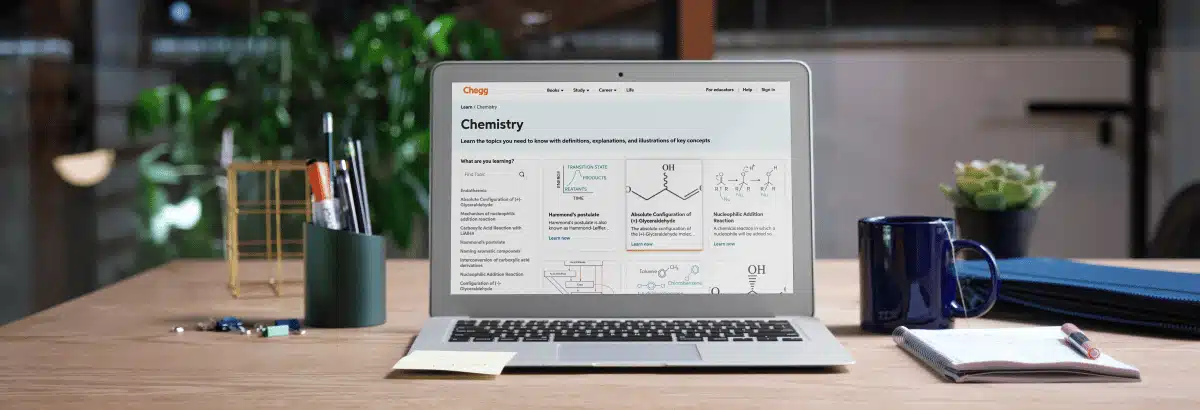

Learn with Chegg

Get 24/7 study support, tutoring help, and learning tools starting at ₹ 299/month*.

Cancel anytime, hassle-free.

Learn with Chegg

Get 24/7 study support, tutoring help, and learning tools

starting at ₹ 299/month*.

Cancel anytime, hassle-free.

Learn a New Language

Speak confidently, engage in real-world interactions and get millions of cultural insights.

Earn with Chegg

Hiring subject matter experts. Work at your own convenience and get paid for every question answered.

Grow with Chegg

Earn Online

Supplement your income with the most trending ways to earn online from the comfort of your home.

Career Guidance

Secure your dream job. Explore hundreds of resources to achieve your career goals.

Govt Exams

Get latest updates, syllabus, study material and prepare for top government jobs.