Is Gautam Adani Really Guilty Of $265 Million Bribery Case? Facts Unfolded

Quick Summary

- Gautam Adani, founder of the Adani Group, faces serious allegations of a $265 million bribery scheme tied to a solar power deal.

- U.S. authorities have issued arrest warrants for him and others in connection with the case, which involves influencing officials to secure favorable contracts.

- The Adani Group denies the accusations, calling them politically motivated, while the controversy raises concerns about corporate ethics, legal accountability, and its impact on India’s economy.

Table of Contents

The name Gautam Adani has always been associated with big business and success in India. However, recent allegations about a $265 million bribery case have raised questions about the Adani Group’s ethics and operations. Let’s explore the facts to understand what’s happening.

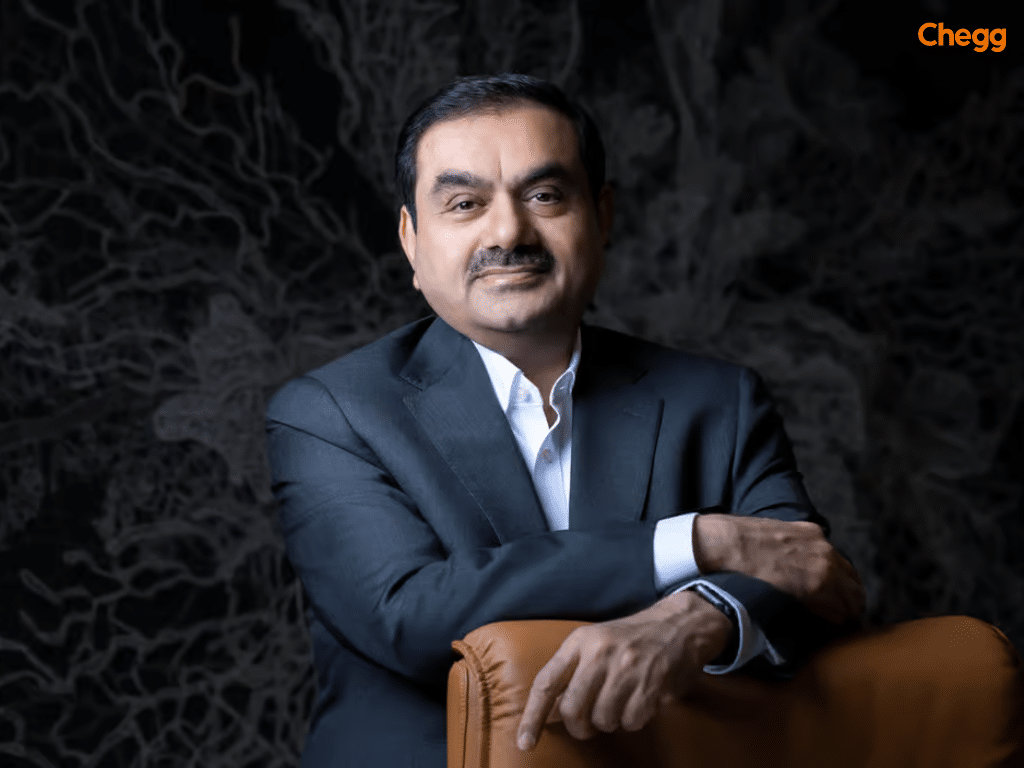

Who is Gautam Adani?

Gautam Adani is the founder of the Adani Group, a massive conglomerate with interests in ports, energy, infrastructure, and more. Over the years, he has built an empire that plays a significant role in India’s economy. However, success often comes with scrutiny, and the Adani Group has faced allegations of corruption and misconduct multiple times.

What is the $265 Million Bribery Case?

The latest controversy revolves around allegations brought in by the SEC (U.S Security and Exchange Commission) that the Adani Group was involved in a bribery scheme worth $265 million. Investigators claim that this money was used to influence officials and secure business deals. This isn’t the first time such allegations have surfaced, but the scale of this case has made headlines globally—U.S. authorities have reportedly issued arrest warrants for Gautam Adani, Sagar Adani and seven others in connection with the case.

What are the Allegations?

The bribery allegations against the Adani Group suggest that the company may have defrauded American investors and bribed officials to secure favourable contracts or avoid regulations. The case revolves around a deal between Adani Green Energy and a U.S. firm to supply 12 gigawatts of solar power to various states. Interestingly, the charges were announced on the same day the company had planned to launch green bonds in the U.S. Following the accusations, the Adani subsidiary ultimately canceled the deal.

Adani’s stocks took a sharp dive as reports surfaced about a possible arrest of one of India’s wealthiest businessmen. The Congress party has repeatedly called for a Joint Parliamentary Committee (JPC) investigation into the “Adani Mega Scam.”

According to the SEC (U.S. Securities and Exchange Commission), the bribery scheme was designed to help Adani Green and Azure Power, two renewable energy companies, benefit from a massive solar energy project awarded by the Indian government. The charges include violations of federal securities laws, with the SEC seeking penalties, bans on holding leadership roles, and permanent injunctions from the court.

The allegations have reignited discussions about corporate ethics and transparency. Critics argue that such practices not only undermine fair competition but also negatively impact smaller businesses striving to compete on equal footing.

How did Gautam Adani Respond?

The Adani Group has strongly denied all allegations, calling them baseless and politically motivated. They argue that these accusations are part of a campaign to tarnish their reputation. In an official statement, the company said it operates within the law and adheres to strict compliance standards.

Past Controversies about Gautam Adani

This isn’t the first time the Adani Group has faced legal and ethical challenges. Previously, the company was accused of stock manipulation, tax evasion, and environmental violations. For instance, in 2024, a report by Hindenburg Research raised concerns about stock manipulation and accounting irregularities, estimating that Adani’s companies were overvalued by nearly $50 billion. While some cases were resolved, others remain under investigation. These past issues add to the skepticism surrounding the current bribery allegations.

How does this Impact the Economy?

As one of India’s largest companies, any controversy involving the Adani Group has a ripple effect on the economy. Investors are closely watching the situation, as it could affect stock prices, foreign investments, and public trust in corporate governance. The $265 million bribery case also highlights the need for stricter regulations and transparency in the business world.

What Happens Next?

Authorities are still investigating the case. If the allegations are proven true, it could lead to significant penalties for the Adani Group and its executives. On the other hand, if the accusations are found baseless, the company will likely emerge stronger. Either way, the outcome will have lasting implications.

Conclusion: Is Gautam Adani Really Guilty?

At this stage, it’s too early to say whether Gautam Adani is guilty of the $265 million bribery case. The allegations are serious and deserve a thorough investigation. For now, the Adani Group maintains its innocence, while critics demand accountability.

Also Read:

To read more related articles, click here.

Got a question on this topic?