Got a question on this topic?

Quick Summary

Table of Contents

Irrespective of how someone makes a living, their income would fall under the heading of active income and passive income. Many professionals in the workforce claim to have heard of these two concepts, but the majority are uncertain of their meanings or how to generate the latter. If you are looking for an answer to a similar question, you’re at the right place.

When someone invests with the expectation that they will make money without expending additional effort, it is said to have a passive income. Contrarily, active income is money received in return for rendering a service. While both these forms of income come with their own pros and cons, it is quite a task to choose the better between the do.

In this article, we will be closely analyzing both active income and passive income. Keep reading!

It is essential to have an understanding of the different sorts of income one may gain in order to achieve the financial objectives of an individual. This will also assist in making alert and informed financial decisions, help in exploring various financial avenues, and assist in building financial security for the future. There are three types of Income opportunities.

Active income means ‘results earned through specific and continuous efforts.’ It refers to earning an income due to efforts put into doing a service according to the agreed contract during a specified time span. Tips, salaries, commissions, wages, and income earned from business or services due to materialistic participation illustrate active income. This service can be for a company or a person, manual or semi-manual work, office-based, and even home-based – all this will be termed as active income.

Active incomes are a safer and dependable form of earning due to their predictable income and ability to create a budget. However, they may not be enough for emergencies and may not be enough in the long run. Traditional income sources include full-time or part-time jobs, but with digitization, freelancing, contract-based work, and small businesses, there are now two categories of active income: active income through self-employment and active income through employment.

The first thing to decide when opting for an active income option is to understand the amount of time one can dedicate to it. The next thing to understand is the skills that one will be able to bring to the table. This can be understood by analyzing the best skills at which one can perform those to the fullest of their capability.

One can gain an understanding of the side hustle one can opt for to earn active income based on their skills and time to dedicate. A side hustle often aims to gain some extra earnings and put your skills to the best of their use.

We have listed some examples of active income one may opt for:

One receives monetary payment each day for a standard 9 to 5 job. Essentially, it is exchanging one’s time and skills for a certain sum of money. The hourly wage is perhaps the most prevalent type of income. Even as a side hustle, one might earn an hourly rate performing different odd occupations. One of the finest features of this type of income is that it frequently offers the chance to work overtime.

Today, blogging is among the most demanded and trending ways of earning income through online platforms. It is one of the best methods of building expertise in the area where one has skills and building something unique out of it. With the world’s digitalization, the demand for content writers is increasing steadily. Some of the best areas as a content writer can be – resume writing, copywriting, proofreading, and ghostwriting. One can even opt to be a freelance writer – which is a common practice among bloggers today.

The two best methods to earn a consistent income are if a person has a marketable skill set or feels he can assist a firm in enhancing a part of their business and increasing income. For instance, as an excellent writer, web developer, graphic designer, photographer, or filmmaker, one may launch a freelancing business delivering those skills to customers. On the other hand, with a thorough knowledge of social media, logistics, digital marketing, or company operations, a person may provide consulting services to businesses that want assistance in your field.

Another way to earn money is by becoming a freelance subject matter expert at Chegg India. It is something similar to providing consulting services to a client online. This comes with the freedom to work from any place at any time. If one is ready to put in the effort by enhancing their knowledge through international exposure and by connecting with peer experts, it is quite possible to earn more than INR 1 Lac per month.

Passive income is referred to be the “pinnacle” of forms of earning income. It is so because it comes with an opportunity to sow seed in the form of time and money upfront in something that would pay off in the long run. That is exactly the concept of passive income, after all. It gives the person the privilege of no longer depending on their active revenue to pay for their lifestyle expenditures when they earn passive income.

A source of passive income is a resource that provides revenue with little to no effort on the part of the individual. One of the common ways to earn a passive income is by investing in an asset that gives a return even if you are not actively involved with it. Passive income can potentially support your living for a very long time, provided you are ready to put in the effort early on. The good news is that there are many ways to get passive money nowadays. One can actively use funds from sources of active income, such as earnings, salary, or other remuneration, are used to buy these assets.

The initial labour needed to produce passive income can take years. But once it is in motion, it can pay off for years. Wondering what some methods for generating passive income are? Check the next section!

What is a passive income source? Only a small percentage of us are aware of what there is and how to get it because most of us were raised to only pursue active income. It doesn’t take up a lot of your time or effort, unlike working a full-time job.

It is always advisable to start investing a part of the salary during the days we are actively working. Over time, these investments accumulate to form enough wealth to easily live off of the interest for the rest of their lives. Thus, interest from assets is the most efficient passive income source. For example, investing in stocks, shares, and mutual funds also entitles a person to passive income in the form of dividends.

One of the most rewarding passive income strategies for generating cash flow is renting a real estate property. Rent payments help a person generate passive income for years if invested for a long time. Owning land is the only labour-intensive part of this income stream. Depending on the neighbourhood and rental demand, the property could be used for commercial, warehouse, industrial, or residential purposes.

In India, gold has traditionally been a popular investment. But in the last few years, people have started purchasing gold bonds as investments. The SGBs are ideal alternatives to owning physical gold since they pay the investor a heavy interest rate of 2.5% to 2.75% per year. Therefore, one can invest in digital gold generating interest every day rather than dealing with the difficulty of carefully keeping the priceless gold!

Affiliate revenue is the reward one receives for referring clients who buy anything after clicking a specially coded link. Since many companies provide affiliate commissions for their products or services, the opportunities are virtually limitless. By doing this, one can monetize their blog, which is one of the finest methods to make money online.

Passive income can offer several benefits to those who pursue it. Here are a few key advantages to consider:

By generating passive income, you can add an extra revenue stream to your financial portfolio. This can provide an additional safety net in case your primary income source is disrupted, or it can allow you to achieve your financial goals more quickly.

Passive income can also provide a pathway to financial independence. By generating enough passive income to cover your living expenses, you can free yourself from the need to rely on a traditional job or income source. This can give you greater freedom and flexibility in your career choices and lifestyle.

Generating passive income can also provide a sense of security and peace of mind about the future. With a reliable stream of passive income, you can feel more confident about your ability to weather financial challenges or unexpected expenses.

Passive income can also offer greater flexibility in where and how you live. By generating income that’s not tied to a specific location or job, you can have more freedom to travel or relocate as needed. This can provide a greater sense of adventure and variety in your life.

Overall, passive income can offer a range of benefits to those who pursue it. Whether you’re looking for financial security, additional income, or greater flexibility in your lifestyle, generating passive income can be a smart and worthwhile pursuit.

Passive income can be a valuable source of revenue, but the amount you can make depends on several factors. One of the most critical factors is the type of investment or asset you choose to pursue. For example, some popular passive income streams include:

It’s important to note that passive income isn’t a get-rich-quick scheme. Building a reliable stream of passive income takes time and effort. You’ll also need to diversify your income streams to ensure you have a consistent flow of revenue. Successful entrepreneurs and investors have achieved financial independence through a combination of smart investments and recurring passive income sources.

To build a successful passive income stream, it’s important to do your research, set realistic expectations, and remain disciplined in your approach over time. As you explore different passive income opportunities, consider seeking.

Source: https://www.bankrate.com/investing/passive-income-ideas/

Portfolio income is the earnings created by a collection or portfolio of financial investments. These investments primarily consist of assets such as stocks, bonds, and other financial instruments. Portfolio income can take several forms, including dividends, interest payments, and capital gains from the sale of securities. Unlike earned income, portfolio income is not directly related to current employment. Instead, it is determined by the performance of your investment portfolio. Portfolio income can offer opportunities for wealth growth, and it is crucial for diversifying one’s income streams.

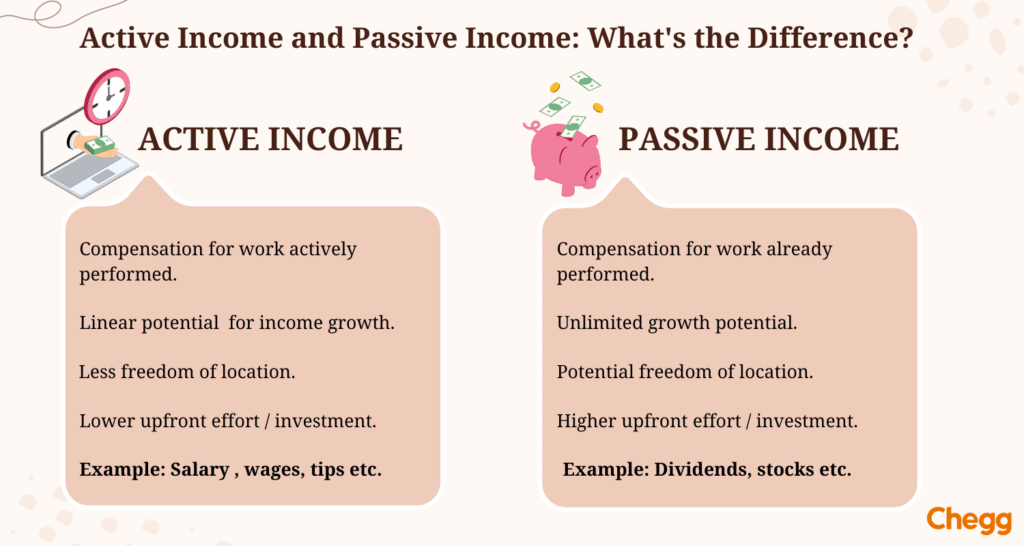

| Active Income | Passive Income | |

| Meaning | Demands active physical and material participation. Usually, the person has to work for someone else (employer). | Can make money with little to no effort and with no material investment. The person is the boss himself or herself. |

| Consistency | Faster and guarantees a consistent stream of revenue | Might be inconsistent and take months or years to start bringing in money. |

| Inter-relation | Provides resources to launch a passive income stream | As a supplement to regular income |

| Effect on Lifestyle | People might not have enough time for their families or to engage in their hobbies. | People can spend more time and money on hobbies and leisure pursuits. |

| End result | Must be alert, engaged, motivated, and working | While you’re asleep, on vacation, and so on, money is being made. |

The amount of taxes a person owes depends on a number of factors, including whether the income is from real estate or financial activities. Passive income is taxed at different rates than active income. Usually, active income is taxed based on the taxpayer’s income bracket. This is why two people can pay different tax rates if their incomes differ. In contrast, whether a gain is long-term (more than a year) or short-term (less than a year) influences the tax rate on passive income. The marginal income tax rate is used to tax short-term capital gains. The tax rate on long-term gains varies depending on your annual taxable income, marital status, and filing status, ranging from 0% to 20%.

Write a brief comparison between the two incomes.

When it comes to generating income, there are two main categories: active income and passive income. Here’s a brief comparison between the two:

This is income that you earn by actively trading your time and skills for money. This includes income from your job, freelance work, or running your own business. Active income is often more stable and predictable in the short term, as it’s tied to your ongoing work efforts. However, it’s also typically limited by the number of hours you can work in a day or week.

Passive income is income earned without actively trading time and skills, sourced from investments or rental properties. It’s flexible and expandable, but requires more initial expenditure. Active income relies on labor efforts, while passive income doesn’t. A balance between both is essential for financial stability.

Income from both active income and passive income sources are related. The more active revenue an individual generates, the more they can spare for investments to generate passive income. In addition, if their active revenue exceeds their usual costs, one can invest in passive income more aggressively. The idea behind passive income is that it enables the recipient to make money by putting in very little time.

Any leftover money from a profitable passive income source can be used to grow that stream or create a new one. Investing in a passive income venture might be advantageous if you have the money for start-up expenditures. The more passive income an individual generates, the more they may afford to take professional risks and perhaps even change jobs for one that pays more. Alternatively, if their passive income grows, they might be able to accept a job that pays less but is more in line with their career.

Active income involves hands-on participation and effort, such as earning a salary or engaging in freelance projects, resulting in immediate but limited-time earnings. In contrast, passive income allows for revenue generation with little ongoing effort, such as through rental properties or investments, providing a foundation for long-term financial security. Striking a balance between the two can significantly improve financial stability and growth. While active income delivers consistent cash flow, passive income contributes to wealth accumulation over time. Grasping and utilizing both income streams can create a more varied and robust financial portfolio.

Active income is crucial since it enables you to swiftly and steadily generate revenue. It does not take years to create, in contrast to passive income. Additionally, active income frequently gives people the means to develop passive income.

Active income plays a vital role by providing money to fund a person’s passive income source. But according to experts, passive income is preferable to active income. They contend that a passive income stream that makes money even if the individual isn’t working supports this. This enables the entrepreneur to take several vacations and return home with more money in his bank account.

A source of revenue can effectively be called an active income source if it satisfies any of the following two conditions:

1. If an individual has to put in at least 500 hours per year on the task.

2. The majority of the work required is physically performed by the person.

To begin earning passive income, start by identifying your strengths and interests. Research investment opportunities, rental properties, or other sources of passive income that align with your skills and interests. Consider starting small and gradually building up your passive income streams over time.

Simple passive income ideas include investing in dividend-paying stocks, renting out a spare room on Airbnb, creating and selling digital products or courses, or investing in a rental property. Other options include affiliate marketing, peer-to-peer lending, and participating in a high-yield savings account or CD.

Authored by, Amay Mathur | Senior Editor

Amay Mathur is a business news reporter at Chegg.com. He previously worked for PCMag, Business Insider, The Messenger, and ZDNET as a reporter and copyeditor. His areas of coverage encompass tech, business, strategy, finance, and even space. He is a Columbia University graduate.

Editor's Recommendations

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.