Top Saving Schemes in India for Best Investment (2025)

Quick Summary

- ✅ Best Saving Schemes in India: Explore top government and private savings plans with high returns and tax benefits.

- 📈 Compare & Choose: Get insights on interest rates, investment tenure, and risk factors.

- 💰 Secure Your Future: Find the best saving scheme in India that suits your financial goals in 2025!

Table of Contents

Saving money is an important habit that helps us secure our future. In India, there are many saving schemes that help people grow their money while ensuring safety and stability. These schemes are offered by the government, banks, and private institutions, making it easier for individuals to invest based on their needs and goals.

This article will explain different saving schemes in India, including their features, benefits, eligibility, and how to apply. Whether you are saving for education, retirement, or emergencies, this guide will help you make an informed decision.

Types of Saving Schemes in India

Saving money is an essential habit that helps in financial security, future planning, and achieving life goals. The Indian government provides several money saving schemes in India that offer security, tax benefits, and guaranteed returns. These schemes are ideal for individuals looking for safe investment options with assured earnings.

1. Government-Backed Saving Schemes in India

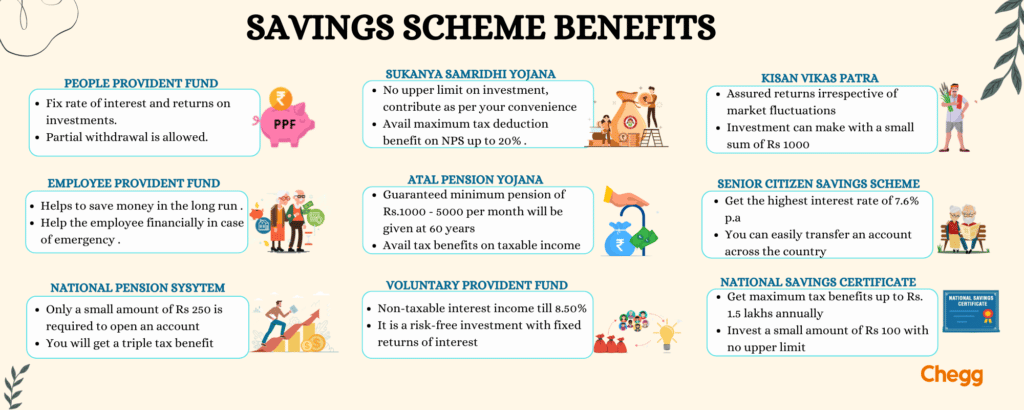

The Government of India offers various savings schemes that are secure, regulated, and beneficial for long-term financial planning. Let’s explore some of the most popular govt saving schemes:

a) Public Provident Fund (PPF)

The Public Provident Fund (PPF) is one of the most trusted saving schemes in India. It is designed to encourage long-term savings and provides attractive interest rates along with tax benefits.

- Interest Rate: 7.1% per annum (revised quarterly)

- Tenure: 15 years (can be extended in blocks of 5 years)

- Tax Benefits: The investment amount, interest earned, and maturity amount are exempt under Section 80C of the Income Tax Act.

- Best for: Individuals who want a secure, long-term savings option with tax-free returns.

Why Choose PPF?

PPF is a great choice if you want to grow your savings over a long period without taking risks. Since the government backs it, it is one of the safest and best savings scheme in India.

b) National Savings Certificate (NSC)

The National Savings Certificate (NSC) is a fixed-income saving scheme that offers guaranteed returns. It is mainly for those who want a safe investment with moderate returns. Which make it the best savings plan India.

- Interest Rate: 7.7% per annum (fixed for 5 years)

- Tenure: 5 years

- Tax Benefits: Investment up to ₹1.5 lakh qualifies for tax deduction under Section 80C.

- Best for: Individuals who prefer a low-risk investment with guaranteed returns.

Why Choose NSC?

NSC is a great option if you want a secure investment for the medium term with tax-saving benefits. It also works as collateral for loans from banks.

c) Senior Citizens Savings Scheme (SCSS)

The Senior Citizens Savings Scheme (SCSS) is specially designed for senior citizens, ensuring a stable source of income after retirement.

- Interest Rate: 8.2% per annum

- Tenure: 5 years (can be extended by 3 more years)

- Tax Benefits: Investments up to ₹1.5 lakh are eligible for deductions under Section 80C. However, the interest earned is taxable.

- Best for: Retired individuals looking for a secure and regular source of income.

Why Choose SCSS?

This scheme is ideal for senior citizens as it provides higher returns compared to regular fixed deposits and ensures a steady income post-retirement.

d) Sukanya Samriddhi Yojana (SSY)

The Sukanya Samriddhi Yojana (SSY) is one of the best saving schemes in India for parents who want to secure their daughter’s future financially.

- Interest Rate: 8% per annum

- Tenure: Until the girl child turns 21 (minimum investment duration of 15 years)

- Tax Benefits: Investments, interest earned, and the final maturity amount are all tax-free under Section 80C.

- Best for: Parents who want to save for their daughter’s education or marriage.

Why Choose SSY?

India post Sukanya Samriddhi Yojana (SSY) is a long-term investment with high returns and tax benefits. It helps parents create a financial cushion for their daughter’s future expenses.

e) Post Office Savings Scheme

The Post Office Savings Scheme (India Post Scheme) offers multiple investment options for individuals looking for a safe place to deposit their money. These schemes are run by India Post and have various plans.

- Interest Rate: 4% – 7.5% per annum (varies by scheme)

- Tenure: Depends on the type of scheme (Savings Account, Recurring Deposit, Fixed Deposit, etc.)

- Tax Benefits: Some post office schemes provide tax exemptions under Section 80C.

- Best for: Individuals looking for safe, small savings with steady returns.

Why Choose Post Office Savings Scheme?

These schemes are highly secure and ideal for people in rural and urban areas who want to save small amounts regularly while earning decent interest.

f) Kisan Vikas Patra (KVP)

The Kisan Vikas Patra (KVP) is a fixed-income savings plan that ensures your money doubles over a fixed period.

- Interest Rate: 7.5% per annum (compounded annually)

- Tenure: 115 months (9 years and 7 months)

- Tax Benefits: No tax benefits on investment or interest earned.

- Best for: Individuals looking for a guaranteed way to double their investment.

Why Choose KVP?

KVP is a great choice if you want to double your savings in a secure manner without worrying about market fluctuations.

Government-backed saving schemes in India provide a safe and reliable way to grow your money. Whether you want to save for retirement, your child’s education, or tax benefits, these schemes offer something for everyone. Choosing the right scheme depends on your financial goals, investment duration, and risk appetite. Always compare the interest rates and tax benefits before investing to ensure you maximize your savings.

2. Bank and Private Saving Schemes in India

Apart from government-sponsored plans, banks and private financial institutions offer multiple saving schemes that help individuals save money while earning fixed or variable interest. Here are some of the most popular options:

a) Fixed Deposit (FD)

A Fixed Deposit (FD) is one of the most popular and secure best deposit scheme in India. It allows individuals to deposit a lump sum amount for a fixed period and earn interest at a predetermined rate.

- Interest Rate: 5.5% – 8% per annum (varies by bank)

- Tenure: 7 days to 10 years

- Tax Benefits: Tax-saving FDs (5-year lock-in) are eligible for deductions under Section 80C of the Income Tax Act. However, interest earned is taxable.

- Best for: Individuals looking for a safe and guaranteed investment option with flexible tenure.

Why Choose FD?

Fixed deposits are an excellent choice if you want to earn a stable return without any market risk. Many banks also provide loan facilities against FDs, making them a convenient option for emergency funds.

b) Recurring Deposit (RD)

A Recurring Deposit (RD) is a saving scheme where individuals deposit a fixed amount every month and earn interest over a chosen period. It is ideal for those who want to develop a disciplined savings habit.

- Interest Rate: 5% – 7.5% per annum (varies by bank)

- Tenure: 6 months to 10 years

- Tax Benefits: No tax exemption is available for RDs. The interest earned is taxable.

- Best for: Individuals who want to save regularly and earn fixed returns.

Why Choose RD?

RDs help individuals build a habit of saving small amounts regularly while earning decent interest. It is a great choice for students, salaried individuals, and small business owners who want to accumulate savings gradually.

c) Equity Linked Savings Scheme (ELSS)

The Equity Linked Savings Scheme (ELSS) is a market-linked saving scheme in India that provides high returns along with tax benefits. It primarily invests in equity and equity-related instruments.

- Interest Rate: Varies (depends on market performance)

- Tenure: Minimum lock-in period of 3 years

- Tax Benefits: Investments up to ₹1.5 lakh are exempt under Section 80C of the Income Tax Act. Long-term capital gains above ₹1 lakh are taxed at 10%.

- Best for: Individuals looking for high returns and tax-saving benefits.

Why Choose ELSS?

ELSS is ideal for individuals who want to grow their wealth over time while saving on taxes. However, since it is linked to the stock market, it carries a higher risk than traditional savings schemes.

Bank and private financial institutions offer a range of saving schemes in India that cater to different financial needs. While Fixed Deposits and Recurring Deposits provide guaranteed returns, Equity Linked Savings Schemes offer the potential for higher earnings.

Recommended Read :- 7 Simple Money Management Tips

Best Saving Scheme in India for 2025 [Comparison Table]

| Scheme | Interest Rate | Tenure | Tax Benefit |

|---|---|---|---|

| Public Provident Fund (PPF) | 7.1% | 15 years | Yes |

| National Savings Certificate (NSC) | 7.7% | 5 years | Yes |

| Senior Citizen Savings Scheme (SCSS) | 8.2% | 5 years | Yes |

| Sukanya Samriddhi Yojana (SSY) | 8% | 21 years | Yes |

| Fixed Deposit (FD) | 5.5% – 8% | 7 days – 10 years | Yes (for 5-year FD) |

| Recurring Deposit (RD) | 5% – 7.5% | 6 months – 10 years | No |

| Equity Linked Savings Scheme (ELSS) | Varies | 3 years | Yes |

How to Choose the Best Saving Scheme in India?

Selecting the right saving scheme in India depends on your financial goals, risk appetite, and the benefits offered by each scheme. Before making a decision, consider the following important factors:

1. Risk Level

Different saving schemes come with varying levels of risk. Government-backed saving schemes in India, such as the Public Provident Fund (PPF), Post Office Savings Schemes or (India Post Scheme), and National Savings Certificate (NSC), are considered very safe as they are backed by the government. On the other hand, investment options like the Equity Linked Savings Scheme (ELSS) and mutual funds involve higher risk since they are linked to market performance.

💡 Tip: If you prefer a secure and stable return, opt for government schemes or fixed deposits. If you can handle some risk for potentially higher returns, consider ELSS or mutual funds.

2. Return on Investment (ROI)

The return you earn on your investment is one of the most crucial factors to consider. Different schemes offer different interest rates and returns:

- Fixed deposits and recurring deposits provide guaranteed but moderate returns.

- Government schemes like PPF and SCSS offer stable interest rates.

- Market-linked options like ELSS have higher return potential but also come with market fluctuations.

💡 Tip: Compare the interest rates and historical performance of various saving schemes in India before investing.

3. Tax Benefits

Many saving schemes offer tax benefits under Section 80C of the Income Tax Act, allowing you to save on taxes while growing your wealth. Some tax-saving schemes include:

- PPF & NSC: Eligible for tax deductions under Section 80C.

- ELSS: Investments up to ₹1.5 lakh qualify for tax savings.

- Fixed Deposits (5-year tenure): Tax-exempt under Section 80C.

💡 Tip: If reducing your tax liability is a priority, choose tax-saving schemes that offer both deductions and exemptions.

4. Liquidity & Flexibility

Some saving schemes allow you to withdraw funds easily, while others require you to stay invested for a fixed tenure.

- High Liquidity: Savings accounts, flexible fixed deposits.

- Moderate Liquidity: ELSS (3-year lock-in), NSC (5-year lock-in).

- Low Liquidity: PPF (15-year tenure), Sukanya Samriddhi Yojana (until girl child turns 21).

💡 Tip: If you need emergency access to funds, choose a scheme with partial withdrawal options or shorter lock-in periods.

Choosing the best saving scheme in India depends on your financial needs, investment goals, and risk-taking ability. If you prefer guaranteed returns with safety, government-backed schemes and fixed deposits are great choices. If you’re looking for higher returns and tax benefits, ELSS or mutual funds may be a better fit. Always assess your financial situation before making an investment decision.

How to Apply for These Saving Schemes?

Investing in saving schemes in India is a simple and straightforward process. Whether you choose a government-backed scheme or a bank-provided option, the steps are generally similar. Here’s a detailed guide to help you apply:

1. Visit a Bank or Post Office

The first step is to visit a nearby bank or post office that offers the saving scheme in India you want to invest in. Some schemes, like Public Provident Fund (PPF) and Fixed Deposits (FD), are available in both banks and post offices, while others, like Sukanya Samriddhi Yojana (SSY), are primarily managed by post offices and select banks.

💡 Tip: Many banks and financial institutions now allow online applications for certain saving schemes. Check if your bank offers digital account opening for ease of access.

2. Fill Out the Application Form

Once you decide on the scheme and the institution, you need to fill out an application form. The form will require:

- Your personal details (name, address, date of birth, etc.).

- KYC documents like Aadhaar card, PAN card, Voter ID, or Passport for identity and address verification.

- Photographs (passport-sized) in some cases.

💡 Tip: If you are opening an account for a minor (such as Sukanya Samriddhi Yojana), you will need additional documents like the child’s birth certificate.

3. Make the Initial Deposit

Most saving schemes in India require a minimum deposit to start your investment. For example:

- PPF: ₹500 (minimum) per year.

- FD/RD: Varies based on the bank’s policy.

- NSC: ₹1,000 (minimum investment).

The deposit can be made in cash, cheque, or online transfer, depending on the bank or post office’s facilities.

💡 Tip: Ensure that you maintain the minimum balance or yearly contribution required to keep the scheme active.

4. Receive Confirmation & Investment Proof

Once your application is processed and payment is successful, you will receive proof of your investment. This can be in the form of:

- Passbook (for PPF, SSY, and Post Office schemes).

- Certificate (for NSC and Kisan Vikas Patra).

- Account statement (for FDs, RDs, and ELSS).

💡 Tip: Keep this document safe as it will be required for withdrawals, maturity claims, or tax benefits.

Applying for saving schemes in India is easy and accessible to everyone. Whether you prefer visiting a bank or using online banking, you can start investing in a few simple steps. Choose a scheme that aligns with your financial goals and make sure to follow the required procedures to enjoy safe and secure savings.

Conclusion

Choosing the right saving schemes in India is crucial for financial security. Whether you want guaranteed returns, tax savings, or high growth, there is a scheme for everyone. Compare your options, invest wisely, and secure your future today!

Frequently Asked Questions

Q1. Which is the best saving scheme in India?

The best saving scheme in India depends on your financial goals. Popular options include Public Provident Fund (PPF), National Savings Certificate (NSC), and Senior Citizens’ Savings Scheme (SCSS) for their attractive interest rates and tax benefits.

Q2. Which bank gives 7% interest on savings accounts in India?

Several banks offer up to 7% interest on savings accounts, including Airtel Payments Bank, Equitas Small Finance Bank, and AU Small Finance Bank.

Q3. What is the 1000 RS savings scheme?

The 1000 RS savings scheme refers to the Post Office Savings Scheme, where you can invest Rs. 1000 monthly and accumulate significant returns over time, such as the Public Provident Fund (PPF) which offers a 7.1% interest rate.

Q3. Name India’s saving schemes with the highest interest rate.

Ans. To entice investors to make more significant investments and achieve higher returns, the government, financial institutions, and banks provide a variety of savings plans. The following are some of the saving schemes in India with the highest interest rates:

1. Public Provident Fund (7.1% interest)

2. Kisan Vikas Patra (7.6% interest)

3. Sukanya Samriddhi Yojana (7.6% interest)

Q4. Which is the best NRI saving schemes in India?

The best NRI saving schemes in India include NRE Fixed Deposits, FCNR Deposits, and Equity-Linked Savings Schemes (ELSS) for their tax benefits and attractive returns.

Q5. What are the four types of investments?

The four types of investments are:

1. Unit Link Investment Plan (ULIP)

2. Systematic investment plan (SIP)

3. Public Provident Fund (PPF)

4. National Pension Scheme (NPS)

Q6. Which is the best small savings scheme?

The best small savings schemes in India include the Public Provident Fund (PPF), National Savings Certificate (NSC), and Sukanya Samriddhi Yojana (SSY) for their high interest rates and tax benefits.

Here are some related resources:

To read more related articles, click here.

Got a question on this topic?