Quick Summary

- Zero Based Budgeting is a budgeting method where every expense must be justified and approved for each new period.

- 43% of organizations that used ZBB to control costs were able to do so successfully.

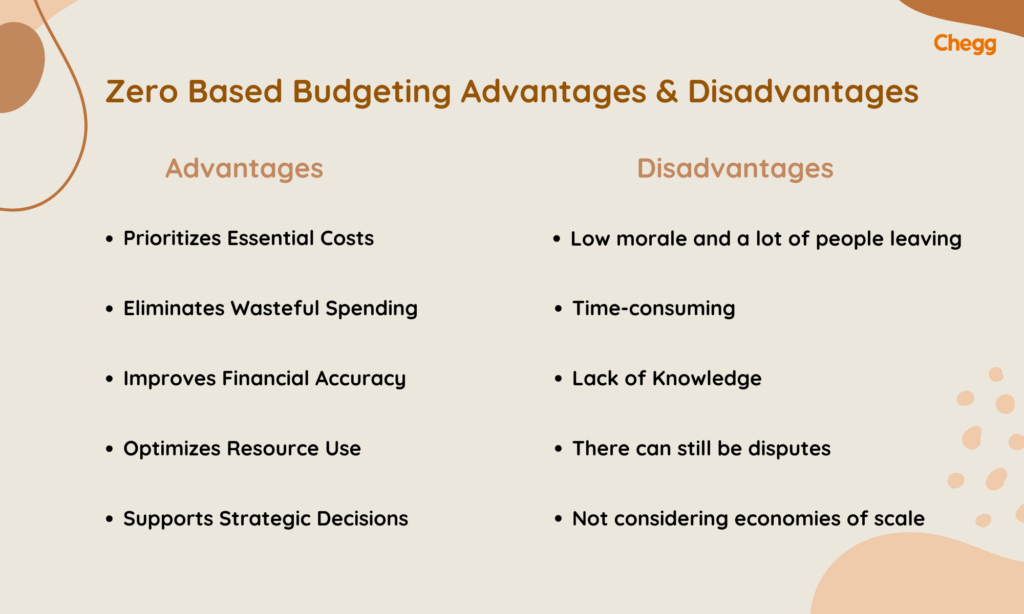

- The advantages of ZBB are prioritizing essential costs, eliminating wasteful spending, etc.

Table of Contents

Taking care of your company’s finances means doing things that could be more compelling. This includes making a budget and looking for ways to cut costs. Budgeting methods have been around for decades. They are reliable and easy to set up and use. However, they might need to be more flexible. They must provide the energy and speed to compete in today’s fast-paced global market. Many organisations use a method called ZBB. ZBB stands for zero based budgeting.

Some people are interested in this new way of doing things. This is because it gives them exciting new ways to start over with their budgeting. Know the pros and cons before deciding if the ZBB method is right for your business.

In 1986, India’s annual spending plan was based on ZBB, as chosen by the government. The federal government made ZBB mandatory for departments to evaluate programs and budget projections.

What Is Zero Based Budgeting (ZBB)?

Zero Based Budgeting (ZBB) is a budgeting method where every expense must be justified and approved for each new period, starting from a “zero” base. Unlike traditional budgeting, it doesn’t carry forward previous budgets but evaluates all costs and activities as if starting fresh each time.

In ZBB, the budget starts over at zero at the end of each period. This is why it is called zero-based budgeting (ZBB). Each new budget comprises resources from scratch, regardless of previous goals set by the company.

Zero Based Budgeting Meaning and Definition

First, let’s talk about what is zero-based budgeting in India.

- It may be one of the longest-lasting ways to save money when done carefully.

- Studies reveal that businesses can cut SG&A costs by 25% annually using ZBB.

- When ZBB is used correctly, it has been shown to boost long-term productivity.

- This is true for businesses that first find and fix the root causes of costs.

- In ZBB, cost-cutting need not be significant as it is based on the top-down goal.

- This means it is different for each company.

- A common misconception is that ZBB is time-consuming and difficult.

- Even though putting ZBB into place can take up to a year, it usually takes a lot less time than that.

- The goal of zero-based budgeting is to make it so that no one person has to take care of all the expenses.

- All employees must use cost management strategies to cut costs everywhere.

How ZBB Works?

Zero-based budgeting is a way for a company to keep track of and control how much money it spends. Deloitte found the following.

- 43% of organizations that used ZBB to control costs were able to do so successfully.

- Companies that didn’t meet their cost goals were unable to control costs. They reported that prices went up because of it.

One can be successful with ZBB by carefully tracking spending and managing cash flow. The method could give department heads and executives information about spending in real-time. This way, they will not have to rely on estimates or forecasts from the past.

It is a way to budget that considers the here and now. Let’s use a marketing group to explain.

- The marketing team has limited resources due to set budgets for the following.

- Social media advertising.

- Making ads.

- SEO.

- As a result, overall costs may go down.

- Moreover, the next zero-budgeting cycle can benefit from better planning and analysis of money.

- In short, each division is given some money and punished if it overspends.

- That is how it works when everything goes right.

- Changes in the market and expenses higher than anticipated can commonly go wrong.

- Such factors can prevent a budget from starting from zero for each category of expenditure.

Zero Based Budgeting Example

Users of zero budgeting tend to be able to stick to their spending goals better. In a global survey, 63% of those who did not use ZBB failed to meet their cost goals. 58% of users of zero-base budgeting met their cost goals.

In countries except for the US, where the rate was 66% vs 57%, ZBB users had a lower failure rate for cost programs. (The failure rate in Latin America is 68%. In Europe, it is 52%, and in the Asia-Pacific region, it is 71%).

Businesses that use ZBB have been known to run into more problems in this area. This suggests that ZBB may be harder to set up and run than other methods.

Two of the biggest problems are the following:

- “Weak/unclear business case” (42% of ZBB users, compared to 25% of non-users).

- “Poorly constructed tracking and reporting”.

Companies in the US may be misusing zero-based costing. They do so by taking a tactical approach to aggressive goals needing strategic cost measures. These include high-cost goals and high failure rates. Problems with implementing ZBB are responsible for its failure in Brazil, where it was widely used.

Users of ZBB are expected to remain consistent in the Asia-Pacific. However, in China, the number is expected to grow. This could be due to fewer problems with implementation and fewer failures in China.

It is not random that ZBB has a low but steady profile in Europe. Here, neither cost goals nor systematic ways to manage costs are as strict as elsewhere. In this situation, ZBB may seem useful for some as it is better than doing nothing.

How Zero Based Budgeting Is Different From Other Methods

The two most common ways are to use a standard budget or a zero-based budget. These methods help companies give money to many different projects. There are several ways these budgeting plans differ. Due to this, organizations must choose their budgeting method wisely based on their goals. Let us compare and contrast zero-based budgeting with other methods.

1. Explaining the Numbers

- In zero-based budgeting, zero is the starting point.

- Past data and statistics are excluded.

- This checks that all cash flow expenses are correct.

- Due to this, it is important to explain any new or different expenses or income.

- In a typical budget, expenses costlier than what was budgeted the previous year must be explained.

- Even if the change is big, it need not be explained each time.

2. Base for Budgeting

- A budget starting from zero for each category of expenditure assumes the following.

- Nothing will be spent or bought in the future.

- Every time the fiscal year changes, a brand-new budget is written.

- Traditional ways of budgeting often base spending plans for the current year.

- They are based on how money was spent the previous year.

- So, the previous level of spending gets a lot of attention.

- When using zero-based budgeting, a new budget is made from scratch.

- This makes it easy to eliminate unnecessary sections or add new ones.

- So, a budget that starts at zero offers more freedom.

- It might be hard to change line items when making a budget the old-fashioned way.

- Market conditions and organisational goals affect how the budget’s many parts change annually.

- A budget is based on the previous year’s spending and income estimates. However, the company doesn’t have to use the same budget items in the current year.

- Thus, it is difficult to change or remove an existing facility.

- It is also challenging to add a new budget category.

- In other words, traditional budgeting is pretty strict.

3. How long it takes?

- A big problem with a budget starting from zero for each category of expenditure is that it is time-consuming.

- After a new project is added to the budget, it takes time and work to approve it.

- This is because of all the checks and balances that need to be made.

- On the other hand, traditional ways of budgeting are faster.

- Most work is already done before the budget process starts.

- Only small updates are needed.

- This is because the previous year’s budget is changed to fit the current term’s needs.

4. Allocation of Resources

- With ZBB, money is largely allocated to projects that benefit the business the most.

- The company prioritises activities that generate money and are important to its long-term health.

- With the help of ZBB, the government may place more weight on important decisions.

- The budget from last year has just been raised to keep up with inflation.

- Traditional planning does not pay attention to the most important tasks for a business.

5. Less work to Learn and Practice

- For ZBB to work, one must be able to explain how current resources are being used.

- This can only be done through deep analysis and complicated calculations.

- Management must have specialised skills and knowledge to create zero-based budgeting.

- This is only possible if implemented by a trained and qualified professional.

- Thus, coming up with zero-based budgeting is challenging.

- On the other hand, traditional budgets don’t need complicated calculations, making them easier.

Zero Based Budgeting Advantages

Zero based budgeting has the following main benefits:

- Cost-benefit analysis forms the basis of the plan.

- Some businesses find it easier to find and get rid of budget items.

- These include items that don’t earn enough when the whole budget is considered.

- Some value-centred performance metrics that could be used in this review include the following.

- The total cost of ownership (TCO).

- Social standing.

- Prospects.

- However, these traits must be considered in the context of a larger budget to provide useful information.

- If done once a month, zero-based budgeting can provide helpful information to compare financial forecasts.

- Using such research in business can generate information about longer periods, like the financial cycle.

- It focuses on making the best use of available resources.

- Everything that makes money, saves money, adds value, etc., gets the money it needs.

- Less important business costs are:

- Moved down in the budget.

- Or cut out completely instead of being carried over to the next year.

- Leads to better management of business processes.

Goals can be reached faster if:

- One spends less on unnecessary items.

- One spends more on things to help business succeed in the long run.

- This can be done through the following.

- Better value.

- Lower costs.

- More efficiency, etc.

- Streamlining operations and lowering costs can help with the following.

- Strategic decisions.

- Planning and managing finances.

- Finding chances to evaluate goals at the project, division, department, and corporate levels.

Zero Based Budgeting Disadvantages

1. Low morale and a lot of people leaving

Zero based budgets start with zero as their base number. To work, many staff members must collaborate to plan and prepare the budget from the ground up. Many divisions may not have enough people or time for quality control at the same level.

2. Time-consuming

Compared to the ZBB strategy, the incremental zero budgeting strategy is easier to use each year.

3. Lack of Knowledge

Managers responsible for explaining every line item and expense must be trained to do so.

4. There can still be disputes

Even if all the department heads get together and discuss their budgets, disagreements can still happen. For example, if one department’s budget is lower than the rest. In such cases, compromises must be made so that each department’s budget is acceptable.

5. Not considering economies of scale

When businesses set goals like making more money, they may ignore economies of scale. They assume costs will increase by the same amount, which can lead to waste.

Implementation of Zero Based Budgeting

To implement zero based budgeting (ZBB), follow this process:

1) Identify Decision Units: Divide the organization into decision units or departments.

2) Set Priorities: Establish the goals and objectives for each decision unit.

3) Develop Decision Packages: Each decision unit creates decision packages that detail the activities, costs, and expected benefits associated with achieving their goals.

4) Rank Decision Packages: Prioritize decision packages based on their importance and organization objectives.

5) Allocate Resources: Allocate resources to decision packages based on their priority and the available budget.

6) Monitor and Adjust: Continuously monitor spending and performance against objectives. Adjust allocations as needed to check resources are used effectively.

Tools Used for Zero-Based Budgeting

For implementing zero-based budgeting, various tools can support the process. Here are some of the best tools to use for zero-based budgeting:

1) Spreadsheets: Spreadsheet applications like Microsoft Excel or Google Sheets can be used to create and manage zero-based budgets. They provide flexibility in organizing budget data, performing calculations, and creating reports.

2) Financial Planning and Analysis Software: Offer features for budgeting, forecasting, and financial analysis. These tools provide budgeting creation, data integration, and reporting. They come with advanced analytics capabilities, enabling organizations to make data-driven decisions.

3) Enterprise Resource Planning (ERP) Systems: ERP systems integrate various financial processes, including budgeting. These systems offer modules specifically designed for budget creation, tracking, and reporting.

4) Budget Planning Software: These tools provide features like budget templates, workflow, automation, and reporting. They often offer user-friendly interfaces and enable collaboration among budget stakeholders.

5) Data Visualization Tools: These tools create interactive charts, graphs, and dashboards that enhance the understanding and communication of budget information. Data visualization tools can help identify trends, patterns, and issues in the budgeting process.

6) Project Management Software: Project management tools like Asana, and Jira can be utilized to track budgeting tasks, deadlines and milestones. These tools help manage the workflow, and assign responsibilities, during the budgeting process.

Difference between Zero-Based Budgeting vs. Traditional Budgeting

| Aspect | Zero-Based Budgeting | Traditional Budgeting |

| Starting Point | Begins from scratch at zero | Starts from previous year’s budget |

| Focus on Costs | Focus on cost reduction and efficiency | Rely on incremental adjustments. |

| Flexibility | Offers greater flexibility and adaptability | Can be rigid and resistant to change |

| Time and Resources | Requires more time and resources at start | Less resource intensive |

| Cultural Shift | Promotes accountability and cost-consciousness | Requires more time and resources at the start |

Zeroing In On The Conclusion

Zero-based budgeting is a method to plan and manage money. It considers how a business works to determine its essential costs. Cost optimization is largely what ZBB offers, which the budgeting process helps with significantly.

It assists people in setting goals, making them more productive and generating more income. Although time-consuming, ZBB is the best and most acceptable way to plan a budget. It also ensures that all operational groups have a sense of responsibility and ownership.

All budgetary spending in ZBB is done in the right way. The goals of zero-based budgeting are as follows:

- To make the most money.

- Spend it as efficiently as possible.

- Waste as little as possible.

Adequate resource allocation is the idea that money should be put toward worthwhile projects. Due to this, the company has more money for projects directly impacting its success. It is a very futuristic way to determine how much money to spend.

Here are some useful resources:

- Zero or Without Investment Business in India – Minimal Expense, Maximum Profits

- Importance of Financial Planning for Small Businesses

- How to Save Money from Salary? Best of 5 Smart Tips

Frequently Asked Questions

What is meant by zero-based budgeting?

Zero-based budgeting is a financial planning method where every expense must be justified for each new period, starting from zero. Unlike traditional budgeting, which adjusts previous budgets, it requires evaluating and approving each cost as if it’s being proposed for the first time.

What is zero-based costing with an example?

Zero-based costing is a method where all costs are analyzed from scratch for each period, instead of using past costs as a base. For example, a company planning its annual budget would justify every expense (e.g., production, marketing) rather than just adjusting last year’s budget.

Why is it called a zero-based budget?

A zero-based budget is called “zero-based” because it starts from zero, meaning no prior budget or expenses are assumed. Each cost must be justified and approved as if it’s being proposed for the first time, rather than carrying over previous budget figures.

What are the advantages of ZBB?

Zero-based budgeting (ZBB) offers several advantages: it ensures cost control by justifying every expense, promotes efficient allocation of resources, helps identify unnecessary expenditures, fosters accountability, and aligns spending with current organizational goals and priorities.

What are the objectives of ZBB?

The objectives of Zero-Based Budgeting (ZBB) are to allocate resources efficiently, reduce unnecessary expenditures, justify all costs, improve cost management, enhance accountability, prioritize essential activities, and align spending with the organization’s strategic goals.

To read more related articles, click here.

Got a question on this topic?