Quick Summary

Financial freedom is a term that many people dream of, but few truly understand. In simple terms, financial freedom means having enough wealth and income to live your life on your own terms without the constant need to rely on a paycheck. It’s about not worrying about money or living paycheck to paycheck. You can pursue what you love, spend time with your family, and enjoy life without stressing about finances.

“A big part of financial freedom is having your heart and mind free from worry about the what-ifs of life” – Suze Orman

But how does someone in India achieve financial freedom? What steps should you take, and what mindset do you need to cultivate? This guide will provide you with detailed information on how to attain financial freedom in India, with practical advice and actionable steps. By the end of this article, you’ll know exactly how to take control of your finances and work towards a financially independent future.

Before we dive into the details of how to achieve financial freedom, it’s essential to define what it means. Financial freedom can be different for everyone. For some, it might mean retiring early, while for others, it could mean having the ability to work for passion rather than money.

At its core, financial freedom is the state where your passive income or investments generate enough money to cover your living expenses. This means you don’t have to depend on your salary or wage to make ends meet.

For many Indians, financial freedom is an attractive goal. With rising inflation, unpredictable job markets, and increasing living costs, the need for a stable financial future has never been greater.

India is rapidly evolving, and so are its financial challenges. The cost of living in major cities like Mumbai, Delhi, and Bangalore continues to rise, while salaries in many industries are not growing at the same pace. This means that many people are finding it harder to save or invest for their future.

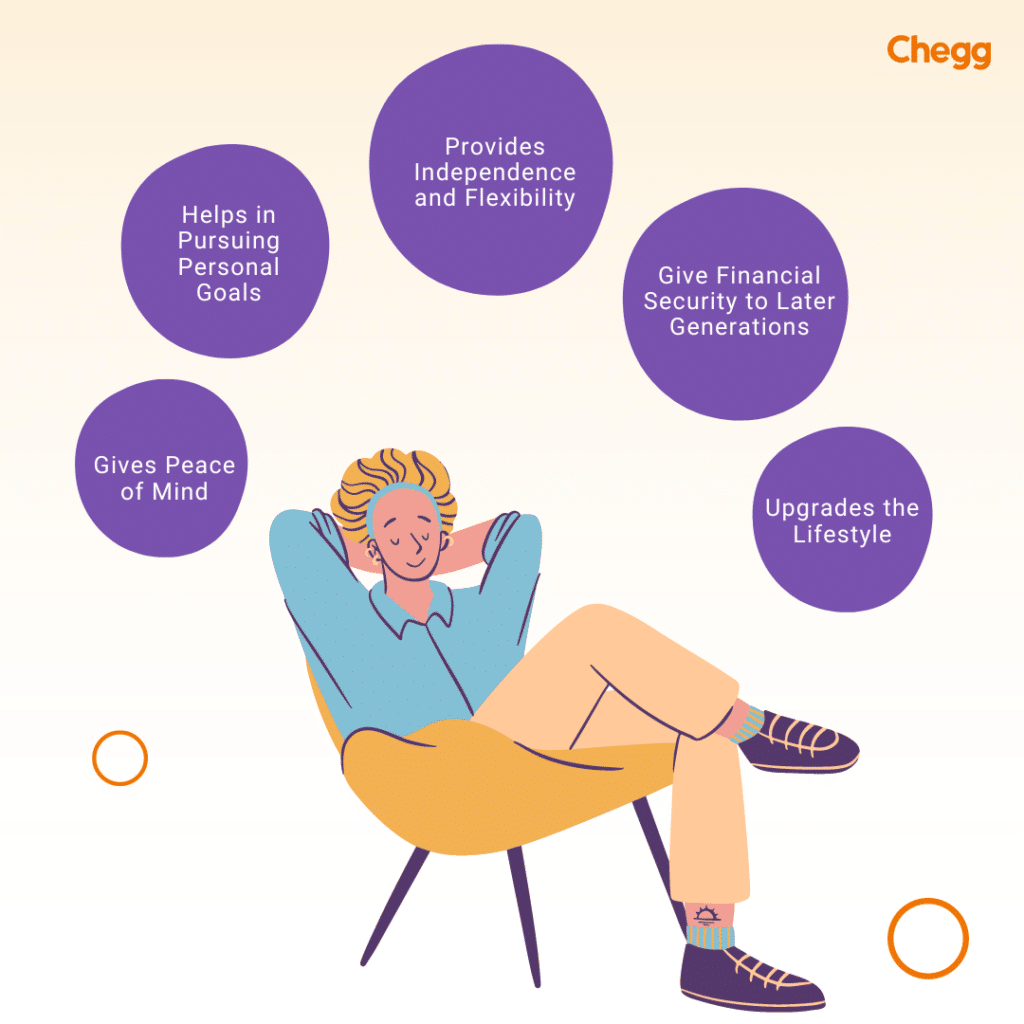

Achieving financial freedom in India can offer you several benefits:

Achieving financial freedom is not a quick process. It requires discipline, planning, and a willingness to make smart decisions. Here’s a 7 steps to achieve financial freedom to help you along your journey.

The first step towards financial freedom is understanding where you stand financially. This means assessing your income, expenses, assets, and liabilities. By doing this, you can get a clear picture of your financial health.

Creating a budget is one of the most powerful tools you have to achieve financial freedom. A budget helps you control your spending, save more, and invest wisely. Here’s how to create a budget that works for you:

One of the most important steps to achieving financial freedom is having a safety net. An emergency fund can protect you from financial setbacks, such as medical bills, car repairs, or sudden job loss.

Debt can be a major roadblock on your path to financial freedom. Especially high-interest debt, such as credit card debt or payday loans. The longer you hold on to this debt, the more money you’ll pay in interest.

Saving money is important, but investing it is what truly helps you build wealth over time. Investments can generate passive income, allowing you to grow your money without actively working for it.

One of the key principles of financial freedom is having multiple sources of income. Relying on a single paycheck or business income can be risky, especially in uncertain economic times.

Recommended Read :- Investment Options: Top 15 Picks for 2025

Achieving financial freedom is not a one-time task; it’s a continuous process. Consistency and discipline are key to making progress. Stay committed to your financial goals, review your budget regularly, and make adjustments as necessary.

Click to Download :-

In today’s digital age, managing your finances has become easier with mobile apps. Here are some of the best apps for financial planning in India:

Utilizing the right financial freedom tools can help you make better decisions and stay on track toward financial freedom:

Building financial knowledge is essential for achieving independence. Here are some valuable resources:

Here are some practical tips tailored for Indian readers to achieve financial freedom:

By following these structured strategies and using the right tools, you can make informed decisions and steadily progress toward financial freedom.

Recommended Read :- How to Start a Startup in India

When discussing personal finance, the terms “financial freedom” and “financial independence” often come up. While they might seem similar, they have distinct meanings and implications. Let’s dive into both concepts to understand their differences and how they can impact your financial journey.

| Aspect | Financial Independence | Financial Freedom |

|---|---|---|

| Goal | Cover basic living expenses without needing employment. | Live life without financial constraints. |

| Stage | A milestone on the path to financial freedom. | The ultimate goal of having enough wealth to live as desired. |

| Mindset | Focuses on security and stability. | Focuses on flexibility and enjoyment. |

| Key Steps | • Creating a budget • Saving and investing • Eliminating debt • Building passive income | • Achieving financial independence • Building substantial wealth • Creating multiple income streams |

| Lifestyle | Maintain current lifestyle without working. | Pursue passions and interests freely. |

| Flexibility | Provides financial security and stability. | Offers financial freedom to make life choices without money concerns. |

| Examples of Use | Retiring early or living off investments. | Traveling, pursuing hobbies, spending time with loved ones without stress. |

By understanding both financial independence and financial freedom, you can better plan your financial future and work towards a life where money empowers rather than restricts you.

Achieving financial freedom is possible for anyone, regardless of their current financial situation. It requires smart planning, disciplined saving, and strategic investing. By following the steps outlined in this guide, you can take control of your finances and begin your journey towards a life of financial independence.

Remember, the key to success is consistency. Start small, stay patient, and keep your eyes on the prize. Over time, with the right steps and mindset, you’ll achieve the financial freedom you’ve always dreamed of.

Don’t wait for 2025, get financial freedom now! Solve subject-related problems, become a subject matter expert, and earn while sitting at home. Approach CheggIndia Expert Hiring and gain some knowledge of the corporate world.

Financial freedom meaning is having enough passive income (rentals, dividends, etc.) or savings to cover your lifestyle without relying on a 9-to-5 job. Example: Retiring early or living off investments.

1. Track expenses (budgeting apps like Mint).

2. Build an emergency fund (3–6 months of expenses).

3. Pay off high-interest debt (credit cards, loans).

4. Invest consistently (stocks, mutual funds, real estate).

5. Diversify income (side hustles, freelancing).

6. Plan for retirement (401(k), NPS, or PPF).

7. Protect wealth (insurance, estate planning).

The 4% rule states you can withdraw 4% of your savings yearly in retirement without running out of money. Example: ₹5 crore savings = ₹20 lakh/year. Based on the Trinity Study.

Total financial freedom means having zero financial stress and unlimited choices (e.g., traveling, philanthropy) thanks to substantial wealth exceeding your needs.

A step-by-step wealth-building framework:

1. Base: Emergency fund + debt-free.

2. Mid: Stable income + investments.

3. Top: Passive income > expenses

वित्तीय स्वतंत्रता (Financial Freedom) का मतलब है निष्क्रिय आय (बिना काम किए) से अपनी जीवनशैली चलाने की क्षमता। उदाहरण: निवेश या प्रॉपर्टी से कमाई।

The 25x Rule is a popular formula: Save 25 times your annual expenses. Example: If you spend ₹10 lakh/year, aim for ₹2.5 crore in investments. Withdraw 4% yearly (per the 4% rule) to sustain your lifestyle.

Steps to Apply the Formula:

1. Calculate yearly expenses.

2. Multiply by 25 for your target savings.

3. Invest in income-generating assets (stocks, real estate).

Top reads:

1. “Rich Dad Poor Dad” by Robert Kiyosaki (mindset shift).

2. “The Simple Path to Wealth” by JL Collins (index fund investing).

3. “Your Money or Your Life” by Vicki Robin (FI/RE movement).

4. “The Millionaire Next Door” by Thomas Stanley (wealth habits).

5. “I Will Teach You to Be Rich” by Ramit Sethi (practical finance).

1. “Live like no one else now, so later you can live like no one else.” – Dave Ramsey

2. “Financial freedom is freedom from fear.” – Robert Kiyosaki

3. “Do not save what is left after spending; spend what is left after saving.” – Warren Buffett

4. “The goal isn’t more money. The goal is living life on your terms.” – Unknown

5. “Invest in yourself. Your career is the engine of your wealth.” – Grant Cardone

In reality, the rule is extremely straightforward. 50-20-30 rules is an easy way to know how to achieve financial freedom in 5 years. Split the cash-in-hand into 3 equal parts as per the rule. 30% of income is spent on wants, 50% on needs, and 20% is set aside for savings and investments. This helps allocate enough funds for everything, and spending becomes easier through pre-set limits.

You put off all unnecessary expenditures and impulsive purchases for 30 days using the 30-day savings rule. The 30-day rule teaches us to wait for a month before going on for a new investment. Within those 30 days think of the pros and cons and then analyze the benefits. If after the completion of the period, investors feel the investing to be the best fit then they should go for it.

This comprehensive guide to financial freedom not only gives you a step-by-step approach but also ensures that you have all the tools and knowledge necessary to reach your goal. By making smart financial decisions, diversifying your income streams, and investing wisely, you can create a life of financial independence in India. Stay committed, and your dreams of financial freedom will become a reality!

Authored by, Amay Mathur | Senior Editor

Amay Mathur is a business news reporter at Chegg.com. He previously worked for PCMag, Business Insider, The Messenger, and ZDNET as a reporter and copyeditor. His areas of coverage encompass tech, business, strategy, finance, and even space. He is a Columbia University graduate.

Editor's Recommendations

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.