Quick Summary

Table of Contents

The Minimum Wages Act 1948, intended to provide appropriate and equal compensation for workers, is a crucial law in the Indian context. The primary goal of this action is to improve the financial situation of workers by establishing a minimum wage.

The Act seeks to stop exploitation and protect workers’ rights, and it is based on the principle of social justice. It creates a framework for setting the Minimum Wages Act 1948 considering several variables, including employment type, location, and skill level. This review explores the legislative underpinnings and clarifies how it aims to provide a just and equitable economic environment.

Fair compensation is morally required as well as required by law. This section examines why maintaining modest salaries is essential to the country’s overall socioeconomic progress. Fair remuneration has a ripple effect throughout businesses, from raising living standards to encouraging a motivated workforce, and it ultimately contributes to a more equitable and peaceful society.

The primary goal of the 1948 Minimum Wage Act, which is a foundation of Indian labor law, was to provide a basis for fair and reasonable compensation for the country’s labor force. The legislature significantly modified this vital law when it amended it in 2000, including a reevaluation of the minimum wage threshold.

The Purpose of the Minimum Wages Act, 1948 is to ensure that workers receive a fair and adequate wage for their labor, preventing exploitation and providing economic security. It aims to:

The Act, introduced in 1948, marked a turning point in India’s efforts to ensure that all workers receive fair pay for their jobs. The 2000 amendment, reflecting a deeper understanding of economic dynamics, mandated a revision of the minimum wage floor level.

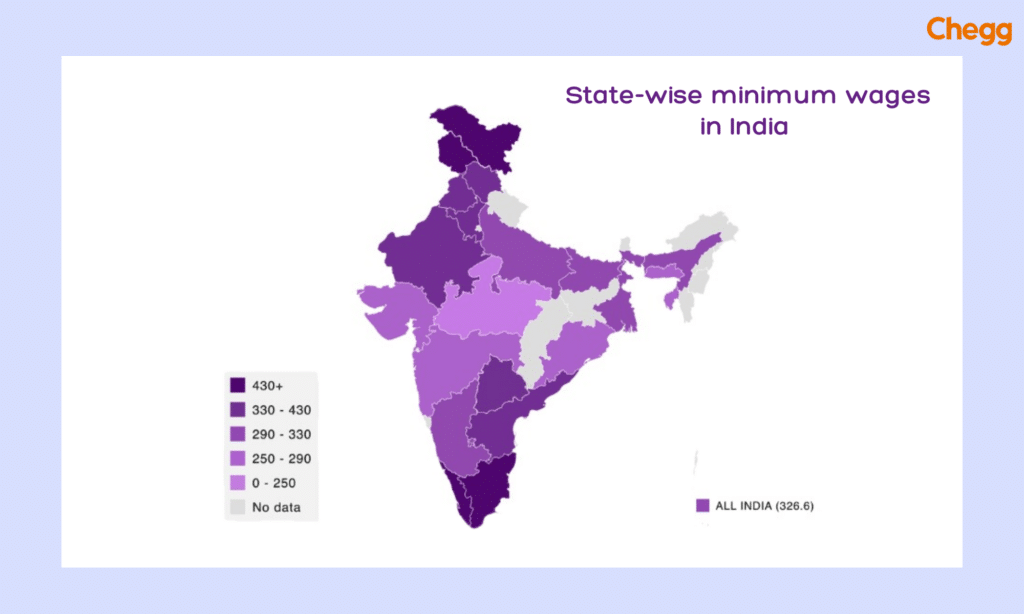

Currently, there are regional differences in India’s minimum wage environment. Andhra Pradesh, Kerala, and Gujarat have the lowest wages. These modifications highlight how flexible the Act is to the various economic settings found in different states.

The modified law’s awareness of the particular difficulties experienced by employees with disabilities is a commendable feature. To remedy this, the law raises the minimum wage for this group, in line with social justice and inclusion ideals.

The Act’s core consultation process necessitates government interaction with a committee of representatives directly affected by minimum wage decisions. This committee is crucial in setting the minimum wage since it considers work type, location, and skill level.

The government is subject to a tight deadline after the committee decides on the minimum wage. The established rate has to be enforced and published in official periodicals within three months to implement the decision quickly.

A fundamental component of the Minimum Wage Act is transparency. The government must publish the decision in a national daily to notify those impacted by the proposed minimum wage. Guaranteeing that stakeholders actively participate in the decision-making process promotes transparency and instills a sense of awareness and ownership.

The Act includes strict measures to strengthen compliance. When wages are not paid, the relevant authority has to make the necessary corrections as soon as possible. The fine is severe, though—ten times the difference between the actual pay and the minimum wage—if there is a delay or carelessness. This clause is a disincentive, emphasizing the importance of following the established minimum pay rates.

The Minimum Wage Act of 1948 serves as a strong defense for the rights and dignity of workers in India. It has been modified and adjusted in response to shifting economic circumstances.

Here’s a rewritten version of how minimum wages are calculated, free of plagiarism:

The minimum wage you see advertised isn’t the whole picture. Here’s what goes into calculating it:

These factors combine to determine the minimum wage an employee should receive.

Other Allowances

Employers may offer additional allowances, such as for transportation, overtime, and bonuses, which are designed to further support employees and incentivize performance or long hours.

2. Regional Variations

Minimum wage rates differ across states and regions in India due to the diverse cost of living. Urban areas generally have higher rates than rural regions to account for the higher living expenses in cities.

3. Skill-Based Wage Differentiation

Wages are also influenced by the skill level required for a particular job. Skilled labor, such as engineers or technicians, often earns a higher wage than unskilled or semi-skilled workers, even though all are guaranteed a minimum wage by law.

4. Sector-Specific Variations

The minimum wage can also differ based on the type of industry. For example, agricultural workers may have different wage rates compared to industrial or service sector employees, due to the nature and challenges of the work.

5. Overtime Pay

If workers exceed the regular working hours, they are entitled to overtime compensation. The minimum wage law ensures that workers receive fair pay for extra hours worked, typically at a higher rate than the standard wage.

6. Periodic Revisions

To keep up with the changing economic conditions, the Minimum Wages Act 1948 rates are reviewed periodically by the government. These reviews consider inflation, economic growth, and cost-of-living adjustments to ensure workers’ wages remain adequate.

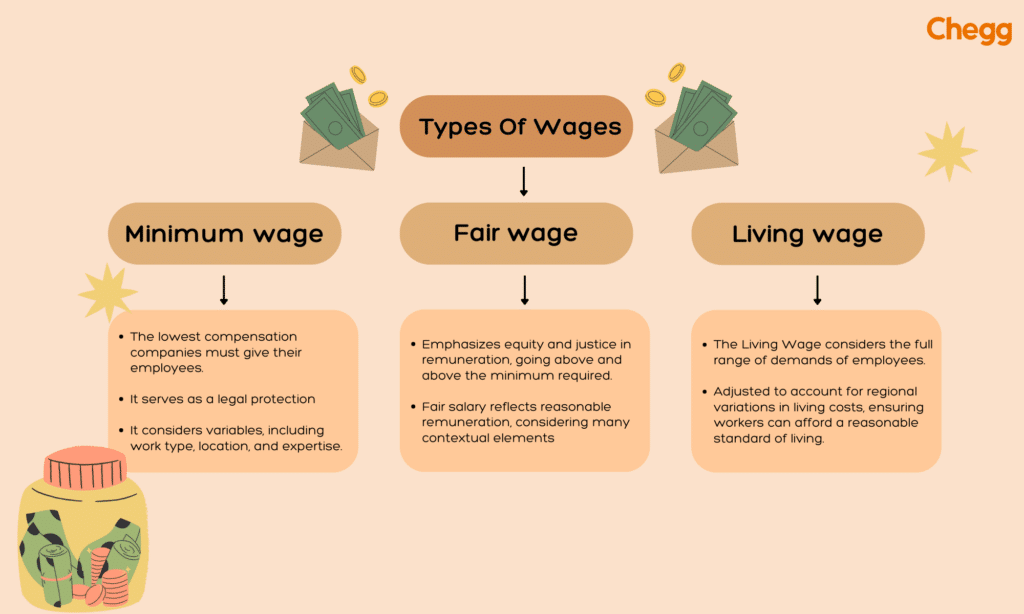

Different salary kinds control the compensation landscape in the Indian job market; each has a specific function related to the welfare of employees. This section examines the different types of wages.

The Minimum Wage establishes the lowest compensation companies must give their employees. It serves as a legal protection. This minimum wage in India is based on social justice principles and is a financial metric. Its goals are to stop worker exploitation and guarantee that all workers are paid enough to cover their basic requirements. It is a starting point and considers variables, including work type, location, and expertise.

A fair wage emphasizes equity and justice in remuneration, going above and above the minimum required. It tries to balance employers’ and employees’ financial interests. This salary type fosters a positive working connection between employers and employees by recognizing the employee’s abilities, output, and contributions. A fair salary reflects reasonable remuneration, considering many contextual elements, even though it may be more than the minimum wage.

The Living Wage considers the full range of demands of employees, striving to offer a quality of living that encompasses comfort, healthcare, education, and fundamental needs. It recognizes the more expansive facets of a life worthy of dignity beyond just sustenance. The living wage in India is adjusted to account for regional variations in living costs, ensuring workers can afford a reasonable standard of living.

A relevant minimum wage in India is crucial in balancing social fairness and economic development. The dual lens of economic and social aims highlights it. Beyond only being a legal obligation, it has evolved into a moral necessity that shows a dedication to the welfare of the workers.

A meaningful minimum wage is essential to accomplishing important goals in the complex economic fabric of India. Employers may stop labor exploitation by establishing a pay floor that guarantees workers a salary aligned with their cost of living. This financial safety net helps increase output because well-paid employees are more likely to be driven and invested in their jobs.

The demand for a decent minimum wage is firmly anchored in social goals independent of economic ones. India’s varied socio-cultural environment needs a pay system that considers employees’ fundamental necessities and upholds the dignity of labor. A significant minimum wage prevents the exploitation of those working in low-skilled or unorganized industries and works as a social safety net for society’s most vulnerable members.

Fixing wage rates (time, piece, guaranteed time, additional time) for any industry is made possible by the Minimum Wage Act of 1948.

Also Read:-

The Information Technology Act 2000

Contingency Fund of India Act 1950 – Type, Meaning, Difference.

Right to Education Act 2009: RTE Main Fеaturеs & Provisions

The Factories Act 1948: Powerfully Transforming Workplaces

Section 7 of the Act establishes the Advisory Board. The Advisory Board, appointed by the relevant government, coordinates the committees and subcommittees established under Section 5 of the Act and advises the appropriate government on setting and amending the minimum wages for Scheduled Employment. Section 8 of the Act provides for the establishment of a Central Advisory Board (CAB).

The Central Government will choose the members of the CAB. The members will consist of independent members selected by the Central Government and an equal number of representatives from both the employer and employee groups. The CAB Chairman will be a non-voting member. The Advisory Board’s coordination and other Act-related matters fall within the purview of the CAB’s work.

The Minimum Wages Act of 1948 establishes the minimum hourly or daily wages for various occupations across India. Here’s a breakdown:

Challenges and Debates of Minimum Wages Act 1948:

This section establishes the Minimum Wages Act 1948 as the official name and specifies the geographic area to which the Act is applicable.

To ensure that everyone knows the Act’s contents, it defines essential terminology used throughout.

This provision gives authorities the authority to set minimum wage rates, which is essential in preventing exploitation and guaranteeing equitable recompense.

It lays forth the accurate minimum pay rates, which provide the basis for equitable remuneration in various industries.

This section provides a precise and systematic framework for setting and amending minimum wages.

The 1957 Amendment removed this provision, which dealt with the establishment and duties of advisory bodies.

This section introduces the idea of an advisory board, a consultative body that influences decisions about the minimum wage.

Similar to the Advisory Board, it establishes a Central Advisory Board, emphasizing a central-level consultative mechanism.

This section describes the organization and makeup of the committees tasked with setting and adjusting the minimum wage.

It allows authorities to correct mistakes made when setting or updating the minimum wage, guaranteeing accuracy.

It addresses non-cash compensation by including provisions for wages given in kind as a component of total payment.

It emphasizes employer responsibility by requiring the minimum rate of wages to be paid on time and in full.

It lays down standards for regular working days, guaranteeing workers fair hours.

Addressing overtime, Section 14 sets guidelines for compensating workers for hours worked beyond the typical working day.

This section addresses pay for employees who work for shorter than typical work days.

It outlines the approach to determining wages when a worker performs two or more work classes.

Section 17 sets minimum time rate earnings for work arrangements that involve pieces of labor.

Employers are required under Section 18 to keep correct registers and records about pay and employment.

It gives inspectors the authority to ensure that the Act is followed by conducting inspections and investigations as necessary.

Detailing the process for workers to claim their rightful wages, this section provides a mechanism for addressing disputes.

This section simplifies the claims procedure by enabling one application to cover several employees.

Section 22 establishes penalties for specific offenses, deterring violations of the Act.

Section 23 describes the circumstances under which employers may be excluded from liability under particular circumstances.

This clause prohibits filing lawsuits in cases covered by the Act, urging parties to use the Act’s procedures to resolve their differences.

To provide statutory Protection, it forbids contracts that permit parties to opt out of the Act’s obligations.

This section outlines the circumstances in which exemptions and exceptions may be applicable. In some cases, it offers flexibility.

Section 27 empowers State Governments to augment the Schedule, allowing for contextual adjustments.

This provision gives the Central Government the power to issue directives for the efficient execution of the Act.

Section 29 gives the Central Government the authority to create rules that complement the Act’s provisions.

Similar to Section 29, Section 30 grants the appropriate government the authority to establish rules for effective implementation.

The last section, Section 31, gives legal support to the conclusions made regarding the fixation of specific minimum pay rates.

This in-depth analysis of the Minimum Wages Act 1948 shows its complex provisions. It illuminates the broad framework it represents for defending the rights and welfare of workers in various industries in India.

The Minimum Wages Act, of 1948, discourages frivolous claims and ensures employee rights by outlining penalties:

The Act ensures both a deterrent against unfair employer practices and a mechanism for recouping lost wages for employees.

The Minimum Wages Act of 1948 acts as a safety net for Indian workers. It sets minimum hourly or daily wages for various occupations across the country, ensuring a baseline level of income. Both the central and state governments have the power to fix and revise these minimum wages, considering factors like cost of living, skill level, and local conditions. Industry-specific tripartite wage boards also play a crucial role in recommending wages for their sectors.

The Minimum Wages Act 1948 emphasizes regular reviews, ideally every five years, to keep pace with changing economic realities. Additionally, the Minimum Wages Act 1948 mandates a dearness allowance review every two years to adjust for inflation and ensure the minimum wage retains its purchasing power. These provisions of the Minimum Wages Act 1948 are crucial for maintaining fairness in wages.

To enforce fair labor practices, the Act prescribes penalties for employers who underpay their workers or violate wage orders. These penalties can range from fines to imprisonment. However, the Act doesn’t stop there. Underpaid workers can claim compensation for the difference between the minimum wage they were entitled to and the actual wage they received.

The Minimum Wages Act plays a significant role in preventing exploitation and promoting decent living standards for low-income workers and their families. While challenges like ensuring transparency in wage fixation and tackling underpayment practices persist, the Act remains a cornerstone for fair labor practices in India.

The Minimum Wages Act 1948 of India is essential for protecting the rights and welfare of its labor force. The Minimum Wages Act 1948 addresses economic inequality and promotes social justice at the same time. To ensure just compensation, improve lives, and foster a vibrant, fair labor market, it is imperative to make regular adjustments, execute policies effectively, and raise awareness about the Minimum Wages Act 1948.

By establishing minimum wages, the legislation seeks to provide equitable recompense for workers, eliminate economic inequities, and promote social justice in the workplace.

Minimum wage laws are subject to frequent adjustments. State governments are usually responsible for reviewing and updating minimum wage laws to reflect changes in the economy.

The legislation applies to all workers and employees in scheduled employment designated by the relevant government, regardless of the type of employment—skilled or unskilled.

No, employers must pay salaries that meet or exceed the minimum amounts stipulated in the Minimum Salaries Act. A payment that is less than the stipulated amount is illegal.

Workers can consult the official announcements made by the corresponding state governments, which include the minimum pay rates for various types of labor. If in doubt, they can also consult labor authorities or unions for advice.

India’s national floor-level minimum wage is INR 178 per day or INR 5,340 per month. The Minimum Wages Act, introduced in 1948, granted specific powers to the Central and State Governments regarding wage regulation.

The Minimum Wages Act, 1948, is a law enacted in India to ensure that workers receive fair wages for their labor, preventing exploitation by setting a legal minimum wage.

Wages are typically reviewed and revised every five years, but the government can revise them sooner to adjust for inflation or changing economic conditions.

Authored by, Amay Mathur | Senior Editor

Amay Mathur is a business news reporter at Chegg.com. He previously worked for PCMag, Business Insider, The Messenger, and ZDNET as a reporter and copyeditor. His areas of coverage encompass tech, business, strategy, finance, and even space. He is a Columbia University graduate.

Editor's Recommendations

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.