Quick Summary

Becoming a Chartered Accountant (CA) is a significant achievement, opening the door to countless opportunities. However, many new CAs in India wonder, “What to do after CA?” The answer depends on your interests, goals, and willingness to explore different career paths. In this article, we will guide you step-by-step through the options available after completing your CA. Whether looking for high-paying jobs, further education, or starting your practice, this guide covers you.

After completing the Chartered Accountancy (CA) course, professionals have a wide range of career options. They can choose to start their own practice, join an established CA firm, pursue higher studies, or explore opportunities in areas like corporate finance, investment banking, and risk management.

After clearing all three levels of CA-CPT/CA Foundation, IPCC/CA Intermediate, and CA Final-you might feel overwhelmed with choices. The keyword question, “What to do after CA?” often involves understanding what aligns best with your skills and aspirations. Let’s break down the primary paths you can consider:

The most common route after becoming a CA is entering the workforce. CAs are in high demand in several industries due to their accounting, taxation, auditing, and financial management expertise.

Additional certifications can be beneficial if you want to specialize further or explore global opportunities. Courses like CPA (Certified Public Accountant), CFA (Chartered Financial Analyst), or an MBA can add value to your resume.

Many CAs dream of being their boss. If you’re wondering “What to do after CA?” and aspire to work independently, starting a practice could be the answer. This involves registering with ICAI, building a client base, and managing your business operations.

Now that you understand the general options let’s explore the career paths you can pursue after completing your CA.

| Career Options | Skills Required | Average Salary (in INR) |

| Internal Audit | • Knowledge of Accounting Principles • Knowledge of Finance • Risk management • Analytical skills • Communication skills | 6.1 LPA |

| Tax Audit | • Knowledge of Tax Laws and Regulations • Analytical and Problem-Solving Skills • Attention to Detail | 5 LPA |

| Banking and Insurance | • Financial literacy • Sales skills • Technological proficiency • Adaptability • Ethical behavior | 2 LPA |

| Teach Accountancy | • Understanding of Accountancy Principles • Patience and empathy • Adaptability and flexibility • Technological proficiency | 4.6 LPA |

| Forensic Auditing | • Knowledge of Accounting and Auditing Principles • Analytical skills • Knowledge of Forensic Tools and Techniques • Communication skills • Attention to detail | 6.5 LPA |

| Consultancy | • Project Management Skills Industry Knowledge • Communication Skills • Analytical Skills • Problem-Solving Skills | 9 LPA |

| Civil Services | • Leadership skills • Adaptability and flexibility • Communication Skills • Integrity and Ethics | Based On Job Designation |

| Investment Banking | • Financial analysis • Attention to detail • Time management • Technical skills • Communication | 9 LPA |

| Writing and Authoring | • Writing Skills • Creativity • Research Skills • Editing and Proofreading • Marketing and Promotion | 4 LPA |

| Financial Manager | • Risk management • Strategic thinking • Analytical skills • Communication skills • Attention to detail | 10 LPA |

| Risk Manager | • Risk Assessment • Analytical Skills • Decision-making Skills • Regulatory Knowledge • Communication Skills | 11.5 LPA |

| Entrepreneur | • Leadership • Creativity • Financial management • Risk-taking Skills • Networking | 9.7 LPA |

Internal audit would be at the top when looking up career options after CA Internal Audit. An internal auditor performs an independent, objective assessment of an organization’s financial and operational systems.

If you choose this career in CA, your primary role will be to review and evaluate the effectiveness of the internal control systems in place, identify areas of potential risk or inefficiency, and make recommendations for improvement. You will work closely with management to ensure the organization complies with relevant laws, regulations, and industry standards.

Tax auditing is another answer to your question of what to do after CA. As a tax auditor, you will be responsible for examining and reviewing financial records and tax returns of individuals, businesses, and organizations to ensure they comply with tax laws and regulations.

Your primary objective will be to identify discrepancies or errors in financial reports, investigate potential fraud or other violations of tax laws, and calculate the correct amount of taxes owed. This is one of the best jobs after ca for people who love working with taxes, calculations, and finding errors to correct.

Working in the banking and insurance sector is another of the best career opportunities after CA. As a banker, you will work in the banking industry, primarily in financial institutions such as banks, credit unions, and investment firms.

You will provide financial services to individuals, businesses, and governments, including loans, savings accounts, investment advice, and money management. You will also help clients navigate complex financial products and services and advise them on making wise financial decisions. While working as a banker/insurance person, you will get your answer to what to do after CA and will also answer the clients.

If you are searching for the answer to what to do after CA? Then, becoming an accountancy teacher might be one of the excellent career options after CA. As an accountancy teacher, you can use your CA specialization to teach students the principles and practices of accounting.

You can also guide and support students to ensure they understand the subject matter and apply their knowledge in practical situations. Effective accountancy teachers use various teaching methods, such as lectures, group discussions, and case studies, to engage students and facilitate learning. This is the best way to make a career in accounting and help the nation’s future accountants.

Forensic auditing is a specialized type of auditing that involves the investigation of financial and accounting records to identify fraud, embezzlement, or other financial misconduct. Forensic auditing is an excellent choice if you are confused about what to do after CA. As a forensic auditor, you will use various techniques, such as data analysis, interviews, and document review, to identify patterns and inconsistencies that may indicate fraudulent activity.

Forensic auditing is becoming increasingly important in today’s business world, as companies face mounting pressure to maintain transparent and ethical business practices. If you choose forensic auditing as one of the jobs after CA, you will be in a career of exciting challenges and growth.

Going into the consultancy field is another of your answers to the question of what to do after CA. You can become a financial consultant and work to advise individuals, businesses, or organizations on various financial matters, including investment strategies, tax planning, retirement planning, and risk management.

You will help your clients achieve their financial goals by assessing their current economic situation, analyzing market trends, and developing customized financial plans. You aim to provide your clients with comprehensive financial advice and help them make informed decisions about their money.

Civil Services refer to the administrative branches of government responsible for implementing and enforcing policies and laws. If you want to work in a government department and are still wondering which career options to choose after CA, you should try civil services. Civil Services Officer, you will be responsible for ensuring the smooth functioning of government and maintaining law and order.

Recruitment to these services is done through competitive exams, and candidates are selected based on merit and suitability for the role. And you will be working at the levels the government assigns you.

Investment banking is a type of financial service provided by banks and financial institutions to help companies and governments raise capital by issuing securities. Bankers act as intermediaries between issuers and investors, providing guidance and support throughout the capital-raising process. In terms of success rate, it is one of the best jobs after CA.

As an investment banker, you typically work with large clients, such as corporations, government agencies, and institutional investors, and earn revenue through fees and commissions. The investment banking industry is highly competitive and requires specialized knowledge of financial markets, complex financial instruments, and regulatory frameworks. Working in this field is the perfect answer to your question of what to do after CA, as you will apply all your CA knowledge here.

Writing can be another answer to your what to do after the CA question. It is putting words on paper or a screen to convey a message or tell a story. It can take various forms, including essays, articles, novels, poems, and scripts. Writing can be done for multiple purposes, such as to inform, persuade, entertain, or express oneself.

As an author, you can write articles, books, and newsletters related to financial tips, knowledge, and advice for people. As your writings become famous, you can make money through affiliate marketing, running ads, and collaborating with brands. It is one of the great career options after CA that you can start even from home.

The answer to what to do after CA has a range of jobs in core finance and sub-specializations. Financial management is a core job role in finance, and it is about investing company resources in a way that brings in the most returns. Financial Management also includes four other categories: Financing Decisions, Investment Decisions, Dividend Decisions, and Working Capital Decisions.

Among all other options after CA, this is a full-time position in an organization’s finance department. There is no need to pursue a separate certification or degree to work in Financial Management. All Chartered Accountants in companies’ finance departments can work in Financial Management.

This is one answer to what to do after CA that is not much different from what traditional companies do. Part of the duties of an average chartered accountant also match what the financial manager does. Financial Managers are in control of the entire company’s budget when employed.

Risk management is another job you can consider positively after pursuing a CA. It is the process of identifying, assessing, and prioritizing potential risks and then taking steps to minimize or mitigate them. It involves analyzing the likelihood and potential impact of risks, developing strategies to prevent or reduce them, and establishing a plan of action in case they occur.

Risk management enables individuals or organizations to anticipate and respond to potential threats or challenges, thereby protecting themselves from financial losses. It is an essential part of any successful business or personal endeavor and involves careful planning, strategic decision-making, and ongoing monitoring and evaluation. This field is an excellent answer to your question about what to do after the CA question. Not only is it an exciting career, but it’s also profitable.

Working for yourself is the best feeling, and entrepreneurship is the venture that gives you this feeling. If you wonder what to do after CA, you can become an entrepreneur in India. But yes, you must have some idea that can be sold as a product or service. Entrepreneurship can lead to great success, and with your financial knowledge as a CA, you can find it much easier to manage expenses and create a budget for the venture.

Recommended Read :- 10 Tips For Entrepreneurs to Become Successful

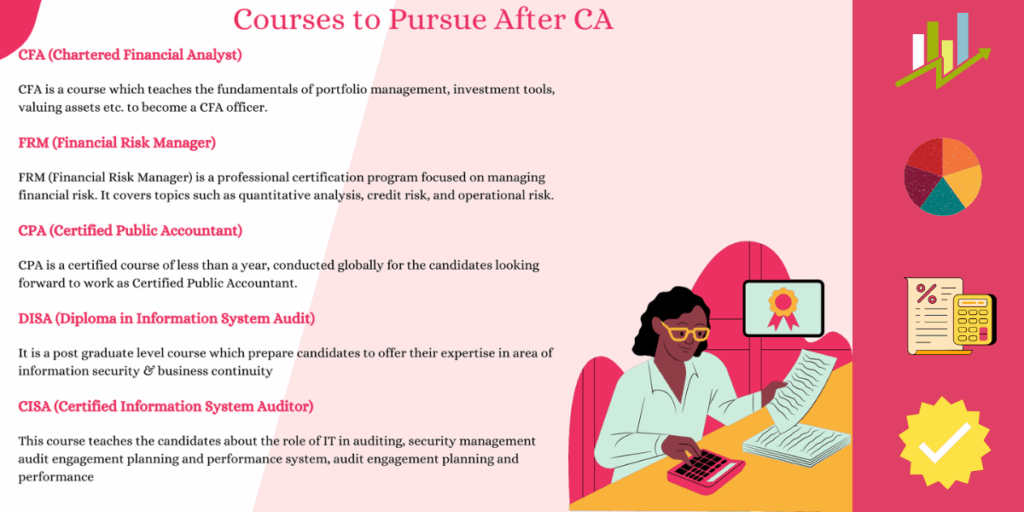

If you wonder what to do after CA and want to gain more knowledge and achieve tremendous success in your career, you can positively pursue the best course after CA. Here is a list of courses you can take after completing CA.

| Course | Description | Course Fees |

| Chartered Financial Analyst(CFA) | • The CPA exam assesses candidates’ knowledge and skills in various areas of accounting and business. • Most jurisdictions require candidates to have a bachelor’s degree from an accredited university or college. | INR 2 to 2.2 lakh |

| Financial Risk Manager(FRM) | • The FRM program is designed to enhance the skills and knowledge of risk management professionals. • To enroll in the FRM program, candidates need a bachelor’s degree or equivalent work experience. | INR 1 to 2 lakh |

| Certified Public Accountant(CPA) | • The CPA exam assesses a candidate’s knowledge and skills in various areas of accounting and business. • Most jurisdictions require candidates to have a bachelor’s degree from an accredited university or college. | INR 3.5 to 3.6 lakh |

| DISA(Diploma in Information Systems Audit) | • The DISA program typically covers various aspects of information system auditing, including risk management, cybersecurity, IT governance, and compliance. • Eligibility criteria may include having a background in information technology, information systems, or a related field. | INR 20,000 + 18% GST |

| CISA(Certified Information Systems Auditor) | • The CISA exam assesses candidates in various domains related to information systems auditing, control, and security. • Candidates typically need at least five years of professional information systems auditing, control, or security work experience to qualify for the CISA exam. | The cost of the CISA exam is $575 is for an ISACA member and $760 for a non-member |

| ACCA (Association of Chartered Certified Accountants) | • Globally recognized accounting qualification. • Focuses on IFRS, financial reporting, and performance management. • CAs may get exemptions for several papers. | ₹2 to ₹3 lakh (based on exemptions) |

| MBA (Finance / Strategy / General Management) | • Ideal for those aiming for leadership roles. • Covers business strategy, management, marketing, and finance. • Recommended: Top B-schools like IIMs, XLRI. | ₹25 to ₹35 lakh (India), ₹50+ lakh (abroad) |

| CMA (US) – Certified Management Accountant | • Focused on cost accounting, budgeting, and internal controls. • Preferred in corporate finance and management roles. • Requires a bachelor’s degree and 2 years of work experience. | ₹1.5 to ₹2 lakh |

| LLB (Bachelor of Law) | • Useful for CAs interested in corporate law, tax litigation, or compliance. • Adds legal knowledge to your finance expertise. | ₹1 to ₹2 lakh (3-year program) |

Starting your practice is a rewarding yet challenging journey. Many people ask, “What to do after CA?” when they aspire to become entrepreneurs. Below is a step-by-step guide to help you get started:

Before practicing, ensure you’re registered with the Institute of Chartered Accountants of India (ICAI). This allows you to offer professional services legally.

Networking is crucial to growing your practice. Attend industry events, connect with small businesses, and leverage social media platforms like LinkedIn.

Expand your service offerings beyond traditional auditing and taxation to attract more clients. Consider adding services like:

Running a successful practice requires sound financial management. Keep track of your expenses, invest in tools like Tally or QuickBooks, and maintain accurate records.

Tax laws and regulations change frequently. Subscribe to newsletters, attend webinars, and take refresher courses to stay ahead.

One of the most common questions aspiring CAs ask is, “What to do after CA?” followed closely by “How much money can I make?” . Let’s look at the average salary ranges across different sectors:

| Role | Annual Salary (INR) |

| Finance Manager | 10–15 LPA |

| Tax Consultant | 8–12 LPA |

| Internal Auditor | 7–10 LPA |

| Assistant Commissioner | 12–18 LPA |

Note: Salaries vary based on location, experience, and employer type.

No matter which path you choose, specific tips will help you succeed in your post-CA journey:

These steps not only help solidify your expertise after becoming ca what to do but also pave the way for a flourishing career in the financial world.

Indian Chartered Accountants are highly regarded across the globe for their strong accounting knowledge and regulatory skills. If you’re considering a global career after completing CA, here’s how the scope of CA abroad unfolds:

| Country | Demand Highlights |

| UAE / Middle East | High demand in audit, taxation, and compliance. No additional certification needed. |

| Canada | CAs can bridge to CPA Canada through exemptions. Finance and auditing roles growing. |

| Australia | Indian CAs can transition via the CA ANZ pathway. Focus on banking and corporate finance. |

| UK | CAs often pursue ACCA or ICAEW for practice rights. Big 4 and financial services hiring. |

| Singapore | Ideal for roles in international taxation and financial management. No local certification needed. |

| USA | High-paying roles for Indian CAs with CPA USA certification. Demand in audit, internal controls. |

Completing your CA is just beginning an exciting journey filled with endless possibilities. Whether you pursue a corporate career, pursue further studies, or start your practice, remember that success comes with hard work, dedication, and continuous learning. By now, you should know “What to do after CA” and how to carve out a fulfilling career path.

We hope this guide has provided valuable insights and inspired you to take the next step confidently. If you found this article helpful, please share it with others who might benefit. Together, let’s empower career path after CA to achieve our goals!

Evaluate numerous career choices to choose the right career path for yourself. Dive into our guide on Career Advice.

Recommended Read:

The best option after CA depends on your career goals. You can pursue high-paying finance, auditing, or consulting jobs or opt for certifications like CFA, CPA, or ACCA to expand global opportunities. Entrepreneurship or starting your practice is also rewarding for ambitious Chartered Accountants.

The next step after completing CA (Chartered Accountancy) is typically to pursue further specialisation, such as obtaining additional certifications (like CPA or ACCA), gaining practical experience in a specific industry, or moving into management roles within finance or accounting.

Kumar Mangalam Birla is the richest Chartered Accountant in India. He is the chairman of the Aditya Birla Group, one of India’s largest conglomerates, and has interests in sectors such as metals, cement, telecom, and finance. He is a qualified CA with an MBA from London Business School.

A Chartered Accountant (CA) can earn ₹20 lakhs per month, but it typically comes with experience, specialization, and high-level roles. CAs in top executive positions (like CFOs), partners in Big 4 firms, or successful entrepreneurs and consultants can achieve this income level.

The average salary for a Chartered Accountant (CA) in India ranges from ₹6 lakhs to ₹12 lakhs per annum, depending on experience and location. Senior CAs or those in managerial positions can earn upwards of ₹20 lakhs per annum.

After becoming a Chartered Accountant (CA), career options include working as an auditor, tax consultant, financial analyst, CFO, or financial planner. CAs can also specialize in forensic accounting, investment banking, or corporate law. Many choose to start their firms or pursue roles in government and academia.

To get a job after becoming a Chartered Accountant (CA), build a strong professional network, attend industry events, and apply through job portals. Consider internships or articleships for experience. Additionally, tailor your resume to highlight skills in accounting, auditing, taxation, and financial management, and prepare for interviews.

Consider retaking necessary exams, exploring alternative qualifications, gaining relevant work experience, networking in your desired field, or seeking advice from a career counsellor.

Authored by, Gagandeep Khokhar

Career Guidance Expert

Gagandeep is a content writer and strategist focused on creating high-performing, SEO-driven content that bridges the gap between learners and institutions. He crafts compelling narratives across blogs, landing pages, and email campaigns to drive engagement and build trust.

Editor's Recommendations

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.