make capital budgeting an essential tool for the company.

Capital budgeting is like planning for a big purchase or investment. It helps businesses decide which projects or investments are worth spending money on. Here are the steps involved in capital budgeting:

The first step is looking for new investment ideas or projects to help the business grow. These opportunities might include purchasing new machinery, expanding operations, launching a new product, or building a new facility. Companies brainstorm and gather ideas from managers, employees, and market trends.

After identifying potential investments, each project is carefully analyzed to determine its potential costs and benefits. This includes considering the project’s risks, expected profit, and how it aligns with the company’s overall goals.

In this step, businesses forecast each project’s future cash inflows and outflows. This means estimating how much the project will cost and the expenses involved. Accurate cash flow predictions are essential to avoid unexpected financial problems.

Once all proposals are evaluated, the company chooses the project with the highest potential returns and lowest risks. The selected project should align with the company’s financial objectives and promise good long-term profitability.

After selecting the best investment, resources such as money, manpower, and equipment are allocated to start the project. This step involves setting timelines, assigning responsibilities, and beginning work on the investment.

The final step in Capital Budgeting is to track and monitor the project’s performance regularly. This helps ensure the investment meets its goals and allows businesses to make necessary adjustments. Continuous monitoring also helps in learning valuable lessons for future investments.

By following these steps, companies can make well-informed decisions that lead to financial success and stable long-term growth through effective Capital Budgeting practices.

Click to Download:- Capital Budgeting pdf

Capital Budgeting involves evaluating and selecting investment projects expected to bring long-term financial benefits to a business. To make wise decisions, businesses use several techniques to assess the profitability and risks of different investment options. Below are the most common methods explained in simple terms:

NPV measures the difference between the present value of a project’s cash inflows and outflows. Simply put, it tells you how much money a project will make after accounting for the value of money over time.

Where:

IRR is the discount rate at which an investment’s NPV becomes zero. It shows the percentage return expected from a project over time.

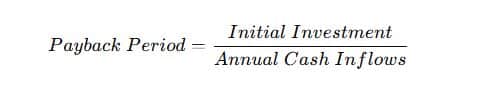

The payback period measures how long it will take for an investment to recover its initial cost.

PI measures the ratio of the present value of future cash inflows to the initial investment. It shows how much return you will get per unit of money invested.

| Technique | Pros | Cons |

|---|---|---|

| NPV | Accurate value estimation | Complex calculation |

| IRR | Easy to interpret | Multiple IRRs possible |

| Payback Period | Simple and quick | Ignores the time value of money |

| PI | Helps rank projects | Needs accurate projections |

These techniques give businesses valuable insights into which projects to invest in and help ensure capital is used efficiently. Companies can use multiple methods to make well-informed Capital Budgeting decisions for long-term success.

Click to Download:- Capital Budgeting Techniques pdf

Capital Budgeting decisions are influenced by several important factors that companies must carefully consider to ensure the success and profitability of their investments. Below are key factors explained

The overall economic environment plays a big role in capital budgeting decisions. Market demand, inflation rates, and financial stability can affect a project’s profitability.

For example

The amount of money a company has directly impacts its ability to invest in new projects.

Every investment comes with some level of risk. Companies need to consider:

One of the most critical factors in capital budgeting is the potential profit the company will earn from the project.

Rules and regulations set by the government, including taxation, environmental guidelines, and industry-specific laws, can impact investment decisions. For example:

Understanding these factors helps businesses make better Capital Budgeting decisions, ensuring their investments align with financial goals and market opportunities. Careful evaluation of each factor allows companies to manage risks and achieve long-term growth.

Capital budgeting involves making long-term investment decisions that help businesses grow, reduce costs, or introduce new products. Indian companies frequently use this process to plan their significant financial investments. Below are some real-world capital budgeting examples explained:

Imagine a popular car company in India, like Tata Motors or Hyundai, deciding to build a new factory in Chennai. The decision to invest in setting up this plant would involve careful capital budgeting.

A textile company in India, such as Arvind Limited, might replace its old machines with energy-efficient ones. This investment decision would also go through the capital budgeting process.

An FMCG (Fast-Moving Consumer Goods) company, like ITC or Britannia, may introduce a new organic snack line. This decision requires thorough capital budgeting.

These examples show how Indian businesses use capital budgeting to make wise investment decisions that help them grow, reduce expenses, and offer new products to consumers.

Let’s explore the key benefits of using capital budgeting:

By understanding the benefits of capital budgeting, companies can plan better, reduce risks, and grow financially secure. This process plays a crucial role in shaping businesses’ long-term success.

Although it helps businesses make wise investment decisions, it has challenges. Companies often face difficulties during the process, which can impact their decision-making. Below are some common challenges explained:

By understanding these challenges, businesses can plan better and seek expert advice when needed. Despite these hurdles, capital budgeting remains essential for making informed and strategic investment choices.

To make smart and successful investment decisions, businesses should follow certain best practices when using capital budgeting techniques. These practices help reduce errors, improve decision-making, and ensure investments align with the company’s goals. Below are some key best practices explained

Relying on one method may not give a complete picture of an investment’s potential. Combining techniques like Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period is better for assessing a project’s profitability.

Even after making an investment decision, it’s essential to monitor the project’s performance regularly. This helps identify problems early and allows the company to adjust if things aren’t going as planned.

Forecasting future costs and revenues accurately can be challenging. Seeking advice from financial experts, like analysts or consultants, can help improve financial projections and decision-making accuracy.

Investment decisions should always support the company’s long-term growth objectives. Businesses should choose projects that contribute to their vision and help them stay competitive.

Recommended Read:- 10 Types of Investments with High Returns,

Capital budgeting is a vital financial tool that helps businesses make informed, strategic investment decisions. Companies can maximize returns and minimize risks by analyzing potential projects using methods like NPV, IRR, and payback period. A structured capital budgeting process ensures optimal resource allocation, aligning investments with long-term goals. Mastering this process is key to sustainable growth, profitability, and innovative financial planning in any business environment.

Capital budgeting means planning and deciding on major business investments or projects. It helps businesses determine which projects are worth spending money on, ensuring they will be profitable in the long run.

The three standard methods of capital budgeting are:

1. Net Present Value (NPV): Calculates the present value of future cash flows minus the initial investment.

2. Internal Rate of Return (IRR): Finds the discount rate that makes the NPV of cash flows equal to zero.

3. Payback Period: Measures the time it takes to recover the initial investment from the project’s cash flows.

Capital budgeting involves evaluating and selecting long-term investments that align with a business’s strategic goals. It ensures that resources are allocated efficiently to projects that generate the most value over time.

Some of the key advantages of the Capital budgeting process are as follows –

1. It helps companies make informed decisions.

2. The business ensures adequate control over its expenses.

3. Capital budgeting techniques are used to evaluate risks in investment.

4. Capital budgeting in finance helps companies improve their market holdings.

5. Methods of Capital budgeting save companies from investments.

The capital budgeting formula often used is the Net Present Value (NPV) formula:

NPV = ∑ ( Cash Inflows / ( 1 + 𝑟 )t ) − Initial Investment

where:

𝑟 – is the discount rate

𝑡 – is the time period.

Authored by, Amay Mathur | Senior Editor

Amay Mathur is a business news reporter at Chegg.com. He previously worked for PCMag, Business Insider, The Messenger, and ZDNET as a reporter and copyeditor. His areas of coverage encompass tech, business, strategy, finance, and even space. He is a Columbia University graduate.

Editor's Recommendations

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.