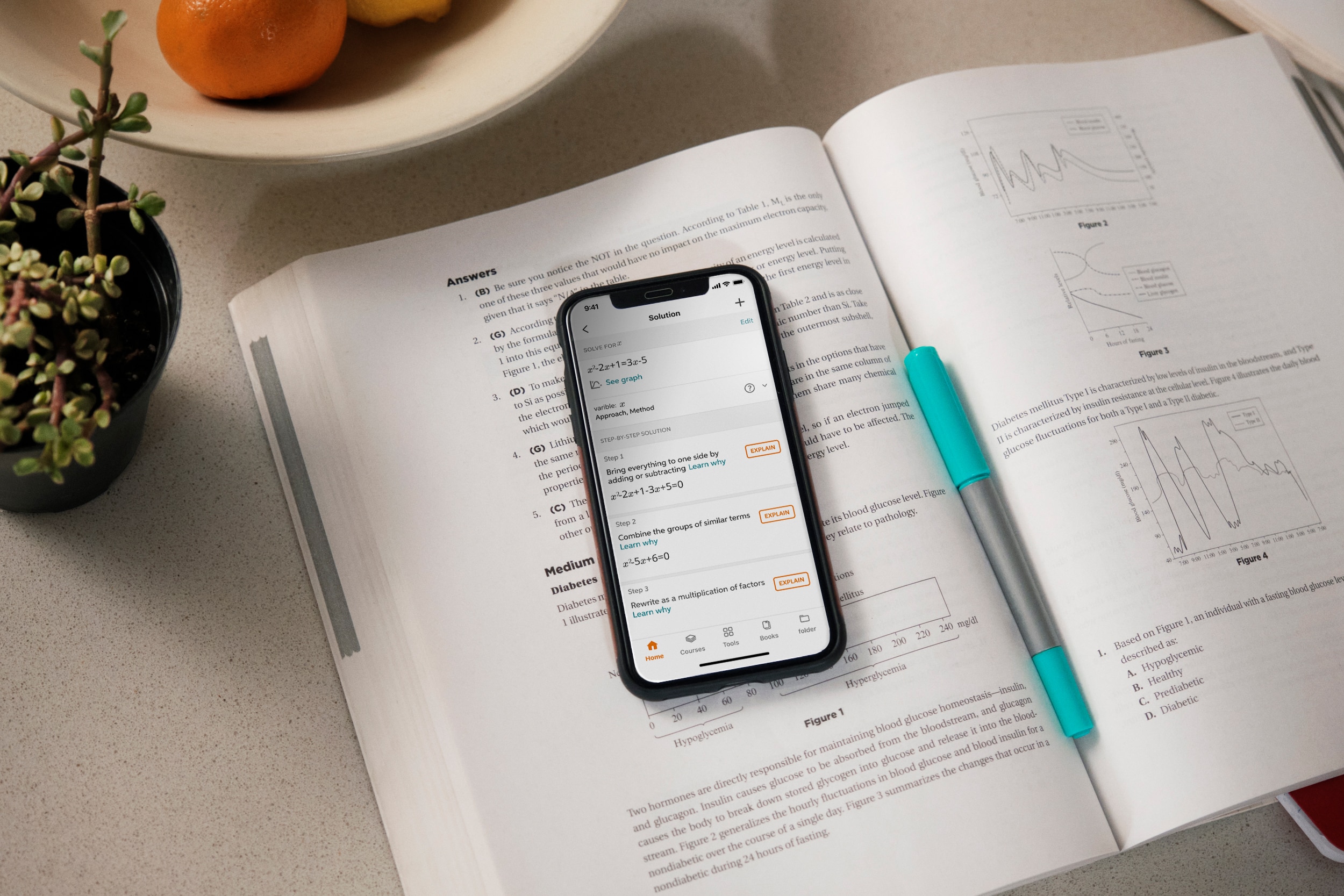

Get 24/7 study support, tutoring help, and learning tools starting at ₹ 299/month*.

Cancel anytime, hassle-free.

Get 24/7 study support, tutoring help, and learning tools

starting at ₹ 299/month*.

Cancel anytime, hassle-free.

Speak confidently, engage in real-world interactions and get millions of cultural insights.

Hiring subject matter experts. Work at your own convenience and get paid for every question answered.

Secure your dream job. Explore hundreds of resources to achieve your career goals.

Get latest updates, syllabus, study material and prepare for top government jobs.

Get latest updates, syllabus, study material and prepare for top government jobs.

Secure your dream job. Explore hundreds of resources & tips to achieve your career goals.

Supplement your income with the most trending ways to earn online from the comfort of your home.

Get 24/7 study support, tutoring help, and learning tools starting at just ₹ 299/month*. Cancel anytime, hassle-free.

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.