Table of Contents

BFSI Full Form

BFSI full form is Banking, Financial Services, and Insurance. It refers to the banking industry, financial services sector, and insurance companies.

BFSI includes both financial institutions and activities. This area encompasses banks, stock exchange venues, insurance providers, as well as asset management firms. They take money from people, give loans, invest money, help control risk, and offer insurance. Financial services from BFSI help the economy. Moreover, it connects savers and borrowers and allocates productive funds.

Banks provide loans, savings accounts, and payment processing services. Investment banks and asset managers offer wealth management services. Insurance protects both individuals and businesses. Both these sectors work together to create synergies and provide comprehensive financial solutions.

BFSI Full Form in Banking

BFSI Full Form in Banking denotes the comprehensive domain of Banking, Financial Services, and Insurance. This inclusive industry is vital to the economy because it offers a variety of services that are essential to both consumer satisfaction and financial stability.

The Banking, Financial Services, and Insurance (BFSI full form) sector’s primary responsibility is to manage a range of services associated with the three fundamental industries banking, finance, and insurance. Changes in consumer behavior, regulatory shifts, technological advancements, and market trends define the evolution of BFSI.

The development of information technology led to improvements in loan procedures, mobile payments, online banking, and many other areas. As a result, the Banking, Financial Services, and Insurance (BFSI full form) industry saw a boom in some areas, including risk management, fraud detection, customer experience, data analytics, and many others.

BFSI Full Form: Components

The BFSI Full Form stands for Banking, Financial Services, and Insurance. This industry offers a wide range of financial services that support people’s financial needs and help maintain stability. It’s similar to the money hub. The BFSI offers a wide range of services to people and businesses and comprises three main groups closely related to each other. It is responsible for a nation’s stability and economic growth.

Here are the details of the components:

- Banking: The banking industry offers a wide range of services, including deposits, withdrawals, approving different kinds of loans, deposits, and much more. There are job opportunities in the banking industry for a variety of services.

- Financial Service: Financial services include a wide range of services such as asset management, mutual fund investing, brokerage, appropriate investment, and advice on profitable and safe investments.

- Insurance Service: Different insurance coverage, including health, property, and product insurance, among others.

The evolution of BFSI

Key components of Banking, Financial Services, and Insurance

BFSI full form says it accepts deposits, lends money, processes payments, and other financial services. Commercial, savings, and cooperative banks are included. Financial services include investment banking, asset management, brokerage, financial advisory, and wealth management. Financial companies help clients choose investments, manage their portfolios, and reach financial goals. Insurance companies take on risk for a premium. Insurance covers life, health, property, and liability risks.

The banking, financial services, and insurance (BFSI) industry has undergone many changes in recent years. Many companies have merged or been acquired, and there has been a convergence of services. Universal banks now offer both insurance and finance to their customers. The BFSI sector has seen growth in NBFCs and specialized financial services firms. Fintech innovations and digital platforms have brought in advanced technologies and new players, improving efficiency, customer experience, and thereby, competitiveness.

Importance of BFSI in the Financial Industry

Banks play an important role in our economy. They make financial transactions easier and help people borrow money. When you put your money in a bank, they can use it to provide loans and credit to others. This helps connect people who want to lend money to those who need to borrow it. Banks also offer electronic payment services that help keep our economy running smoothly. Overall, banking is an essential part of our financial system.

Investment, advisory, and wealth management firms are financial services. Investors, portfolio managers, and financial goal-setters benefit. Financial planning, investment banking, asset management, brokerage, and retirement planning. Companies offer products to boost the economy and help people save and invest.

Importance of insurance in risk management and protection against unforeseen events

Risk management and financial security depend on insurance. Insurance protects against accidents, illnesses, property damage, and liability claims. Such insurance companies pool policyholder risks and use premiums to compensate for covered losses. Insurance coverage has many benefits. It encourages investment and entrepreneurship, protects individuals and businesses from major financial losses, and promotes financial stability. Insurance coverage has many benefits. It encourages investment and entrepreneurship, protects individuals and businesses from major financial losses, and promotes financial stability.

BFSI and Economic Development

1. Contribution of BFSI to Economic Growth and Development

Banking, Financial Services, and Insurance (BFSI full form) indicates how it boosts economic growth in many ways. It mobilizes savings and invests them productively. Bank loans help businesses expand, invest, and hire. Financial services firms help people and businesses manage their money, promoting economic growth. Insurance reduces risks and encourages investment and entrepreneurship.

2. How does the BFSI sector support businesses, individuals, and government entities?

Banking, Financial Services, and Insurance (BFSI full form) puts businesses in the equity and debt markets, loans them money, and advises them. It helps people with banking, investing, insurance, and financial planning. The BFSI sector helps the government manage finances, sell bonds, and regulate the financial system.

3. Highlight the role of BFSI in promoting financial inclusion and access to financial services.

The Banking, Financial Services, and Insurance (BFSI full form) sector offers financial services to underserved individuals and businesses. These services include microfinance, mobile banking, and agent banking, which can benefit rural economies.

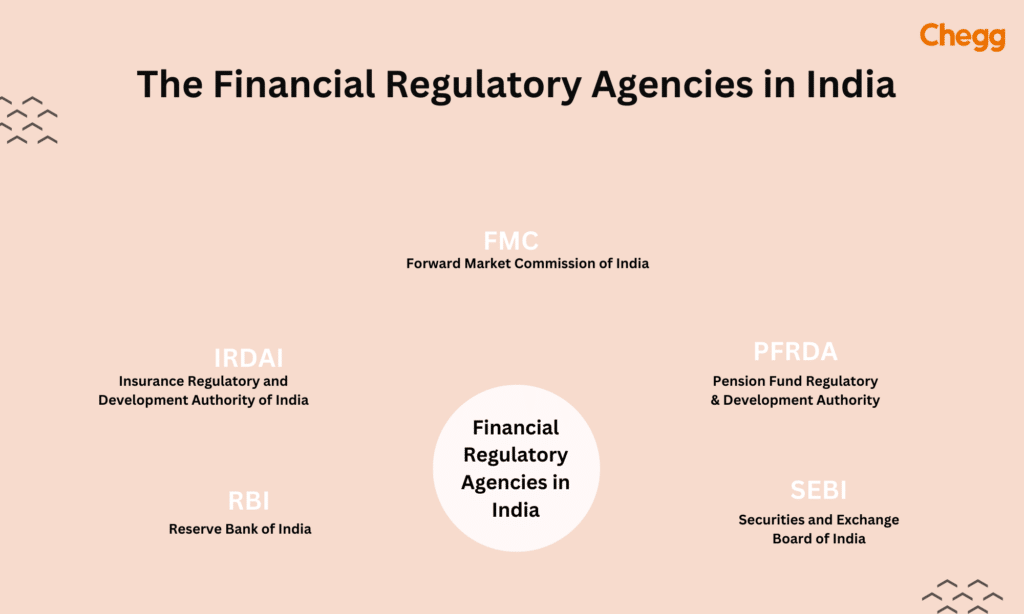

Regulatory Framework and Challenges

1. The regulatory framework governing the BFSI sector.

The Banking, Financial Services, and Insurance (BFSI full form) industry is regulated to ensure stability, protect consumers, and promote fairness. Central banks, financial regulators, and insurance regulators are in charge of overseeing banks and insurance companies. Regulations cover areas such as capital, risk, customer protection, anti-money laundering, and prudential norms. Compliance with these regulations is necessary to maintain the integrity and stability of the financial system.

2. Key challenges and risks the BFSI sector faces, such as cybersecurity and regulatory compliance.

The Banking, Financial Services, and Insurance (BFSI full form) sector faces several challenges and risks. Financial institutions handle sensitive data, making them prime targets for cyberattacks. To prevent data breaches and financial fraud, protect customer data and cybersecurity. Banks and other financial companies have to follow many rules that keep changing. This takes a lot of knowledge and effort to keep up with. Market volatility, credit risk, operational risk, and reputational risk are all factors that can have an impact on BFSI’s stability and profitability.

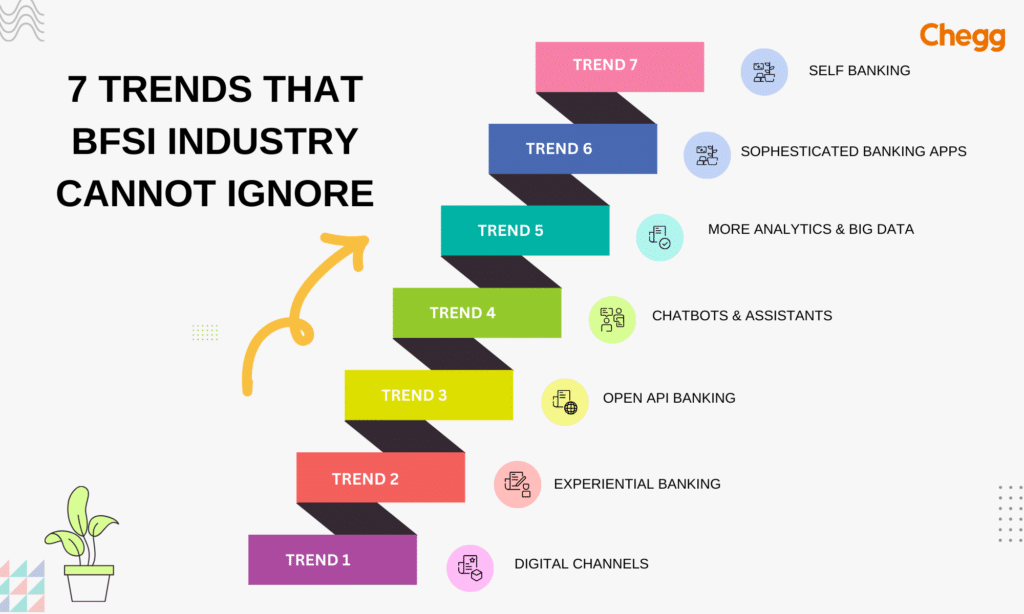

Future Trends and Innovations in BFSI

1. Emerging trends and technological advancements in the BFSI sector

Banking, Financial Services, and Insurance (BFSI full form) is experiencing significant technological advancements and innovation. Mobile and online banking make financial services accessible to customers. Financial technology is changing payments, lending, wealth management, and insurance. Insurtech streamlines insurance operations. Artificial intelligence, blockchain, robo-advisory, and open banking are also transforming financial services.

2. The impact of disruptive technologies on traditional BFSI operations.

Technology disrupts Banking, Financial Services, and Insurance (BFSI full form) business models, customer experiences, and efficiency. Digital banking reduces branch costs and expands. Fintech platforms provide peer-to-peer payments, alternative lending, and investment advice. Blockchain could revolutionize cross-border payments, trade finance, and identity verification. Disruptive technologies require incumbents to innovate.

3. The potential benefits and challenges of embracing technological innovations.

The use of technology has many benefits for the banking, financial services, and insurance industries. It can improve customer service and make banks more efficient. Digital platforms also help people who may not have had access to financial services in the past. Additionally, automation and data analytics can better evaluate financial risks and personalize services.

However, there are also drawbacks to adopting technology. Banks must address cybersecurity, privacy, and regulatory compliance. Companies need to invest in their technology, update their old systems, and teach their workers how to use new technology.

Skills Required in the Banking Financial Service Insurance Sector

The Banking, Financial Services, and Insurance (BFSI full form) in Banking stands for Banking, Financial Services and Insurance. It’s a simple word that describes the realm of banking along with other financial services that work together to help handle and manage financial matters.

Candidates seeking employment in the BFSI Sector must possess a variety of abilities, including technical, people-oriented, and industry-specific skills, depending on the demands of the company. To be considered for multiple job roles at BFSI, candidates applying for different positions must possess these skills.

- Skills in communication and problem-solving

- Good hearing

- Organizing abilities

- Self-control

- Knowledge of finance and analytical abilities

- Marketing and sales abilities

- Flexibility

- Time management

The Banking, Financial Services, and Insurance (BFSI full form) industry extends a warm welcome to all. There aren’t any set prerequisites for candidates’ skills, though. Candidates must use the aforementioned abilities, though, to take advantage of the many opportunities in this field.

BFSI: Salary for Different Job Roles

The table below lists the salaries for the various positions in the BFSI Domain.

| Job Profile | Minimum Educational Qualification | Salary (Per Annum) |

| Correspondent for Business and Facilitator | Passed the Class 10th exam with a recognized board. | Rs. 4,00,000 to Rs. 10,00,000 |

| Debt Recovery Agent | Completed high school or a similar program | Rs 2 lakh to Rs. 4 lakh |

| Credit Processing Associate | A bachelor’s degree in business, economics, finance, or a similar discipline | Rs. 3 lakh to 5 Lakh |

| Microfinance Executive | A bachelor’s degree in business, economics, finance, or a similar discipline | Rs 2 lakh to Rs. 4 lakh |

| Insurance Agent | Diploma in an equivalent field or high school education. | Rs 2 lakh to Rs. 4 lakh |

| Mutual Fund Agent | Diploma in an equivalent field or high school education. | Rs 2 lakh to Rs. 4 lakh |

| Accounts Executive/ Assistant | A bachelor’s degree in business, economics, finance, or a similar discipline | Rs 2 lakh to Rs. 4 lakh |

Benefits of the BFSI Sector

It functions as a broad umbrella that covers all aspects of money management, including banks, insurance, and financial services.

The Banking, Financial Services, and Insurance (BFSI full form) sectors are growing and have the potential to grow quickly in the upcoming years. Opportunities are plentiful in the BFSI sector. It gives a lot of people, especially recent graduates, job opportunities. Here are some of the significant benefits of working in any of the BSFI sectors.

- The BFSI industry has grown quickly in recent years and is predicted to continue growing in the years coming.

- It offers opportunities for rapid career growth.

- There are a lot of job openings for both experienced and fresh candidates.

- There are many positions, which means there are numerous options.

- Changing jobs and companies regularly is very simple.

Conclusion

The banking, finance, and insurance sector, called BFSI, is important for the economy. It helps with money transactions thereby connecting people who save. However, it also manages risks. BFSI has grown and now includes banks, finance companies, and insurance providers. The sector helps the economy by giving access to money, supporting businesses and people, and ensuring everyone can use financial services.

For more Full Forms → Click Here

Learn more about some other full forms:

| DMLT Full Form | DNB Full Form | Ph.D. Full-Form |

| BAMS full form | Md Full Form | |

| BDS Full Form | BHMS Full Form | BAMS full form |

BFSI Full Form: FAQs

What does BFSI stand for?

BFSI full form is Banking, Financial Services, and Insurance.

Why is the BFSI sector important for the economy?

The BFSI industry facilitates financial transactions, savings, and access to capital, helping to grow and stabilize the economy.

What are some key components of the BFSI sector?

The BFSI industry relies on various financial intermediaries, such as commercial banks, investment banks, insurance companies, and asset management companies.

How does insurance contribute to the BFSI sector?

Insurance contributes to BFSI through risk management and financial security for individuals and businesses.

How is technology influencing the BFSI sector?

Digital banking, fintech, and insurance tech have revolutionized the BFSI sector. It enhances customer experiences, streamlines operations, and introduces new financial services.

Got a question on this topic?