Quick Summary

Gratuity is a monetary benefit employers provide to employees as a token of gratitude for their service. In India, gratuity is governed by the Payment of Gratuity Act, 1972, and applies to organizations with ten or more employees. If you’re searching for how to calculate gratuity, this guide will walk you through everything you need to know—step by step. From understanding eligibility criteria to calculating your gratuity payout, we’ve got you covered.

Gratuity is a lump-sum payment made by an employer to an employee when they retire, resign, or are terminated after completing a minimum service period. It is a reward for long-term dedication and loyalty to the organization.

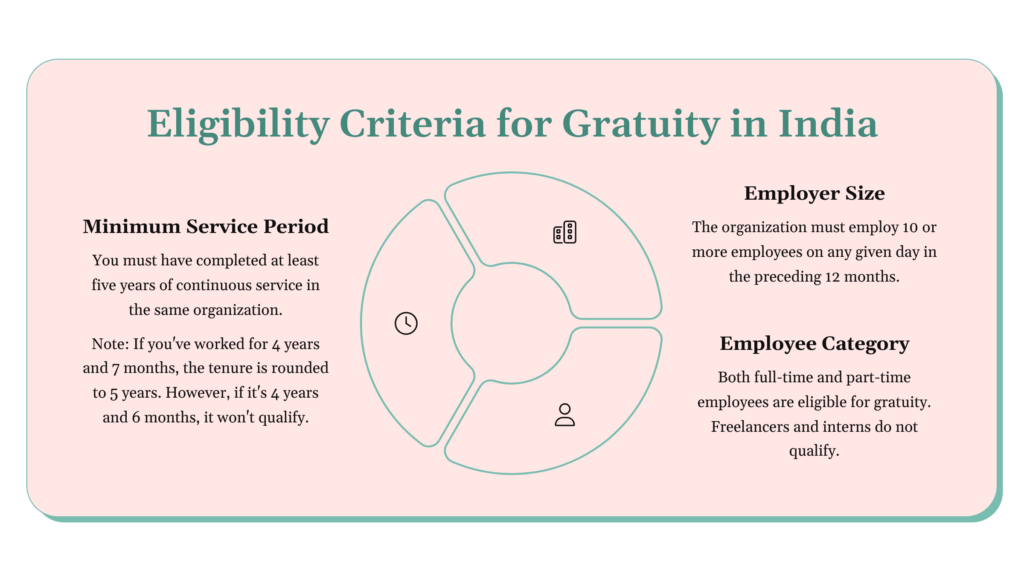

In India, gratuity is mandatory under the Payment of Gratuity Act if the following conditions are met:

However, there are exceptions. For instance, if an employee passes away or becomes disabled due to illness or accident, gratuity can be paid even before completing five years of service.

Now that you know what gratuity is, let’s move on to how to calculate gratuity under Indian law.

To claim gratuity, certain conditions must be fulfilled. Here’s a breakdown of who qualifies for gratuity:

If you meet these criteria, you’re eligible to receive gratuity. Now, let’s explore the formula for how to calculate the gratuity based on your salary and years of service.

The calculation of gratuity in India depends on whether your organization is covered under the Payment of Gratuity Act. Below is the formula used to calculate gratuity:

If your employer falls under the ambit of the Payment of Gratuity Act, the gratuity amount is calculated using the following formula:

Gratuity = (Basic Salary + Dearness Allowance) × 15 ÷ 26 × Tenure of Service

Here’s what each component means:

Let’s say your basic salary is ₹40,000 per month, DA is ₹10,000, and you’ve worked for 8 years and 7 months.

So, your gratuity payout would be approximately ₹2,45,191.

If the Payment of Gratuity Act doesn’t cover your employer, the formula changes slightly:

Gratuity = Average Salary × ½ × Tenure of Service

Here, the Average Salary is the average of your last 10 months’ salary.

The method of calculating an employee’s gratuity varies depending on the type of employment. Whether you are a government employee, a private sector employee, or a daily wage worker, understanding your gratuity calculation is crucial to ensure you receive the correct amount.

Let’s explore how gratuity is calculated for different categories of employees.

Government employees in India are entitled to gratuity as per the Payment of Gratuity Act, 1972. The calculation method is as follows:

Gratuity = (Last Drawn Salary × 15 × Number of Years Worked) ÷ 26

Where:

If a government employee’s last drawn salary (Basic + DA) is ₹50,000, and they have worked for 30 years, the gratuity calculation will be:

(50,000 × 15 × 30) ÷ 26 = ₹8,65,385

Since this amount is below the ₹20 lakh limit, it remains fully tax-free.

For government employees, how to calculate gratuity is straightforward as it follows a fixed structure with complete tax exemption.

Private sector employees also receive gratuity if they have completed at least five years of continuous service with the same employer. The formula used is the same as for government employees.

Gratuity = (Last Drawn Salary × 15 × Number of Years Worked) ÷ 26

If a private sector employee has a last drawn salary of ₹70,000 and has worked for 25 years, the gratuity amount will be:

(70,000 x 15 x 25) ÷ 26 = ₹10,09,615

Since this amount is below ₹20 lakh, it is fully tax-free. However, if the gratuity amount exceeds ₹20 lakh, the excess portion is taxable.

For private sector employees, understanding how companies calculate gratuity helps in tax planning and financial decision-making.

Unlike salaried employees, daily wage workers do not have a fixed monthly salary. Instead, their gratuity is calculated based on their daily wage rate.

Gratuity = ( Daily Wage × 15 ) × Number of Years Worked

Where:

If a daily wage worker earns ₹800 per day and has worked for 10 years, their gratuity amount will be:

( 800 × 15 ) × 10 = ₹1,20,000

This amount is well within the tax-free limit of ₹20 lakh.

Knowing how to calculate gratuity ensures that daily wage workers know their rightful benefits and can claim them accordingly.

Gratuity serves as a financial security measure for employees after long-term service. Whether you are a government employee, a private sector employee, or a daily wage worker, understanding how to calculate gratuity is essential to ensure you receive the correct amount.

By following the right formula and keeping track of tax implications, you can maximize your gratuity benefits and plan for a secure financial future.

A gratuity calculator can be incredibly helpful for the following reasons:

Gratuity is tax-free up to ₹20 lakhs for government employees and certain categories of private employees.

If you are a central or state government employee, your entire gratuity amount is 100% tax-free, regardless of how much you receive.

The tax implications of gratuity for private employees depend on the amount received:

Let’s say an employee from the private sector receives ₹25 lakhs as gratuity.

Understanding how to calculate gratuity can help employees plan their finances better. Employees can also reduce tax liability by using exemptions available under the Income Tax Act or investing in tax-saving options.

By knowing these taxation rules, employees can be better prepared to handle their gratuity payouts effectively.

Related Read:- How to Calculate HRA in Salary

Knowing how to calculate gratuity amount and the process to claim it can help employees receive their rightful amount without any hassle. Below are the steps to claim gratuity in India:

Employees who are eligible for gratuity must fill out Form I and submit it to their employer. This form serves as an official request for the gratuity payment. It should include details such as:

Once the application is submitted, the employer will verify whether the employee meets the eligibility criteria. Employees can also learn how to calculate gratuity using the standard formula.

Once the gratuity amount is calculated, the employer must process the payment within 30 days from the date of application submission. The payment can be made through bank transfer, cheque, or demand draft.

If the employer fails to pay gratuity within 30 days, they are legally bound to pay interest on the pending amount as per government rules. This ensures that employees receive their gratuity without unnecessary delays.

Understanding how to calculate gratuity and the correct claiming process can help employees receive their rightful benefits on time. By following these steps, employees can ensure a smooth and hassle-free experience while claiming gratuity.

Employers are responsible for calculating the gratuity amount. And then pay it to their employees in a timely and accurate manner. Yet, mistakes can happen, and employers need to be aware of these common errors to avoid them. Here are some common mistakes and how to avoid them:

To ensure you receive the maximum gratuity amount, follow these tips:

These strategies will help you maximize your gratuity payout while ensuring compliance with legal requirements.

Understanding how to calculate gratuity is essential for every working professional in India. By following the steps outlined in this guide, you can accurately determine your gratuity amount and avoid unnecessary complications. Remember, gratuity is not just a financial benefit—it’s a reward for your hard work and dedication.

Share this article with your friends and colleagues if you found it helpful. For quick calculations, use our free gratuity calculator tool available on our website.

Want to explore helpful techniques to save and grow your hard-earned money? Dive into our guide on Earn Online.

The formula for calculating gratuity is:

Gratuity = (Last Drawn Salary x 15 x Years of Service) / 26

This formula is for employees covered under the Gratuity Act in India.

To calculate gratuity for 5 years, use the formula: Gratuity = (Last Drawn Salary x 15 x 5) / 26. For example, if your last drawn salary is ₹30,000, your gratuity would be: ₹86,538.46.

To calculate a 20% tip, multiply the total bill amount by 0.20. For example, if the bill is ₹1,000: ₹1,000 \times 0.20 = ₹200.

The number 15 represents the 15 days of salary for each year of service, as per the Gratuity Act.

The gratuity calculated is 26. The formula is “Gratuity = (15/26) x Last Drawn Salary x (Number of Completed Years of Service) x 240/365.”

Yes, gratuity is calculated based on the employee’s last drawn basic salary and dearness allowance (DA). The formula is:

“Gratuity = (15/26) x Last Drawn Salary x (Number of Completed Years of Service) x 240/365”.

To calculate gratuity manually:

1. Formula: “Gratuity = (15/26) x Last Drawn Salary x (Number of Completed Years of Service) x 240/365”

2. Steps:

i) Identify last drawn basic salary & DA.

ii) Multiply by 15 (days).

iii) Multiply by years of service.

iv) Divide by 26 (working days in a month).

Authored by, Amay Mathur | Senior Editor

Amay Mathur is a business news reporter at Chegg.com. He previously worked for PCMag, Business Insider, The Messenger, and ZDNET as a reporter and copyeditor. His areas of coverage encompass tech, business, strategy, finance, and even space. He is a Columbia University graduate.

Editor's Recommendations

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.