Quick Summary

A PPF calculator India 2025 with interest rates is a free online tool that helps you estimate the maturity amount and total interest earned on your Public Provident Fund (PPF) investment. It allows you to project savings for long-term goals like retirement, your child’s education, or wealth creation. Whether you are checking returns with a PPF maturity calculator 15 years or learning how to calculate PPF returns manually, this tool provides accurate results based on your contribution and tenure. By simplifying complex calculations, the PPF calculator ensures smarter and more informed investment decisions.

PPF (Public Provident Fund) is a long-term investment plan offered by the Indian government. Its primary purpose is to encourage savings among individuals. The scheme’s primary purpose is to provide a safe and reliable way for individuals to accumulate savings over time while enjoying tax advantages. It encourages disciplined saving, helping individuals build a substantial corpus for retirement, children’s education, or other major financial milestones.

PPF Interest Rate & Update Frequency

Some of the key features of PPF include:

The following are the benefits of investing in PPF:

The formula used by a PPF calculator is similar to the one used to find the future value of an annuity. In simple terms, it figures out how much your regular contributions will grow over time, based on the annual investment you make and the interest rate set for the PPF scheme.

The standard formula for calculating the maturity amount is:

M = P × [ ((1 + i)^n – 1) / i ]

Where:

The portion in the brackets calculates how much your regular deposits will grow over time (called the annuity factor). Multiplying that by your annual contribution gives you the final maturity value.

Imagine you contribute ₹80,000 every year into your PPF account for 20 years, with the interest rate fixed at 7.1%.

Applying the formula:

M = ₹80,000 × [ ((1 + 0.071)^20 – 1) / 0.071 ]

Solving this step-by-step:

M ≈ ₹80,000 × 50.84

M ≈ ₹40,67,200

So, after 20 years, your PPF investment would grow to approximately ₹40.67 lakh, combining your total contributions and the accumulated interest.

Formula:

A=P×((1+r)n−1r)×(1+r)A = P \times \left( \frac{(1 + r)^n – 1}{r} \right) \times (1 + r)A=P×(r(1+r)n−1)×(1+r)

Where:

Solution:

A=1,50,000×0.071(1+0.071)15−1×(1+0.071) A≈₹40,68,209A \approx ₹40,68,209A≈₹40,68,209

So, maturity = ~₹40.7 lakh after 15 years.

The PPF calculator is vital in helping individuals make informed financial decisions, aligning their savings with long-term goals, and enhancing their overall economic well-being.

Read more:

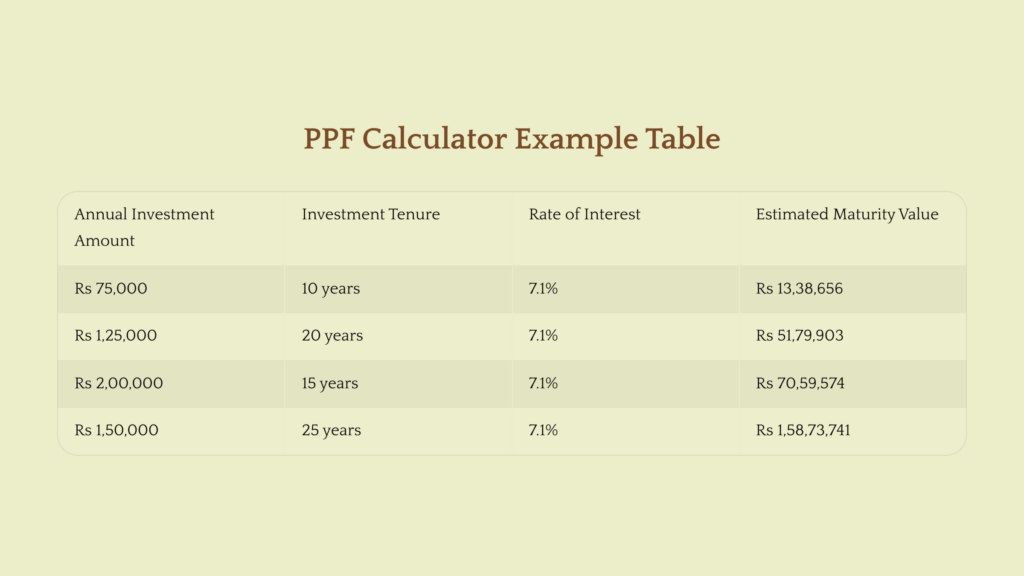

For example, an investor wants to invest Rs 50,000 annually in PPF for 15 years. Assuming a PPF return rate of 7.1%, here’s how it works:

The estimated maturity value of the investment will be Rs 17,64,894.

Similarly, an investor wants to invest Rs 1 lakh annually for 15 years at the same interest rate. The estimated maturity value, calculated with a PPF calculator, will be Rs 35,29,787.

In conclusion, it can help investors plan their PPF investments and estimate expected returns. Moreover, the PPF calculation is simple and easy to understand.

It is a simple tool. With the PPF calculator, investors can determine the returns they can expect on their PPF investment.

Here’s a step-by-step tutorial:

It is a useful tool for investors to calculate the returns they can expect on their investment in PPF.

| Feature | Chegg PPF Calculator | Groww | ET Money | BankBazaar |

| Speed | Instant results | Fast | Moderate | Moderate |

| Ease of Use | One-click, no login | Requires app | Requires app | Multiple steps |

| Mobile-Friendly | Fully responsive | Yes | Yes | Basic |

| Updated Rates | Quarterly auto-update | Occasional | Occasional | Not always updated |

Read More:

PPF is a popular long-term investment option among investors. Here are some tips for maximizing your PPF savings:

Read More:

In conclusion, planning your investments with a PPF calculator India 2025 with interest rates helps you stay ahead by projecting accurate returns. Whether you are using a PPF maturity calculator 15 years to plan long-term wealth creation or exploring how to calculate PPF returns manually, having clarity on maturity value and interest growth is essential. The Chegg PPF calculator offers instant, reliable, and updated results, making it easier to compare options and secure your financial future with confidence.

Recommended Read:

The PPF Calculator is an online tool that computes potential returns by considering the investment amount, tenure, and interest rate. It simplifies planning for PPF investments, aiding investors in maximizing their returns effortlessly.

No, it is designed specifically for calculating returns from Public Provident Fund (PPF) investments. It considers the PPF interest rate, which is unique to this investment. Different calculators and methods need to be used for other types of investments to calculate potential returns.

Suppose you invest ₹1 lakh per year into a Public Provident Fund (PPF) account for 15 years.

Assuming a constant interest rate of 7.1% per annum, your total contribution over the investment period would be ₹15 lakh.

At maturity, the estimated corpus would grow to approximately ₹27.12 lakh, which includes both your invested amount and the interest earned.

PPF is a secure investment choice supported by India’s government, ensuring its safety. Investors also benefit from tax advantages under Section 80C of the Income Tax Act. However, PPF returns can fluctuate due to market conditions and prevailing interest rates.

Yes, the Public Provident Fund (PPF) is completely tax-free. Both the interest you earn and the amount you get at maturity aren’t taxed. Plus, the money you invest in PPF qualifies for tax deductions under Section 80C of the Income Tax Act, helping you save even more on your taxes.

If you are wondering how much to invest in PPF, the minimum investment amount for PPF is Rs 500 per year. The maximum investment limit is Rs 1.5 lakh per year. Investors can make multiple deposits in a year. But the total investment cannot exceed Rs 1.5 lakh. The investment can be made in any number of installments, as long as the total does not exceed the annual limit.

You can withdraw your PPF (Public Provident Fund) investment before the end of the investment tenure, but with certain restrictions. You can withdraw partially from the 7th year onwards, subject to specific limits. However, you can only completely withdraw the PPF investment after completing the 15-year lock-in period. It’s important to note that early withdrawals may incur penalty charges and reduce interest earnings.

Although the Public Provident Fund (PPF) is highly regarded for its safety and attractive tax benefits, mutual fund SIPs stand out for their potential to deliver higher returns over time. Choosing between the two largely depends on your individual risk tolerance and financial objectives. In many cases, blending both options can help create a more balanced and resilient investment portfolio.

PPF is ideal for individuals seeking a secure, long-term investment with tax benefits. It is particularly suited for retirement planning due to its low risk and tax-free returns. On the other hand, LIC policies are suitable for those seeking life insurance coverage along with savings or investment benefits.

PPF is better for long-term, tax-free savings with higher returns, while FD offers short-term safety and liquidity. Choice depends on financial goals, risk tolerance, and investment horizon.

Yes, partial withdrawals are allowed after 7 years, while full maturity withdrawal is available after 15 years.

Authored by, Sakshi Arora

Digital Content Writer

Sakshi is a Content Creator and Strategist who specializes in crafting well-researched content across diverse topics including economics, finance, health, and more. She brings a fresh perspective to every piece she writes, always aiming to offer real value to her readers. When she’s not writing, you’ll likely find her curled up with a book—she’s a proud bookworm—or sipping on endless cups of chai, her favorite obsession.

Editor's Recommendations

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.