Quick Summary

Looking for easy ways to earn money online without prior experience? Micro job sites in India are one of the most practical solutions, especially for beginners. These platforms connect users with simple tasks-such as data entry, content writing, app testing, tagging images, or taking surveys-that pay per gig and require minimal technical skills. Popular platforms include Amazon Mechanical Turk, Clickworker, JumpTask, and SproutGigs, which connect businesses with a global workforce to handle tasks requiring human intelligence. They are particularly useful for students, homemakers, and part-time job seekers who want to earn extra income from home on a flexible schedule.

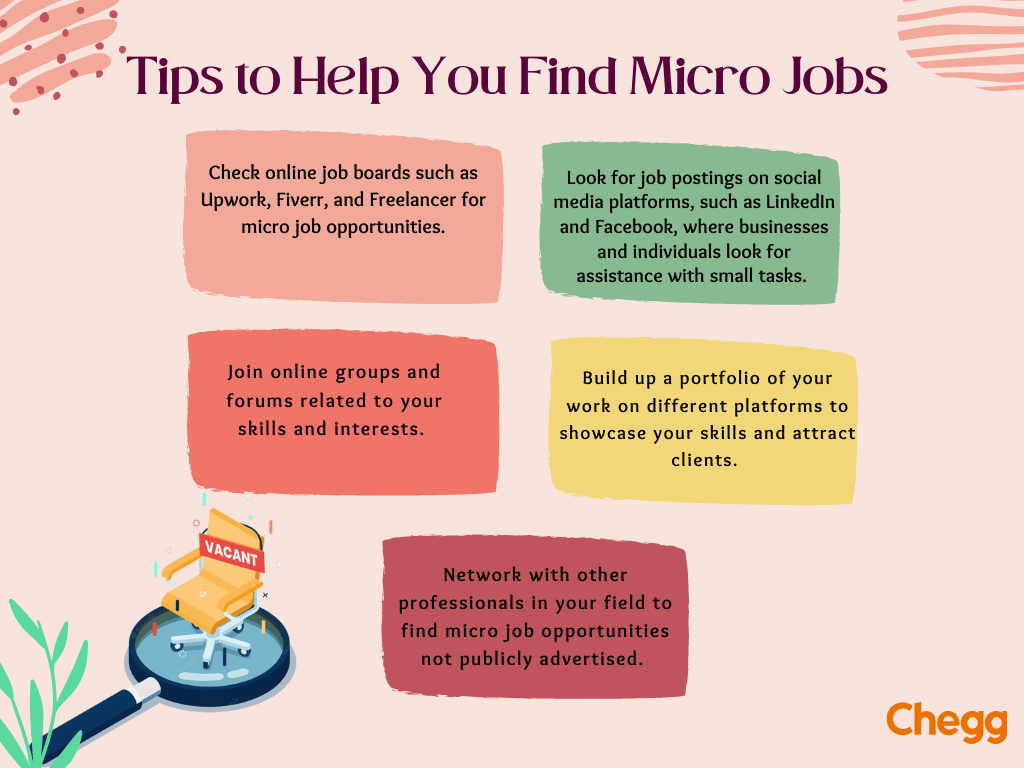

As India’s gig economy grows rapidly in 2025, more people are turning to these opportunities for low-investment, skill-building income. Platforms like Fiverr and Upwork have seen a sharp rise in Indian freelancers, while local options such as WorkNHire and Freelancer.in are gaining traction. Micro-job platforms not only serve as side hustles but also open doors to global income streams and long-term freelancing or entrepreneurship. For offline or real-world tasks, platforms like TaskRabbit and newer players like JumpTask provide quick, simple, and instant-paying gigs, making micro jobs a flexible and accessible option for anyone looking to earn online.

Micro job websites are online platforms that connect individuals with small, short-term tasks or “gigs” that can be completed quickly, often without specialized skills or experience. With microwork, companies that require assistance in some way post online tasks on the best micro job sites and offer payment to the individual who works on and completes the task.

Microworkers are not employees. This means it’s vital for you to understand the terms of the contract you’re signing. Tasks are finished quickly without the more time spent bidding, clarifying expectations, and everything else that comes with a freelance job.

Some typical micro jobs include:

There are three types of micro task job. It includes:

Read More: Online Data Entry Jobs

Micro job sites usually pay in different ways. Payment methods can vary for different websites. Be sure to check the payment options for the specific site you start working. Some of the methods include:

Pay for micro jobs online varies based on the job type, platform, and your skills. On the best micro job sites 2025, earnings can range from ₹100 to ₹500 per task, depending on complexity and demand.

You can earn a good side income by working on a microtask. However, the amount you earn from micro task job will depend on the type of job, the site you use, and your skills and experience.

Many micro job sites without investment are available today. Some of them have been established for more than ten years while some are new. Before signing up on any platform, you must understand that not every site is legit.

Here are some micro task websites that can help you earn extra income:

| Micro Job Site | Minimum Payment | Payment Method |

|---|---|---|

| GigBucks | INR 400 | PayPal |

| Fiverr | INR 400 | PayPal |

| Envato Studio | INR 500 | Visa, Mastercard, PayPal |

| Clickworker | INR 600 | PayPal, Bank Transfer |

| Zeerk | INR 160 | PayPal |

| Microworkers | INR 700 | PayPal, Skrill |

| Appen | INR 400 | PayPal |

| Survey Junkie | INR 800 | PayPal |

| Figure Eight | INR 800 | PayPal |

| Lionbridge | INR 4000 | Dwolla |

| Isoftstone | INR 650 | PayPal |

| Remotasks | INR 400 | PayPal |

| Crowdtap | INR 410 | Amazon Gift Cards |

GigBucks is one of the high-paying micro job websites for making money online. It’s also a simple platform for freelancers. This platform allows you to earn between INR 400 to 4000 per gig. However, to earn such a large sum, you must be skilled and informed in that field. Before posting gigs on the platform, understand what you are good at, then post gigs according to your skills.

Fiverr is among the best free micro job sites. It offers a variety of services and micro-jobs. If you want to make money quickly, showing your skills will enable you to earn a lot of money on Fiverr. Once your gigs are published, they will be visible to audiences all over the world. The gig starts at INR 400 and can go as high as INR 8000, depending on your experience, proficiency, and area of expertise.

Envato is one of the world’s largest online micro job websites. WordPress theme design, design, freelance content writing, audio, logo design, mobile app development, and many other job categories are popular on this platform. This platform provides full-time income for many successful freelancers. Earning INR 1.7 LPA on this platform is not much more difficult if you have the vital skills.

Clickworker is an excellent option for people who want to work from home. This platform offers an abundance of online micro-jobs. Clickworker is a long-running micro job site. It has over 15 years of experience with micro-tasks and has completed over 1 million projects. Members of the Clickworker micro job platform can be from any country. The minimum payment amount is INR 600-800.

One of the micro job websites is Zeerk. Here, you can set your price and sell services on the Zeerk micro job platform. Depending on the job, earnings can range from INR 160 to 8200. Zeerk is an online micro jobs site that caters to online customers and pays freelancers without complaints. One benefit of micro freelancing here is that they are not required to wait for payment. You are paid once the customer approves the job.

Microworkers is an online micro job sites with over 1.4 million users who have completed over 42 million Micro Tasks. As you complete tasks, you will be assigned a star rating. Higher ratings will allow you to access a broader range of jobs. It pays out via Dwolla, PayPal, and Transpay, but you must earn a minimum of INR 736 before you can cash out. Payments are delivered twice per week.

Appen is one of the most popular beer money platforms. Jobs on Appen are very similar to those on other platforms. On Appen, however, you apply to a specific type of job, such as rating jobs, language-based jobs, or microtasks. The pay range is also higher than other free micro job sites, with some Appen jobs paying up to INR 1100 per hour. Most people use Appen to work 40 hours per week on this platform to get a good amount of money.

Survey Junkie is a long-time player in the paid survey game. It is yet another way to make money with surveys. It permits you to cash out INR 400 as micro-works finance, making it one of the more valid options. Signing up for Survey Junkie is free, and unlike many other sites, the site is devoted to surveys. Here you get multiple surveys to fill and after completing each survey you will be paid.

Another popular way to earn money by completing microtasks is Figure Eight. Some of the tasks you may encounter include content moderation, business listing verification, and image tagging. Figure-eight tasks can pay anywhere from a few cents to a couple of dollars, so you could make an extra INR 8000 in beer money every month if you use it diligently.

Lionbridge, a strong competitor of Appen, offers various microtasks like search engine evaluation, website testing, quality rating, and transcription. If you couldn’t get into Appen, Lionbridge is a great alternative to earn extra income. On the best paying micro job sites, earnings range from ₹654 to ₹1,144 per hour, depending on the job type and experience. It’s a reliable platform for flexible online work.

If you’re looking for a global chance to make some beer money, iSoftStone, along with companies like Appen and Lionbridge, is a great option to consider. Ad evaluators, linguists, transcribers, and speech data collection workers from all over the world are being sought by iSoftStone. You can set your hours and earn between INR 654 and 900 per hour for a completed microtask. Bonuses for consistent, high-quality work are also given.

Remotasks is a newer entrant in the crowdsourced micro jobs market, and they pay less than companies like Appen or Lionbridge on average. If you can’t get into other platforms but still want to make some extra beer money, RemoTasks might be able to tide you over until you can find better work. Payments are made through PayPal, and you can up to INR 820 per hour on this platform.

Crowdtap is a platform you should look into if you believe you should be paid for your opinion. Every day, Crowdtap asks users questions, and you can earn points for answering them. Points can be restored for various rewards, including gift cards to major retailers such as Amazon. Most gift cards require 1,000 Crowdtap points to cash out, which will take some time.

This site has many micro jobs where you can earn money by visiting websites. It’s also one of the few micro job sites where you can earn a minimum of INR 400 and deposit it in the bank. The most significant benefit of SproutGigs is that it always has many small jobs available. You can also earn through various affiliate programs and earn 5% when a new person signs up on the platform using your link.

ySense is a strange hybrid of a survey site and a micro job platform, and it truly has something for everyone. Users can earn money on ySense by taking surveys, downloading offers, and watching videos. Users can cash out using various gift cards or PayPal, with the lowest reward being 245.19. ySense is also available in several different countries.

Read More: Earn Money Online with Work-from-Home Apps

Most micro jobs websites use advancing methods and platforms to ease unity between job seekers and businesses.

Here’s a glimpse of how micro job sites work:

These top micro job sites aim to create a simple, easy, and efficient process for both micro workers and businesses.

Here are some advantages and disadvantages of micro job sites that you should consider before taking online micro-jobs:

| Pros | Cons |

|---|---|

| No start-up costs required and minimal experience needed. Work can be done on your own schedule. | Pay is relatively low and may not provide a consistent full-time income. |

| High flexibility-work from home, avoid commuting, and choose your own working hours. | Success requires discipline, consistency, and hard work; without it, earnings remain limited. |

| Most tasks are simple and beginner-friendly, suitable even for people with no advanced skills. | The market is highly competitive, with thousands of workers offering similar services. |

| Opportunity to work with both national and international companies, earning in global currencies. | Maintaining good reviews and positive ratings is crucial; negative feedback can hurt future opportunities. |

Micro job sites are valuable platforms that connect freelancers with businesses and clients looking for small, quick tasks. They make it easy for beginners and part-time workers to find short-term jobs and complete them on their own schedule.

These platforms not only provide an additional source of income but also help users build skills in areas like graphic design, data entry, programming, and even soft skills such as time management and communication. For example, many Indian students and homemakers use sites like Fiverr or Clickworker to gain experience, earn extra cash, and later transition into larger freelance projects.

That said, micro jobs should be viewed as a stepping stone rather than a full-time career option. Pay per task is relatively low, and competition is high, which makes consistency, patience, and quality work essential to stand out.

Dive into our guide to explore all about online jobs to fit any lifestyle.

To get micro jobs, sign up on popular micro job platforms like Amazon Mechanical Turk, Clickworker, or Swagbucks. Create a profile, browse available tasks, and choose ones that fit your skills and schedule. Complete tasks to earn money or build experience.

Microtasks such as data entry, online surveys, transcription, content writing, image categorization, and app testing. Platforms like Amazon Mechanical Turk, Clickworker, and Swagbucks offer these tasks, paying users for completing them.

Yes, you can earn money from Microworkers by completing small tasks like surveys, data entry, content moderation, and testing websites. Simply create an account, choose tasks that match your skills, and get paid for completing them. Payments are made via PayPal or other methods.

You can earn money on websites like Amazon Mechanical Turk, Clickworker, Microworkers, Swagbucks, Fiverr, Upwork, and TaskRabbit. These platforms offer a variety of tasks, from surveys and data entry to freelance gigs, allowing you to earn money based on your skills and time.

Micro earning refers to earning small amounts of money by completing short tasks or microjobs, often online. These tasks, like surveys, data entry, or testing websites, can be done quickly and don’t require specialized skills, making it easy to earn extra income in your spare time.

1. Fiverr

2. Upwork

3. TaskRabbit

4. Gigwalk

5. Freelancer

6. PeoplePerHour

7. We Work Remotely

8. Amazon Mechanical Turk

9. Clickworker

10. Guru

The top 5 micro job sites are:

Fiverr – Offers freelance services starting at $5 for various skills.

Upwork – Connects freelancers with clients for short-term and long-term projects.

PeoplePerHour – Focuses on hourly-based freelance work.

Freelancer – Allows bidding on micro-jobs and projects.

Amazon Mechanical Turk (MTurk) – Provides small tasks like data entry and surveys.

An example of a micro job is data entry, where a freelancer inputs data into spreadsheets or databases for a small payment. Other examples include logo design, online surveys, and social media posting. These tasks are usually short-term and pay per task or gig.

Depending on the site, a microworker gets paid through platforms like PayPal, bank transfers, cryptocurrency, or digital wallets. Payments are usually made per completed task or after reaching a minimum payout threshold. Some platforms also offer gift cards or prepaid cards as payment options.

A microwork app is a mobile application that connects users with small, quick tasks in exchange for payment. Examples include Fiverr, Amazon Mechanical Turk, and Clickworker, where users can complete jobs like surveys, data entry, and image tagging. These apps allow freelancers to earn money flexibly from anywhere.

Authored by, Anshika Sharma

Digital Content Writer

Anshika specializes in writing informational content designed to educate and engage readers at all levels. She aims to spark curiosity and make learning a genuinely enjoyable experience. When she’s not writing, she’s often immersed in research for her next piece or exploring new topics to expand her knowledge and creativity.

Editor's Recommendations

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.