What is Fixed Cost? - Definition, Calculation, Examples, and Importance in 2025

Quick Summary

- Definition: Fixed costs are business expenses that remain constant regardless of production or sales, such as rent, salaries, and insurance.

- Calculation: Fixed costs are calculated by identifying all non-variable expenses over a specific period, helping businesses manage budgets efficiently.

- Examples: Common fixed costs include office rent, employee salaries, loan payments, and depreciation of equipment.

- Importance in 2025: Understanding fixed costs is crucial for financial planning, profit analysis, and making informed business decisions in a dynamic economy.

Table of Contents

Introduction

In the world of business and finance, understanding costs is crucial for managing budgets, setting prices, and achieving profitability. One of the key concepts in cost management is the idea of fixed cost. But what is fixed cost?

A fixed cost is an expense that does not change regardless of the level of production or sales. These costs remain constant over a while, even if a company produces more or fewer goods. Examples include rent, salaries, insurance, and loan payments, which must be paid regularly, no matter the business activity.

This article will provide a detailed and easy-to-understand explanation, making it simple for anyone to grasp the concept.

Definition of Fixed Cost

What is Fixed Cost? Fixed cost refers to the expenses a business incurs that do not change regardless of the level of production or sales. These costs remain constant whether a company produces 1 unit or 10,000 units.

For example:

- Rent for office space

- Salaries of permanent employees

- Insurance premiums

These expenses do not fluctuate with the company’s production or sales volumes.

In simple terms, fixed costs are the predictable, steady expenses that businesses must pay, no matter how much they produce or sell.

Characteristics of Fixed Costs

Understanding what is fixed cost is essential for managing business finances effectively. Fixed costs are expenses that do not change regardless of how much a company produces or sells in the short term. These costs are a crucial part of business operations and play a key role in financial planning.

1. Constant in Nature

Fixed costs remain the same even if there is a significant change in production levels. Whether a company manufactures 100 units or 1,000 units, these expenses typically stay unchanged in the short run. For example, rent for office space or salaries of permanent staff will not fluctuate based on output.

2. Unrelated to Output Levels

A defining feature of fixed costs is that they are independent of how much is produced or sold. Even if the production output drops to zero, businesses must still bear these costs. For instance, equipment maintenance contracts need payment regardless of production activity.

3. Stable Over a Specific Period

While fixed costs do not change in the short term, they can be subject to revisions over time. Rent agreements, for example, may be renegotiated annually, leading to an increase or decrease. However, within the agreed period, these costs typically remain stable.

4. Essential for Business Operations

Fixed costs often represent critical expenses that allow a business to function smoothly. Examples include utilities, insurance, and salaries for administrative staff. These costs form the foundation of operational continuity, irrespective of production levels.

5. Predictable and Budget-Friendly

One of the benefits of fixed costs is their predictability. Businesses can budget these expenses accurately, which aids in financial planning and forecasting. Knowing what is fixed cost helps companies assess their breakeven point and make better operational decisions.

By understanding the characteristics of fixed costs, businesses can better manage their resources, optimize spending, and achieve long-term growth while maintaining essential operations.

Examples of Fixed Costs

To fully understand what is fixed cost, it helps to look at fixed cost examples. Fixed costs are those expenses that remain constant, regardless of how much a business produces or sells. These costs are unavoidable and necessary for maintaining the basic operations of any company.

1. Office Rent

A business pays rent for its office or manufacturing space regardless of the level of activity happening inside. Even if the office is temporarily closed or production slows down, the rent remains unchanged. This predictable monthly or yearly payment makes rent a classic example of a fixed cost.

2. Employee Salaries

Salaries paid to full-time staff are another common fixed cost. These employees receive a set amount each month, no matter how many products are manufactured or sold. For instance, the salary of an HR manager will stay the same, even if the company experiences a dip in sales.

3. Insurance Premiums

Businesses often purchase insurance policies to protect against potential risks such as theft, accidents, or natural disasters. The premiums for these insurance policies are fixed and must be paid regularly, regardless of the company’s production levels or profitability.

4. Depreciation of Assets

Depreciation is the gradual reduction in the value of assets such as machinery, vehicles, and office equipment over time. Although depreciation is a non-cash expense, it is treated as a fixed cost because it remains consistent and predictable throughout the asset’s lifespan.

5. Utility Bills (Basic Charges)

Utility bills, such as electricity and water, often have fixed basic charges that must be paid regardless of consumption. Even if the business uses minimal electricity or shuts down temporarily, these minimum charges still apply.

By understanding these examples, it becomes clear what is fixed cost and how these expenses impact business finances. Properly managing fixed costs allows companies to predict their financial obligations and make informed decisions to achieve profitability.

How to Calculate Fixed Costs

What is fixed cost and how to calculate it is essential for managing business expenses and planning budgets effectively. Fixed costs are the expenses that do not change regardless of the production level or sales volume of a business. Follow these simple steps to calculate fixed costs accurately:

Step 1: List All Expenses

Start by identifying all the expenses your business incurs within a specific period (monthly, quarterly, or yearly). These expenses typically fall under categories like rent, salaries, insurance, raw materials, and utility bills.

Step 2: Separate Fixed and Variable Costs

Once you’ve listed your expenses, classify them into two categories:

- Fixed Costs: Expenses that remain constant, such as office rent, employee salaries, and insurance premiums.

- Variable Costs: Costs that fluctuate with the level of production, like raw materials, packaging, and shipping fees.

For example:

- Rent of ₹15,000 per month is a fixed cost because it remains unchanged regardless of sales volume.

- The expense for raw materials may vary depending on production levels, so it is considered a variable cost.

Related Read – What Is Variable Pay in CTC: Do Incentives Matter?

Step 3: Add Up Fixed Expenses

Now, sum up all the expenses identified as fixed. This total represents your business’s fixed cost.

Example Calculation:

Let’s say the following are your business expenses for a month:

- Office Rent: ₹15,000

- Insurance Premium: ₹5,000

- Employee Salaries: ₹25,000

The total fixed cost would be:

₹15,000 + ₹5,000 + ₹25,000 = ₹45,000

Step 4: Use the Fixed Cost Formula

Another way to calculate fixed costs is by using the formula:

Fixed Cost = Total Cost − Total Variable Cost

Example Calculation Using the Formula:

Suppose a company’s total cost for a month is ₹80,000, and the total variable cost is ₹35,000.To calculate the fixed cost:

Fixed Cost = 80,000 − 35,000

Fixed Cost = ₹45,000

This means the fixed cost for this business is ₹45,000.

By understanding what is fixed cost and knowing how to calculate it, businesses can better predict financial obligations, set pricing strategies, and manage overall profitability more effectively.

Fixed Cost vs. Variable Cost

It is important to understand the difference between fixed costs and variable costs.

| Aspect | Fixed Cost | Variable Cost |

|---|---|---|

| Definition | Costs that do not change with production levels | Costs that change with production levels |

| Examples | Rent, salaries, insurance | Raw materials, packaging, shipping |

| Dependence on Output | No | Yes |

| Time Stability | Stable over time | Fluctuates |

Example for Clarity:

- If a bakery rents a shop for ₹10,000 per month (fixed cost), this amount stays the same whether they bake 100 or 1,000 cakes.

- However, the cost of flour (variable cost) increases as more cakes are baked.

Importance of Fixed Costs in Business

Fixed costs are expenses that remain constant regardless of production levels or sales volume. They play a significant role in business operations and decision-making processes. Let’s explore why they are important:

1. Budget Planning

Fixed costs provide a stable foundation for creating accurate budgets. Since these expenses remain unchanged over a specific period, businesses can forecast their financial obligations and allocate funds effectively.

Example:

A company renting an office space for ₹50,000 per month knows this amount won’t change regardless of production. This predictability allows them to plan other expenses more accurately.

2. Pricing Strategy

When setting prices for products or services, businesses must ensure that both fixed and variable costs are covered to maintain profitability.

Why it Matters:

If a business doesn’t account for fixed costs when pricing its products, it may suffer financial losses even if sales volumes are high.

Example:

If manufacturing a product costs ₹500 in variable expenses and the business has a fixed cost of ₹1,00,000, the product pricing must be set high enough to recover these fixed expenses over time.

3. Profitability Analysis

Knowing what is fixed cost helps businesses calculate their break-even point—the point where total revenue equals total costs, including both fixed and variable expenses.

Why it Matters:

This analysis helps determine how much a company needs to sell to start making profits.

Example:

If a company incurs ₹2,00,000 in fixed costs, it must generate sales that cover this amount before any profit is realized.

4. Financial Stability

Effective management of fixed costs can help ensure a business remains financially stable, even during periods of low sales.

Why it Matters:

High fixed costs can strain a business if revenue fluctuates. Businesses with controlled fixed costs are better equipped to handle market uncertainties.

Example:

During an economic downturn, a company with lower fixed costs may survive better than one with high fixed obligations.

By managing fixed costs businesses can maintain better control over their finances, set competitive prices, and achieve long-term financial stability.

Break-Even Analysis Using Fixed Costs

The break-even point is when a company’s revenue equals its total expenses, resulting in no profit and no loss. It helps businesses understand how many units they need to sell to start generating profits.

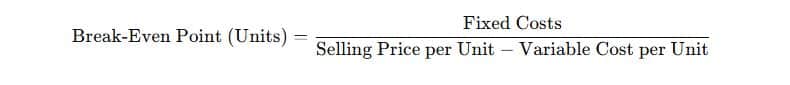

Break-Even Formula

The formula for calculating the break-even point is:

Break-Even Point (Units) = ( Fixed Costs / Selling Price per Unit − Variable Cost per Unit )

Explanation of Terms:

- Fixed Costs: These are expenses that remain constant, such as rent, salaries, or insurance, regardless of how many products a business sells.

- Selling Price per Unit: The price at which a single unit of the product is sold.

- Variable Cost per Unit: The cost incurred to produce or sell each additional unit, such as raw materials or shipping expenses.

Example Calculation:

Let’s break it down step by step for better understanding:

- Fixed Costs = ₹50,000

- Selling Price per Unit = ₹200

- Variable Cost per Unit = ₹100

Step 1: Subtract Variable Costs from Selling Price:

200 − 100 = 100

This means each unit sold contributes ₹100 toward covering fixed costs.

Step 2: Divide Fixed Costs by the Contribution Margin:

50,000 / 100 = 500

Result:

The business must sell 500 units to break even.

Why is this Important?

- Financial Planning: Knowing the break-even point helps businesses plan sales targets and set realistic goals.

- Risk Management: By understanding what is fixed cost and calculating the break-even point, businesses can better assess risks during periods of fluctuating demand.

- Profit Strategy: After reaching the break-even point, every additional sale contributes directly to profit.

Mastering break-even analysis, businesses gain a valuable tool for managing expenses and achieving profitability.

Understanding Operating Leverage

Operating leverage is an important financial concept that helps businesses understand how fixed and variable costs impact their profitability. It measures how efficiently a company can increase profits by producing and selling more units.

When a company has high operating leverage, it means that a large portion of its costs are fixed. This allows it to generate more profit per additional unit sold. On the other hand, low operating leverage means that most costs are variable, making it harder to boost profits significantly with higher sales.

Formula for Operating Leverage

Operating leverage can be calculated using the formula:

Operating Leverage = Q×(P−V)(Q×(P−V))−FOperating \, Leverage = \frac{Q \times (P – V)}{(Q \times (P – V)) – F}

Where:

- Q = Number of units produced

- P = Price per unit

- V = Variable cost per unit

- F = Fixed costs

Key Characteristics of Operating Leverage

- Higher Fixed Costs Increase Leverage – A company with higher fixed costs has greater operating leverage.

- Profitability Grows with Sales – The more units sold, the more profit is generated due to lower per-unit costs.

- Greater Risk and Reward – High operating leverage can lead to higher profits in good times but also greater losses if sales decline.

- Impact on Break-even Point – Companies with high operating leverage need to sell more units to cover fixed costs before making a profit.

- Industry-Specific Variations – Capital-intensive industries (e.g., manufacturing) usually have higher operating leverage compared to service-based businesses.

Why is Operating Leverage Important?

- Helps in Decision-Making – Companies use it to decide whether to invest in automation or hire more workers.

- Affects Pricing Strategies – Knowing leverage helps in setting competitive prices while maintaining profitability.

- Measures Financial Risk – Higher leverage means higher potential profit but also greater risk in downturns.

- Guides Business Expansion – Helps businesses assess whether increasing production will be cost-effective.

- Influences Investor Confidence – Investors analyze operating leverage to evaluate a company’s financial health and growth potential.

Understanding operating leverage is essential for businesses looking to optimize costs, maximize profits, and stay competitive in the market.

Real-Life Applications of Fixed Costs

Understanding what is fixed cost isn’t just for textbooks—it affects our daily lives! Let’s explore how fixed costs work in real-world Indian scenarios, from your home to local businesses

1. Fixed Costs in Everyday Life

A. For Families

Imagine your family’s monthly budget:

- Rent/Housing EMI: ₹18,000/month for your 2BHK flat in Bangalore. Whether you use all rooms or not, this cost stays the same.

- Internet Bill: ₹799/month for a Wi-Fi plan. Even if you don’t stream movies for a week, the bill won’t change.

Why it matters: Fixed costs help families plan savings. For example, if your parents know rent is ₹18,000, they’ll set aside that money first.

B. For Students

- School Bus Fees: ₹1,500/month. Whether you take the bus 20 days or skip it for 5 days, the fee remains the same.

- Tuition Fees: ₹2,000/month for math classes. Even if you miss a class, the fee doesn’t drop.

Fun Fact: Your monthly pocket money isn’t a fixed cost—it’s a variable cost because parents might reduce it if you forget chores!

2. Fixed Costs for Small Indian Businesses

A. Example: A Mumbai Kirana Store

- Monthly Rent: ₹12,000 for the shop space.

- Staff Salary: ₹15,000/month for the helper.

- Licenses: ₹2,000/year for a shop license.

Application: The owner knows he must earn at least ₹27,000/month (rent + salary) just to cover fixed costs. Only after that can he make a profit

B. Example: A Home-Based Tiffin Service in Delhi

- Gas Cylinder Subscription: ₹1,000/month (fixed cost, even if fewer tiffins are made).

- Delivery Bike EMI: ₹3,500/month.

Challenge: During holidays, orders drop, but fixed costs stay the same. The owner might offer discounts to attract customers and cover these costs.

3. Fixed Costs in Schools & Colleges

Your school has fixed costs too!

- Teacher Salaries: Paid monthly, regardless of student attendance.

- Building Maintenance: ₹50,000/year for repairs.

What is fixed cost’s role here? Schools must collect fees to cover these expenses, even during summer breaks.

4. Farmers & Fixed Costs

Indian farmers face fixed costs like:

- Tractor Loan EMI: ₹10,000/month.

- Land Lease: ₹1 lakh/year for renting farmland.

Problem: If crops fail due to droughts, farmers still pay these fixed costs. This is why farming can be risky.

Pro Tip: Fixed costs are like your phone’s monthly plan—predictable but unavoidable. Plan for them wisely!

Now you know what is fixed cost and how it applies to real life! Whether it’s your home Wi-Fi bill or a farmer’s tractor loan, fixed costs are everywhere. By understanding them, you can make smarter money decisions—just like a pro!

Tips to Manage Fixed Costs Effectively

Now that you understand what is fixed cost, let’s learn how to manage these expenses smartly. Whether you’re a student, a family, or a business owner, these tips will help you save money and avoid stress!

1. Negotiate Rent or Contracts

Fixed costs like rent or internet bills can sometimes be reduced with a little effort.

- Example for Students: If your hostel fee is too high, ask if there’s a cheaper shared room option.

- Example for Businesses: A Delhi bakery owner saved ₹5,000/month by politely asking their landlord for a rent discount during slow seasons.

Pro Tip: Long-term contracts (like 2-year internet plans) often have lower monthly rates than short-term ones.

2. Switch to Cost-Effective Tools

Replace expensive fixed costs with cheaper alternatives.

- For Families: Use a ₹299/month prepaid mobile plan instead of a ₹599 postpaid plan.

- For Businesses: A Mumbai startup replaced its ₹8,000/month office landline with WhatsApp calls (saving ₹7,500/month).

Remember: Always calculate total savings before switching.

3. Share Resources with Others

Split fixed costs to reduce your burden.

- Students: Share a ₹1,200/month Wi-Fi plan with your neighbor (pay ₹600 each).

- Businesses: A Bangalore gift shop shares its ₹20,000/month store space with a coffee stall. Both split the rent!

Bonus Idea: Use co-working spaces to avoid high office rents.

4. Track Your Fixed Costs Monthly

Write down all fixed costs in a simple table. This helps you:

- Avoid surprises (e.g., “Oh no, my insurance renewal is due!”).

- Plan your budget better.

Example for Families:

| Fixed Cost | Amount (₹) |

|---|---|

| Rent | 15,000 |

| School Bus Fees | 1,500 |

| Electricity Bill | 2,000 |

Pro Tip: Use free apps like Moneycontrol or Excel to track expenses.

5. Plan for Emergencies

Fixed costs don’t stop during tough times. Save money in advance to cover them.

- Example: A Chennai family saves ₹1,000/month in a “fixed cost emergency fund” for unexpected rent hikes.

Golden Rule: Save at least 10% of your income for fixed costs.

Warning: Don’t Cut Essential Fixed Costs!

Some fixed costs are necessary for safety or quality. For example:

- A Pune factory shouldn’t reduce fire insurance (₹3,000/month) to save money.

- Students shouldn’t skip health checkups (₹500/month) to cut costs.

Managing what is fixed cost is like planning your school timetable—know what’s coming, prepare for it, and avoid last-minute panic! By negotiating, sharing, and tracking expenses, you can control fixed costs instead of letting them control you.

Action Step: List your fixed costs today and see where you can save!

Conclusion

Understanding what is fixed costs and how it impacts business operations is essential for financial success. By knowing how to identify, calculate, and manage fixed costs, businesses can make informed decisions, improve profitability, and achieve long-term stability. Whether you are a student, entrepreneur, or financial professional, mastering this concept will benefit you in many ways.

Innovative, low-investment ideas for the hidden entrepreneur in you! Explore our guide on Business Ideas.

Here are some useful resources:

- CPM Full Form: Cost Per Mille, Definition and its role in marketing

- Maximizing Your Earnings: Negotiate Beyond Your Current CTC

- NPCIL Recruitment 2024: Latest News, Date, Eligibility, Salary & Vacancies

Frequently Asked Questions (FAQs)

Q1. What do you mean by fixed cost?

A fixed cost is an expense that does not change with the level of production or sales. Examples include rent, salaries, and insurance premiums.

Q2. What is variable cost?

Variable cost is an expense that changes directly with the level of production or sales. Examples include raw materials and labor costs.

Q3. What describes a fixed cost?

A fixed cost is described as an expense that remains constant regardless of the amount of goods or services produced. It’s a predictable and stable expense.

Q4. What is fixed price and cost price?

Fixed price is a set price that does not change, while cost price is the amount it costs to produce or purchase an item.

Q5. Do salaries come under fixed cost?

Companies consider salaries a fixed cost. Employees receive the same pay regardless of the company’s performance.

Q6. What makes up the total fixed cost?

Total fixed costs are the total of a company’s continuous, non-variable expenditures. Assume a corporation pays $10,000 per month for office space, $5,000 per month for machines and $1,000 per month for utilities. In this example, the total fixed expenses for the firm would be $16,000.

Q7. What do business fixed costs include?

Fixed costs remain constant regardless of changes in production volume. These expenses are time-dependent rather than dependent on the quantity of goods or services produced or sold by your company. Examples include rent, leasing charges, salaries, insurance premiums, and loan repayments.

Q8. What is fixed cost in economics?

In economics, a fixed cost is a cost that does not vary with the level of output. Examples include rent and salaries.

Q9. What is fixed cost and variable cost?

Fixed cost is an expense that stays the same regardless of production levels, like rent. Variable cost changes with production levels, like raw materials.

Q10. What is fixed cost in cost accounting?

In cost accounting, a fixed cost is an expense that does not change with the level of production or sales, such as rent or salaries.

Q11. Fixed and variable costs examples?

Fixed costs: rent, salaries. Variable costs: raw materials, labor.

Q12. What is fixed cost formula?

The fixed cost formula is: Fixed Costs = Total Costs – Variable Costs.

Q13. What is fixed cost in accounting?

In accounting, fixed cost refers to expenses that remain constant regardless of production or sales levels, such as rent and salaries.

Q14. What is fixed cost in business?

In business, fixed cost is an expense that does not change with the level of production or sales. Examples include rent, insurance, and salaries.

To read more related articles, click here.

Got a question on this topic?